Key dealers

- Bitwise registered a close ETF and marked the first step towards starting the first near ETF in the United States.

- A US NEAR ETF would provide institutional access to the close token, in line with broader industry trends.

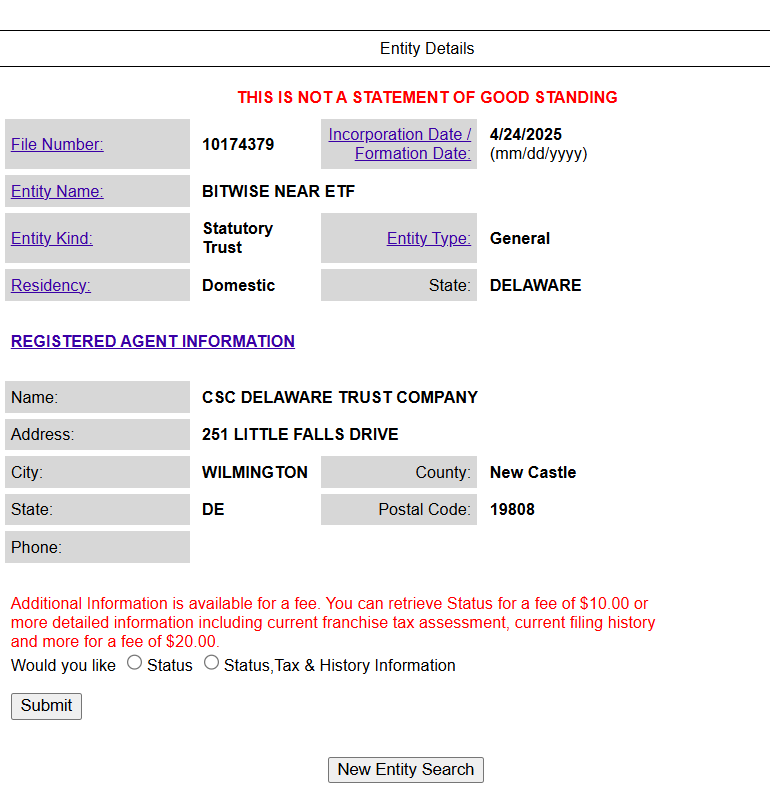

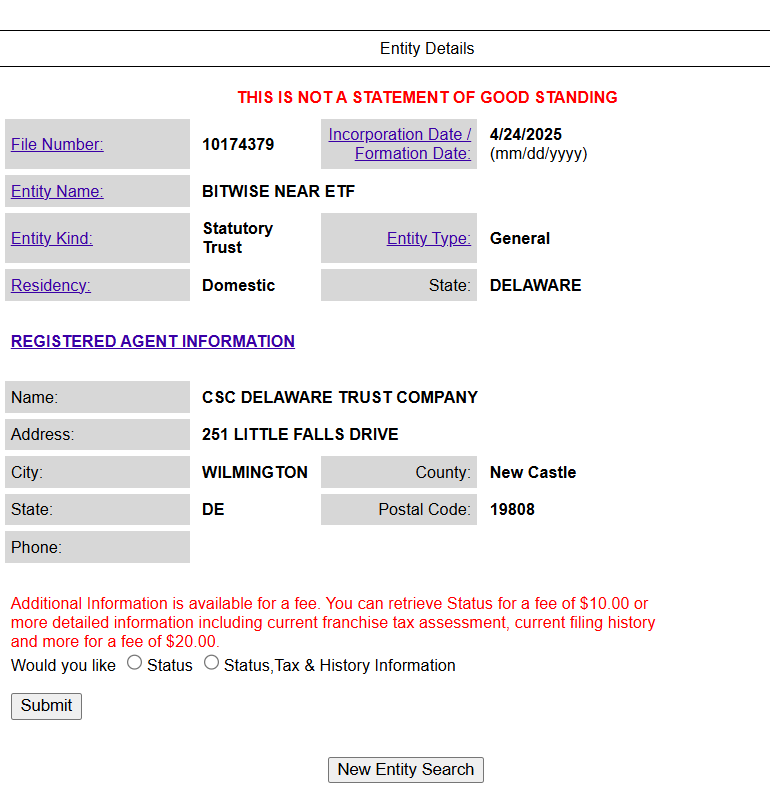

American fund manager Bitwise Asset Management has registered a unit of trust called Bitwise near ETF in Delaware-a trait that usually precedes a formal archiving at SEC for a exchange-traded product that would trace closely, the original access for the close protocol.

If succeeded, Bitwise’s proposed fund would be the first US-based ETF, which is bound to Layer 1 blockchain with a focus on scalability and the developer’s availability.

Before Bitwise’s move, other asset managers such as 21 Shares and Grayscale had already introduced almost related investment products. 21Shares offers 21Shares close to the protocol that stakes ETP, which provides exposure to close tokens along with fencing rewards.

Meanwhile drives grayscale Grayscale near trustA private investment vehicle that gives accredited investors access to closely, although it is not structured as an ETF.

A US-listed near ETF would increase institutional access to the token as it offers a regulated, exchange-traded vehicle. The ETF structure allows institutions to gain exposure too closely without the complexity of managing private keys, custody arrangements or wallet infrastructure.

Plus, by tracking the spot price for the underlying asset and revealing holdings daily, ETF provides real-time price opening and a closer adaptation to market value functions that are decisive for portfolio management and compliance.

Bit by bit, a pioneer within the Crypto Asset Investment Products had over $ 5 billion in assets under management from October 2024, which highlighted an increase of 400% during that year, the company said in a statement.

The company manages a wide range of investment products, including crypto index funds, thematic ETFs, Spot Crypto ETPs, Alpha solutions with multiple strategies, separately handled accounts and private funds.

Bitwises Spot Bitcoin ETF (BITB), which was launched in January 2024, has grown to $ 3.6 billion in assets management, according to the latest data. Although he is on the market for over a year, Bitb is ranked among the top performing Bitcoin funds, with stable growth and strong investors’ demand.

In addition to close, Bitwise aims at ETFs related to other leading crypto assets, such as XRP, Dogecoin and Solana, to name a few.

The new registration is part of Bitwise’s ongoing effort to expand its digital asset offers in addition to Bitcoin and Ethereum, as institutional appetite for Altcoin exposure is gaining momentum.

Bit by bit, as well as other fund managers, foresee that a crypt-friendly environment in the Trump era will help to speed up the approval and adoption of crypto investment products.

Earlier this week, Trump Media and Crypto.com completed a deal to launch America-First ETFs, including those bound to Cronos. The parties said they were aiming to take advantage of pro-crypto policy according to the Trump administration.

Whether the growing set up of proposed cryptofunds will ultimately reach the market depends on the securities controller. Recently, SAC chairman Paul Atkins, together with other commissioners, is expected to review and rule on several waiting ETF applications in the coming months.