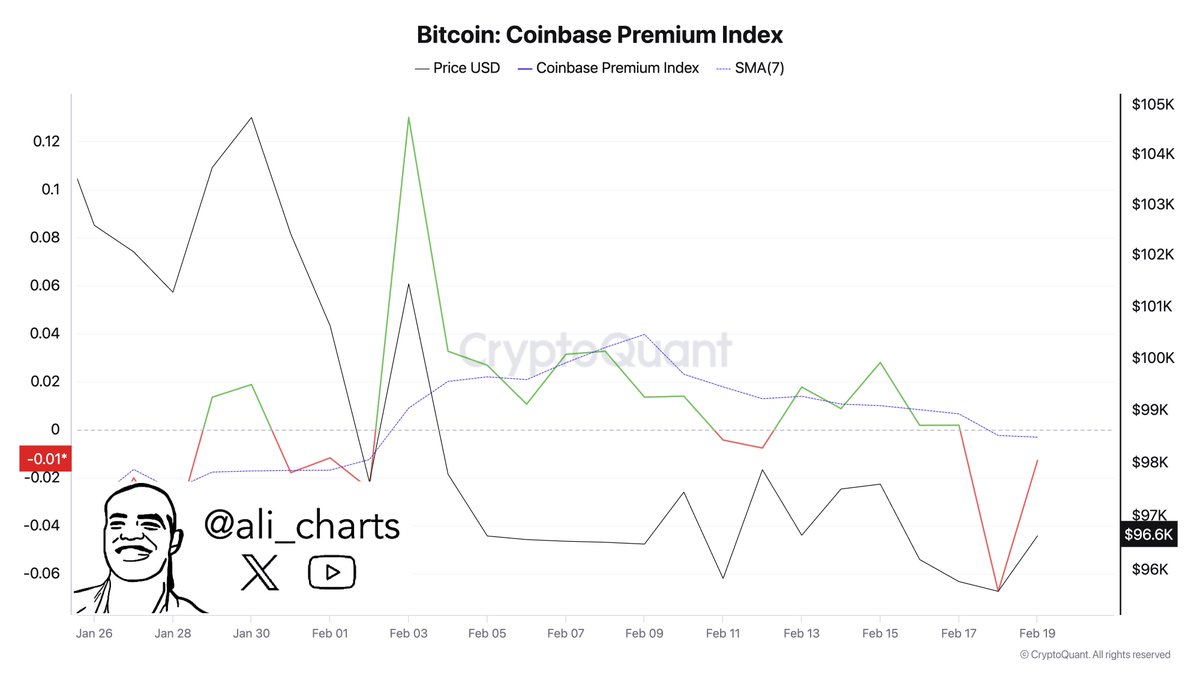

The BTC’s price could get caught up in consolidation longer than originally expected, as the latest information on the chain shows that Bitcoin Coinbase Premium Index has dropped back below zero. What makes this waning metric signal for the foremost cryptocurrency?

IS Bitcoin price with the risk of movement downward?

In a recent post on the X platform, prominent Crypto Pundit Ali Martinez revealed The fact that Bitcoin Coinbase Premium Index has decreased and dropped back during a critical zone in recent days. Coinbase Premium Index is a chainmetric that traces the difference between the BTC price on Coinbase (USD pair) and Binance (USDT pair).

This indicator can also provide insights on the difference in buying and sales behaviors of investors on the two crypto trading platforms. Bitcoin Coinbase Premium Index reflects the feeling of the American institutional units (the major players at Coinbase) and how it differs from the global exchanges.

Usually, when the Bitcoin Price Premium on Coinbase rises or is a positive value, it means increasing demand from US investorsWhich is willing to spend more than other global investors to buy flagship Cryptocurrency. On the other hand, the Coinbase slides the Premium index below the zero mark that signals that US investors buy less compared to global traders.

Source: Ali_charts/X

This low purchase activity is highlighted by the narrow performance for Spot BTC Exchange-Traded Funds in recent weeks. The latest market data shows that the US Bitcoin ETF market registered a total outflow of $ 559 million over the past week.

With institutional and Large US investors are not gathered Bitcoin at current prices, the market leader was able to fight to build all real haussearted speed. Historically, a prolonged decline in Coinbase Premium Index Metric has been associated with a consolidation period or even potential down -to -date for the BTC price in the short term.

BTC whales discharge assets

In a separate post on X, Martinez observed That a class Bitcoin investor has trimmed its holdings in recent weeks. Santiment data shows that whales holding between 10,000 and 100,000 coins have sold 30,000 BTC (worth approximately $ 2.9 billion) in the last ten days.

This level of sales activity explains something the sluggish price measure for bitcoin in recent weeks. From this writing, the price of BTC sits just above the $ 96,500 brand, which reflects an increase of 0.8% over the past 24 hours. Premier Cryptocurrency is down by 1.1% over the past week, according to data from Coingceko.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView