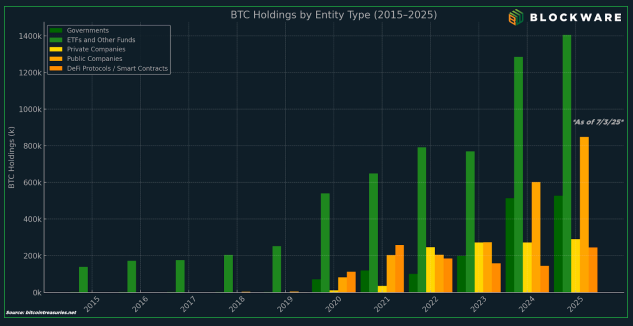

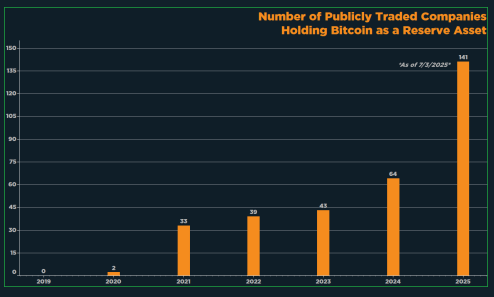

Public companies around the world have stacked into bitcoin this year. According to Blockware Intelligence, the number of public companies that holds Bitcoin jumped with 120% in 2025.

This increase brought the sum to 141 companies. And at the end of 2025, at least 36 is expected to add Bitcoin to their balance sheet. It would represent a 25% increase from today’s number.

Rising tide of the company’s bitcoin -adoption

Based on reports from Blockware’s Q3 2025 Market UpdateThree dozen new participants could join the so -called “Bitcoin Treasury Companies” over the next six months. These companies act as a bridge between traditional markets and crypto world.

During the first half of the year, companies dedicated large and small more than 159.107 BTC to their books and set a new record for companies’ crypto purchases.

Source: Blockware

Big names still lead the packaging

The top place remains with US President Donald Trump’s favorite crypto Prosecutor Michael Saylor’s Strategywhich has an astonishing 597 325 BTC.

That figure is about 12 times what Mara Holdings in second place owns, at about 50,000 BTC. The two lonely account for most of Bitcoin held by public companies.

Some players can take a risk

Blockware points out that many newcomers are either brand new companies or those who are facing tough business challenges.

For companies with low growth or shrinking markets, parking fund in Bitcoin can to an estimated 40 to 50% composed annual growth rate look more appealing than running a fighting. But that choice comes with its own risks.

Source: Blockware

The company’s bitcoin growth faces warning signs

Glassnod’s lead analyst James Check sounded an alarm on July 4 and warned that the simple upside may already be gone for Latecomers. Venture Firm Breed described a “death spiral” risk for companies that trade close to the net asset value.

Some crypto dealers echoed that view and said that these companies will be tested at the next bear market, especially if NAV premiums start to slip.

At the moment, the movement against Bitcoin is very real. Larger, well-capitalized companies can weather the ups and downs better than smaller players.

Investors and analysts will look at how these taxes perform when the markets cool off. If premiums hold, new participants can keep up. If not, some balance sheets may face a rough journey.

Image from Pexels, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.