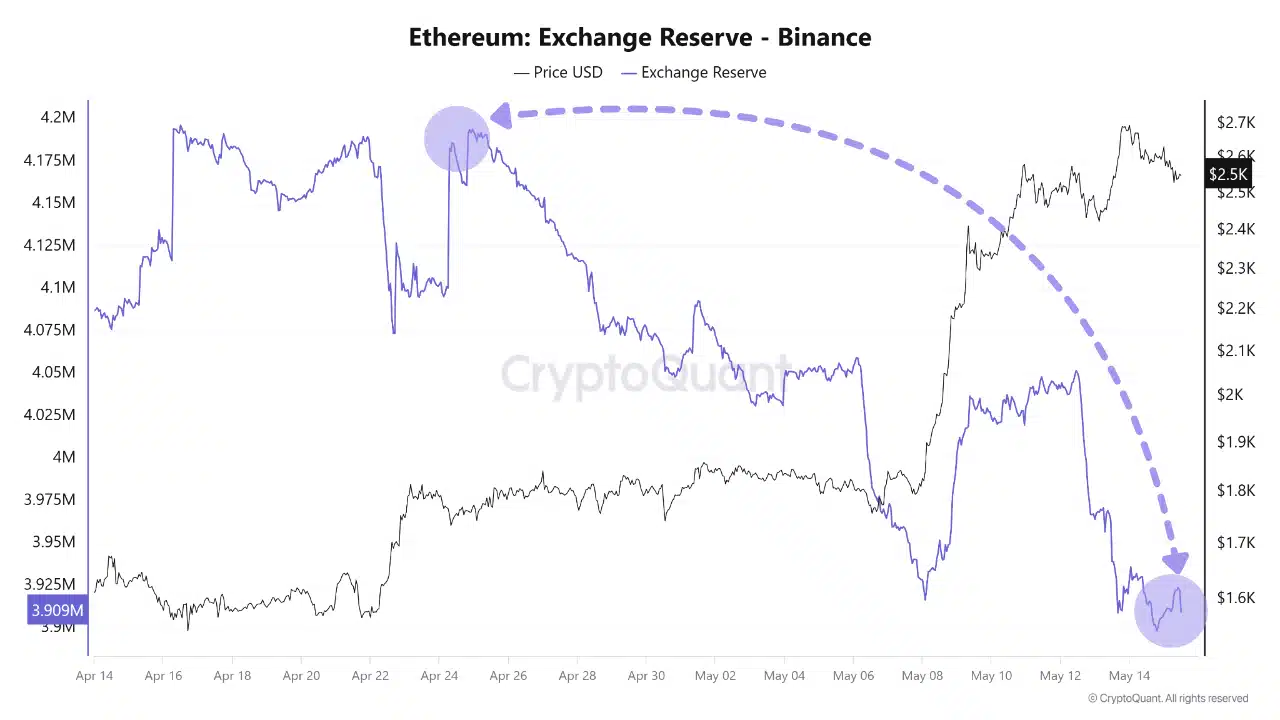

- Ethereum reserves at Binance fell by 300,000 ETH, which reduced centralized sales pressure and increased hike.

- 81% of the holders are in profit, with important wallet clusters close to $ 2,665, which increases the odds for profit or breakout.

Ethereum (ETH) Reserves at Binance have dropped sharply and dropped from 4.1 million ETH to 3.9 million ETH since mid -April.

This 300,000 ETH reduction Signals increased investors’ confidence in long -term holdings and decentralized protocols.

As a result, the centralized sales pressure continues on the sales side. At press time, ETH changed his hand to $ 2,605.85, an increase of 2.77% in 24 hours.

With fewer coins available for immediate sales, bulls can get control. Of course, this delivery dynamics can lean the wave in favor of bulls, especially if withdrawals remain.

ETH’s total stock market reserves amounted to $ 18.9 million and marked a 0.78% daily dip. Although the drop seems minimal, it highlights a cautious position among investors.

Many people prefer to keep ETH from centralized platforms. This is in line with broader accumulation trends that are reviewed large wallets. Therefore, the reduction in the reserve value implies reduced sales appetite.

Can ETH clear $ 2,665 in the middle of rising liquidations?

The liquidation of the liquidation revealed thick liquidation zones between $ 2,600 and $ 2,665, and formed a strong resistance cluster. This area can lead to volatility when tested.

However, Ethereum’s steady progress against these zones shows growing buyers confidence. If ETH breaks over $ 2,665, cascade short liquidations can increase the rally further.

Despite this, traders should look carefully – the price can stop or short consolidate before continuing their rise.

Ethereum gas use fell to SEK 14.09 billion, which marked a significant decline from earlier heights. This decrease can reflect improved fee efficiency or a temporary dip in high volume activity.

That being said, it does not mean debilitating grounds.

Lower gas costs often enable more affordable user participation over the defi- and NFT platforms. Therefore, this drop can support broader network commitment rather than preventing it.

Factors still supporting ETH’s strength

At the time of writing, Ethereum registered 555,880 daily active addresses and 1.42 million transactions.

These measurement values strongly highlight user engagement despite the fact that they changed fee dynamics. Therefore, Ethereum’s underlying tool remains intact.

Consistent activity continues to reflect confidence in the network’s capacity over different use cases. This user -driven strength, combined with decreasing gear reserves, offers structural support for price increases.

In addition, 81.07% of the holders were in profit. The largest concentration was between $ 2,460 and $ 2,665 – right where ETH faces resistance.

ETH, however, remains over the key support, and signals on the chain remain Hausse. If the price breaks over $ 2,665 with volume, short positions can unwind.

This can trigger a sharp rally.

Therefore, traders should monitor this zone carefully. A confirmed outbreak can mark the beginning of Ethereum next impulsive movement towards higher levels that have not seen in recent months.

Is an outbreak imminent?

Ethereum’s basic factors remain strong, supported by reduced reserves, growing user activity and high profitability among holders.

The resistance around $ 2,665 remains the most important barrier.

But if bulls push past this level with conviction, a breakout can follow. Data on the chain favors upward continuation, but momentum must hold. Merchants should look at this critical zone carefully.

A successful outbreak can confirm the beginning of Ethereum next rally phase.