Key dealers

- Bitcoin ETFS registered a record of $ 1.1 billion net flows in the middle of a sale driven by macroeconomic problems.

- The decline of crypto market is driven by investors’ risk aversion due to customs threats and inflation problems.

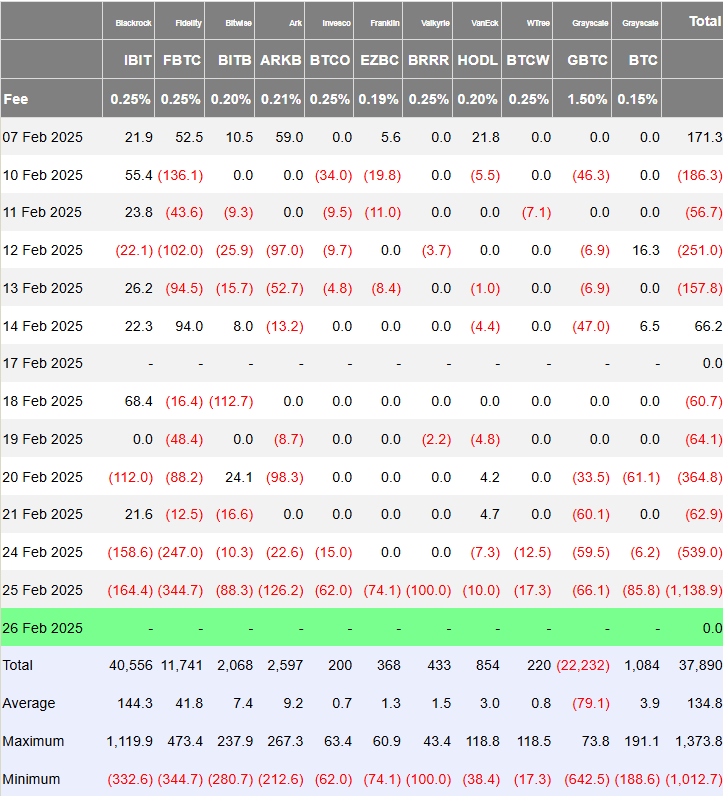

US Spot Bitcoin ETFs published about $ 1.1 billion in net outflows on Tuesday, their largest outflow of one day since the launch, according to data from Father side Investors. So far this week, The group Net outflows have increased to over $ 1.6 billion.

The massive withdrawal continued during a sharp crypto market sales, with investors who withdraw from risk resources as they handled growing macroeconomic problems after President Trump’s customs threat.

Fidelity’s FBTC led the excursion with approximately $ 344 million in outflows, followed by Blackrock’s Ibit with almost $ 162 million in redemption and Ark Invests ArkB with $ 126 million.

At the same time, Bitwise’s Bitb and Grayscales BTC each registered over $ 85 million in net outflows.

Franklin Templeton’s EZBC lost $ 74 million, with Grayscales GBTC and Invescos BTCO decreased by $ 66 million and $ 62 million respectively.

Competing funds managed by Valkyrie, Wisdomtree and Vaneck also reported net outflows.

Intensive outflows darkened the previous record on December 19, when the group of Spot Bitcoin ETFS saw almost $ 672 million in withdrawals after Bitcoin fell below $ 97,000.

The withdrawals surpassed the previous record of $ 672 million set on December 19, marking on the sixth day in outflows for the ETF group, which saw $ 539 million withdrawn on Monday.

Bitcoin touched $ 86,000 today, its lowest level since November, and is currently shopping for $ 88,000, a decrease of 7% over the past week, per tradingview. The total crypto market ceiling has decreased 3.5% over the past 24 hours.

The steep downturn over all assets triggered $ 1.6 billion In utilized liquidations on Monday, Crypto reported Briefing.

Former Bitmex CEO Arthur Hayes warned of a potential market decline when hedge funds relax their basic trading involving Bitcoin ETFs.

“Lots of $ Ibit holders are hedge funds that went long ETF -short CME futures to earn a return greater than where they finance, short -term US Treasury,” said Hayes. He warned that if Bitcoin’s price falls, “These funds will sell $ Ibit and buy back CME futures.”

Market concerns follow President Trump’s reactivation of tariffs on goods from Mexico and Canada, which reworks the fear of inflation and shoots investors away from risk resources.

Crypto -Fear and greed IndexA measure of the feeling of cryptic market has dropped from 25 to 21, left in the “extreme fear zone.”