Since he met a new highest time in January, Bitcoin (BTC) has struggled to establish a raised form that resulted in a descent that has lasted over the past two months. According to the prominent market analyst EGrag Crypto, the main Cryptocurrency can probably remain in correction in the next few months before a prize collection started.

Bitcoin’s 231-day bicycle tips on $ 175,000 goals in September

After a first price decline in February, EGRAG CRYPTO Postulated Bitcoin may experience a price correction due to a CME gap before experiencing a price bounce. However, the lack of strong raised beliefs in recent weeks has forced a conclusion that the main Cryptocurrency is stuck in a potentially long corrective phase.

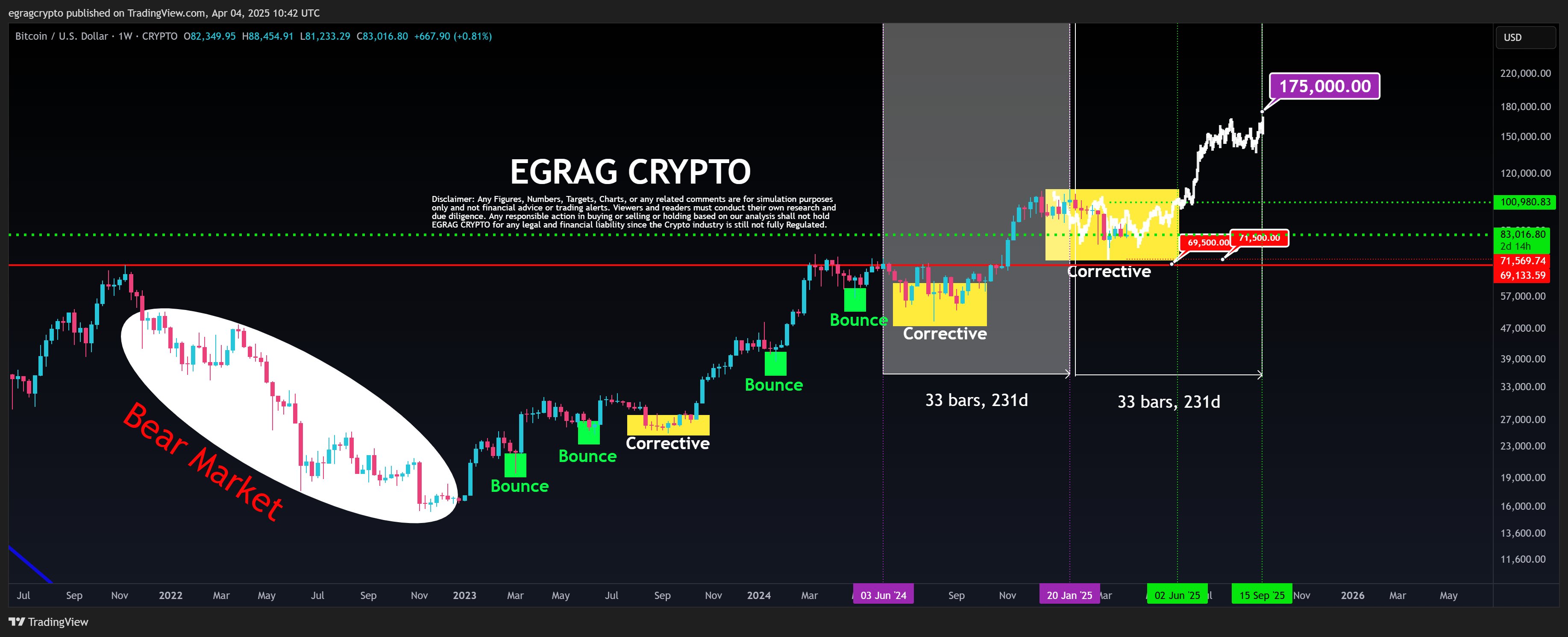

According to EGRAG in a Last postBitcoin’s ongoing correction is consistent with a fractal pattern, ie. A repetitive price structure that has appeared over several time frames. This pattern is based on a 33-bar (231-day) cycle during which BTC transmits from a corrective phase to an explosive price collection.

By comparing previous cycles with the current development, EGRAG has predicted that Bitcoin could potentially break out of its recalibration in June. In this case, analysts expect the crypto market leader to hit a $ 175,000 market top in September, which suggests a potential profit of 107.83% at current market prices.

But when this price rally, Market Bulls must ensure a breakout over the hard price barrier to $ 100,000. On the other hand, there may be a case below $ 69,500 $ 71,500 support price level to annul this current Hausse installation and possibly signal the end of the current bull run.

BTC Investers await when exchange activity slows down

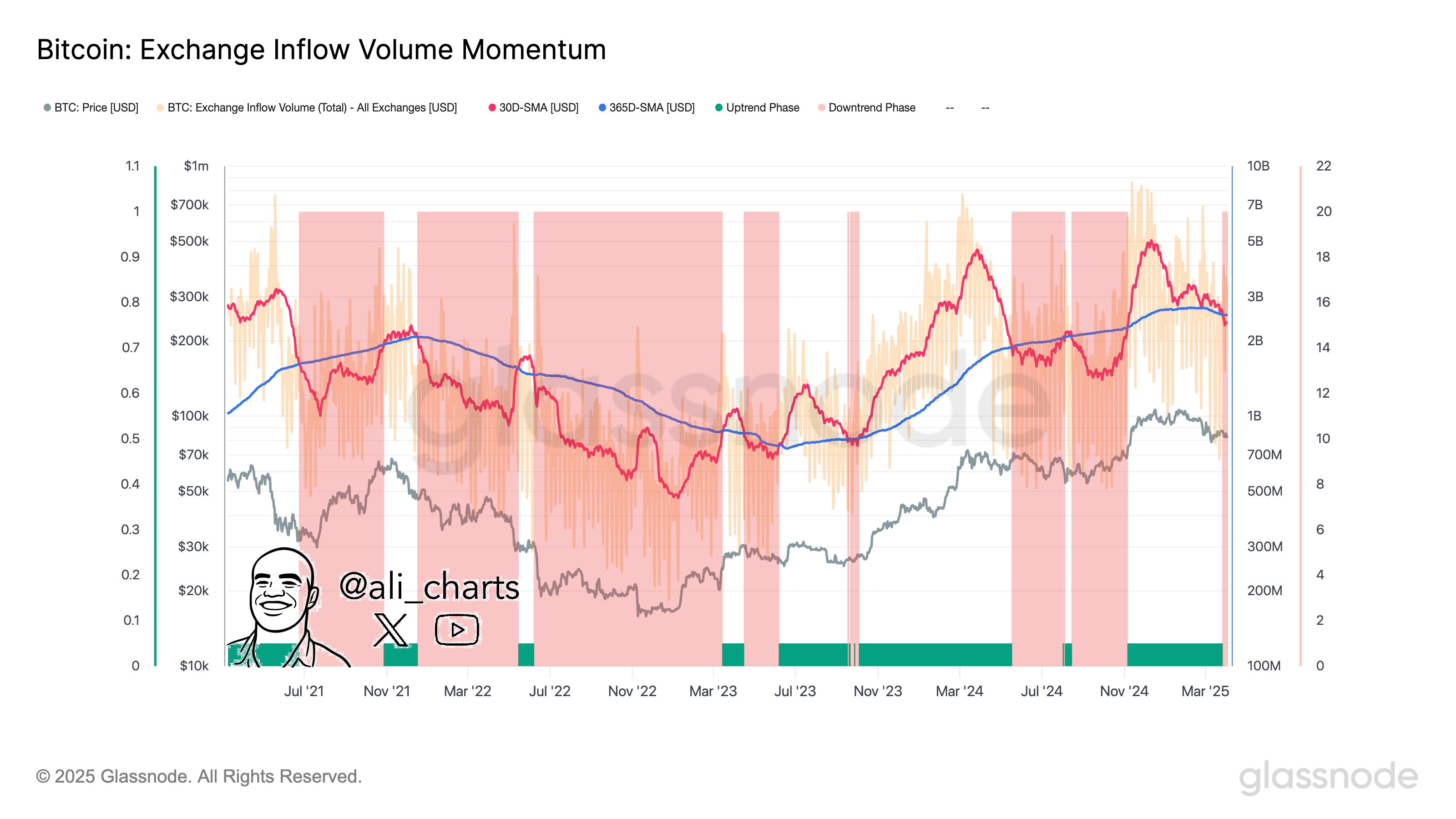

In second news, the popular crypto expert Ali Martinez has reported A reduction in bitcoin exchange-related operations that indicate reduced investors’ interest and network use. In particular, this development suggests that investors hesitate to deploy or withdraw Bitcoin on exchanges may, due to market uncertainty about the immediate future track of the asset.

According to Martinez, Bitcoin is now likely to undergo a trend shift when investors are waiting for the next market catalyst. Noteworthy Bitcoin has shown affordable resistance despite New customs duties introduced by the US government On April 2. According to Data from SantimentBTC’s price dipped only 4% during the hours after the announcement-a milder reaction compared to previous customs-related market movements.

Since then, BTC has made some price profits and currently deals at $ 83,805 when investors flock to the crypto market that has registered an inflow of $ 5.16 billion over the past day. At the same time, BTC’s trade volume increases by 26.52% and is valued at $ 43.48 billion.

Image from UF News, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.