- Altcoin-Bitcoin correlation is broken down and suggested on fragility under Bitcoin Solo rally.

- Elevated dominance over voltage showed caution, not conviction; The risk of snapback looms near the highest times.

Bitcoin’s (BTC) The last wave turns the head, but not for the usual reasons. While BTC slowly climbs, the wider Altcoin market stops – a rare divergence.

With bitcoin -dominance that rises and historical correlations break down, analyst Sounds alarms: This rally can be run on vapors, and the risk of a sudden reversal is growing.

Altcoin -Correration is crushing when bitcoin climbs

Bitcoin’s Ascent no longer lifts all boats.

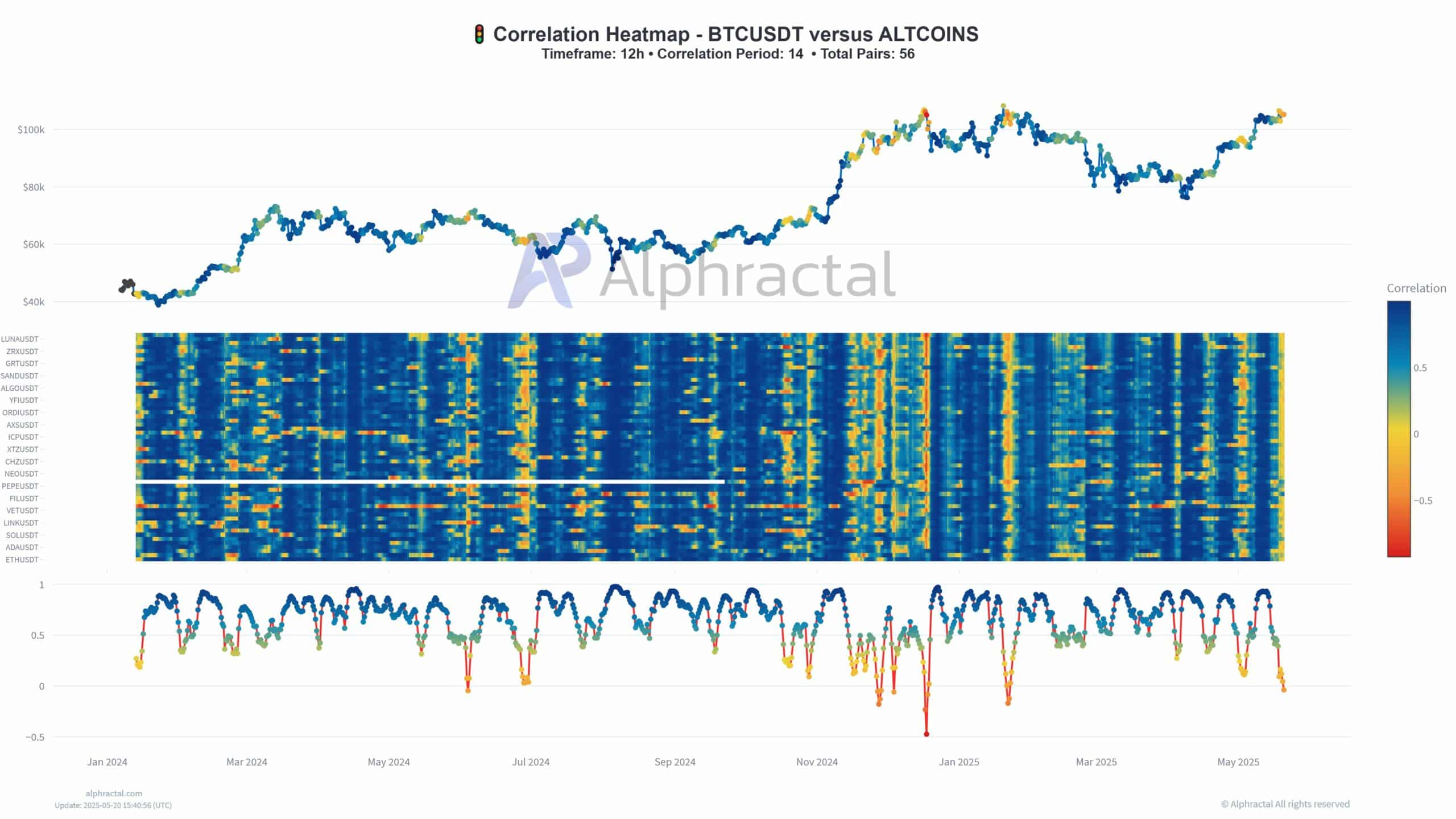

The 14-period rolling correlation between BTC and Major Altcoins has decreased sharply since the end of April 2025.

