Data on the chain shows that the major Ethereum investors have added their holdings recently, a sign that may be Hisse for the ETH Prize.

Ethereum large holders Netflow has become positive recently

In a new one post At X, the market intelligence platform has been talking about the trend in Large holders Netflow for Ethereum. This metric measures the net amount for Cryptocurrency that moves in or out of the wallets controlled by Large holders.

The analytics company defines three categories for investors: retail, investors and whales. In retail, members hold less than 0.1% of the supply in balance, investors between 0.1% and 1%, and the whales more than 1%.

At the current exchange rate, 0.1% of the ETH offering, the interruption between retail and investors, is worth over $ 214 million, a very significant amount. This means that the addresses that can qualify for investors are already quite large, let alone those who have come to the whales.

As such, the large holders, the actual cohort of interest in the current discussion, include both these groups. Thus, the major holders Netflow keeps track of the transactions related to investors and whales.

When the value of this metric is positive, this means that the big money in the network receives a net number of deposits for their wallets. On the other hand, it proposes under the zero mark that these important holders participate in net sales.

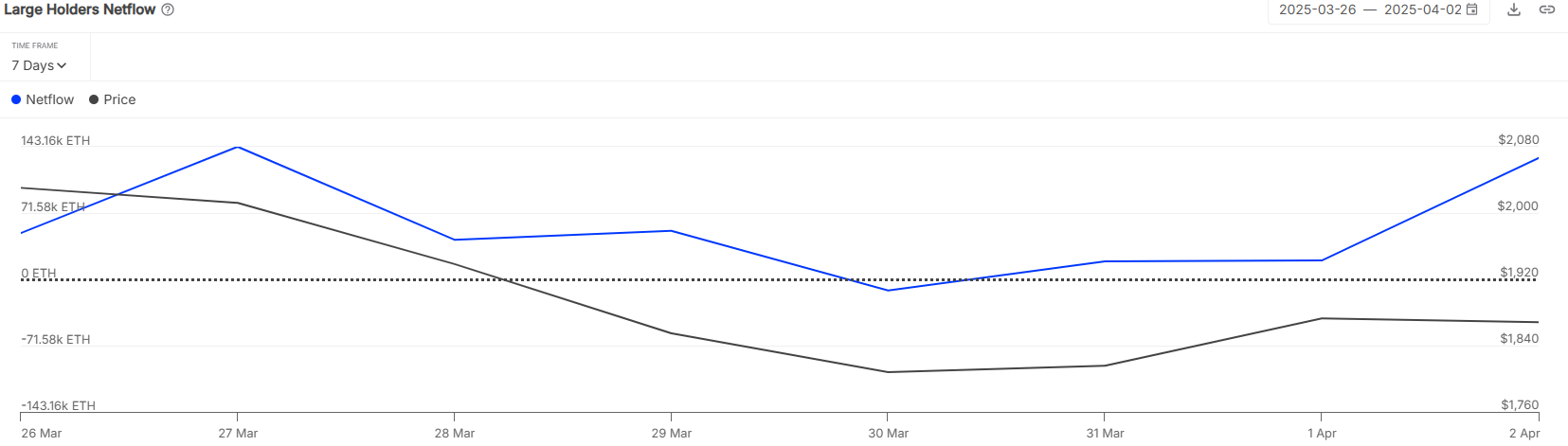

Now here is the chart shared by intotheblock showing the trend in Ethereum large holders Netflow over the past week:

The value of the metric appears to have been positive in recent days | Source: IntoTheBlock on X

As can be seen above, Ethereum has large holders Netflow remained almost entirely in the positive territory under the graph, which means that investors and whales have gathered. Only the second in the month were these key units charged on a net 130,000 eth (about $ 230 million).

The net inflow for the major holders has arrived while Cryptocurrency has decreased, so it is possible that this cohort believes that the latest prices have offered a profitable entry into the asset. It remains to be seen if this accumulation would be enough to help ETH achieve a bottom or not.

In some other news, Ethereum charge is down to the lowest level since 2020 this quarter, as the analytics company has pointed out in another X post.

The changes that occurred in key ETH metrics during the first quarter of 2025 | Source: IntoTheBlock on X

After a sharp decline of 59.6%, Ethereum is total transaction fees down to $ 208 million. According to Intotheblock, this trend is driven “mainly by the gas limit increase and transactions that move to L2S.”

Tet price

Ethereum saw recovery over $ 1,900 earlier this week, but it seems that it has expired as the coin back to $ 1,770.

Looks like the price of the coin has plunged recently | Source: ETHUSDT on TradingView

Image from Dall-E, Intotheblock.com, Chart from tradingview.com

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.