Unlike previous rally where Altcoins moved synchronized with Bitcoin, the current trend shows fragmentation. Most altcoins now show almost zero or negative correlation on 12-hour time frame.

This connection, highlighted by cooler blue shades in the heat map, signals a declining market.

A bitcoin-led rally often lacks long-term strength and can sometimes precede a broader risk-off change on the market.

Dominance recycled

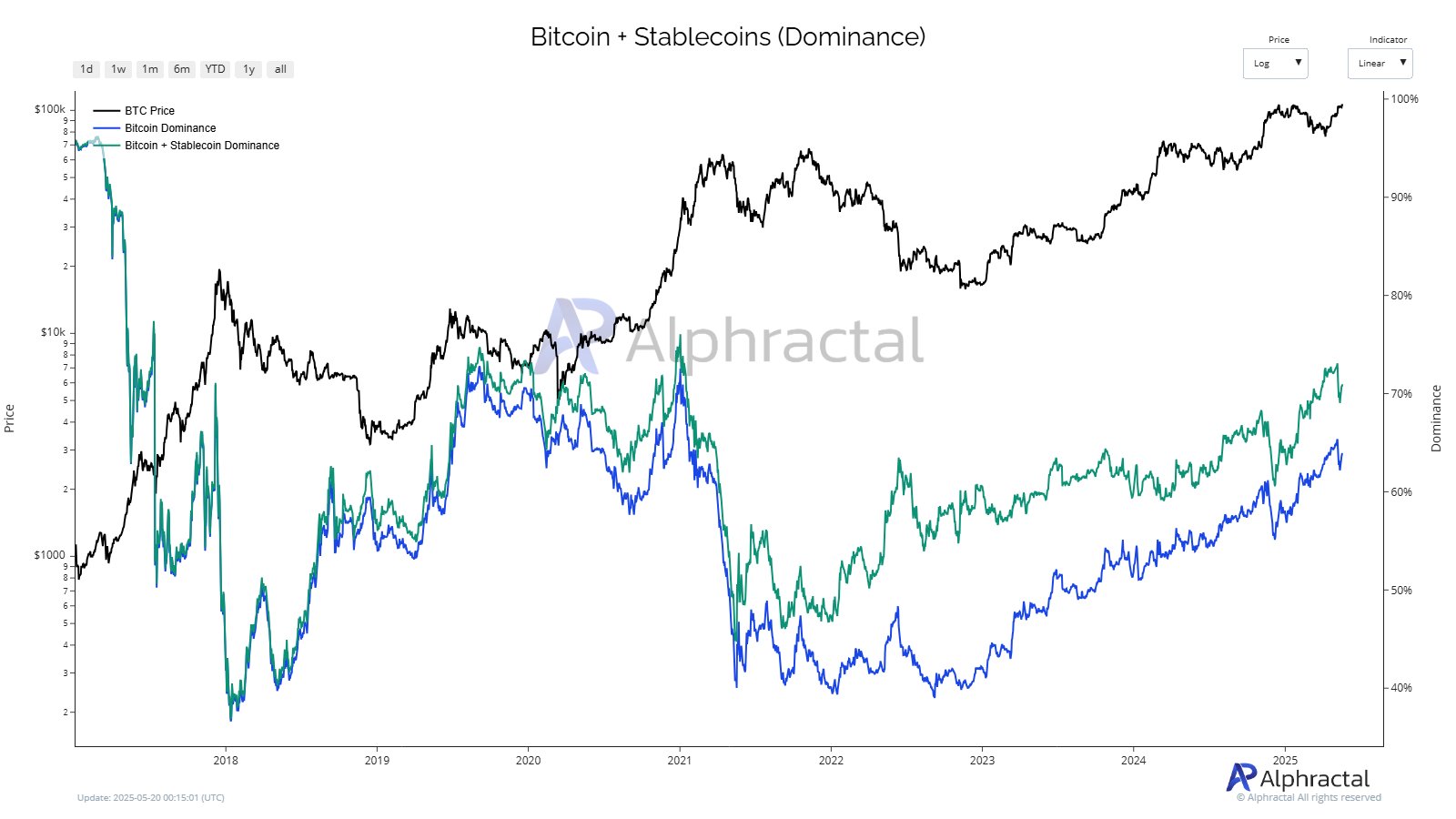

BTC The price climbing has been accompanied by a powerful resuscitation in market dominance, not only for BTC alone, but in combination with Stablecoins.

The common dominance borders 70%and shows a return to risk-off behavior and consolidation of capital in “safer” crypto assets.

While the Bitcoin dominance alone remains during its top 2021, the introduction of Stablecoins shows that traders are waiting for the side line.

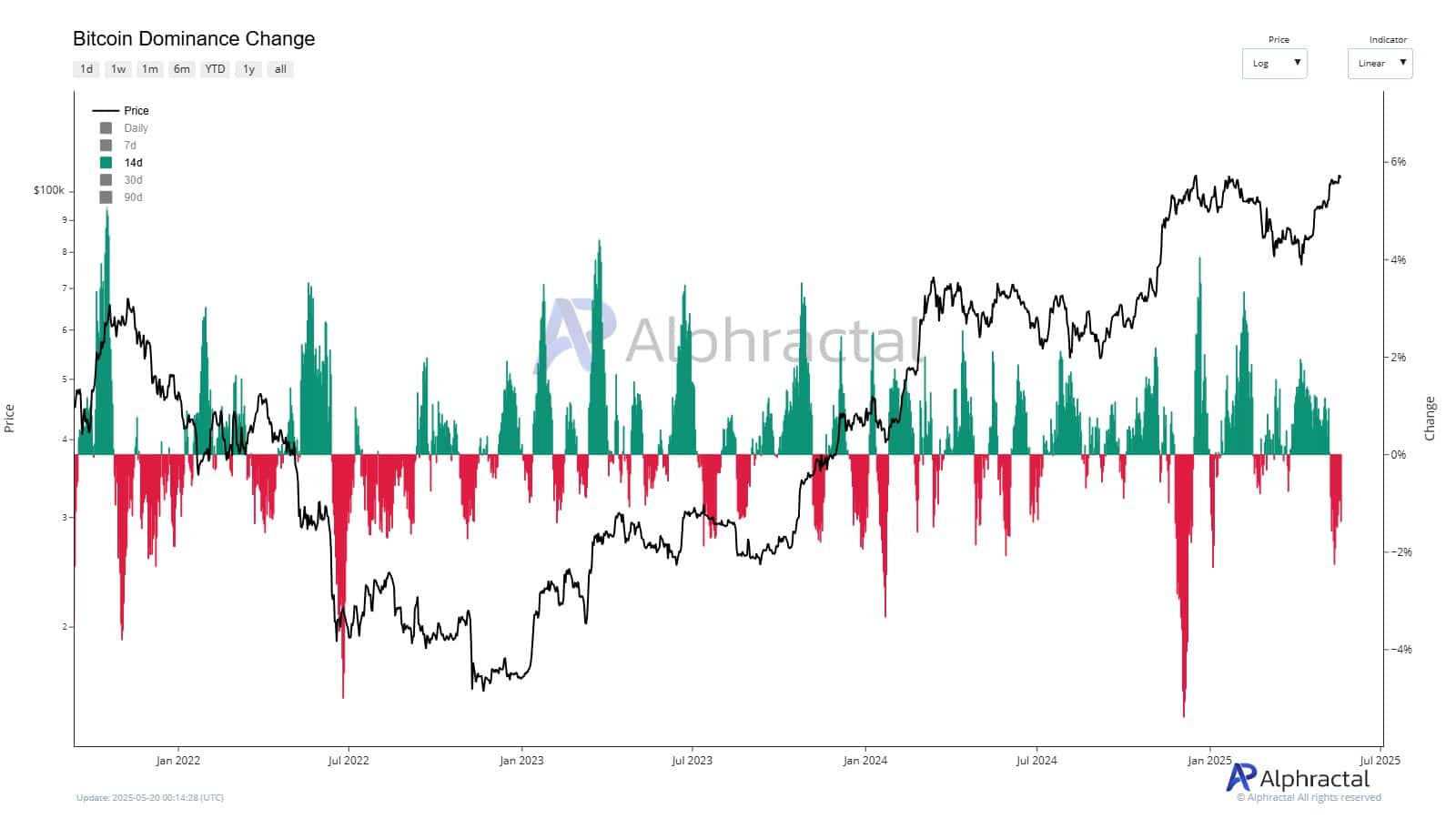

Despite price gains, BTC dominance change has often become negative, which emphasizes continued capital rotation and market government during the surface force.