- Falling Bitcoin Net Delta proposes that the buyer momentum weaken despite aggressive long exposure over $ 88,000.

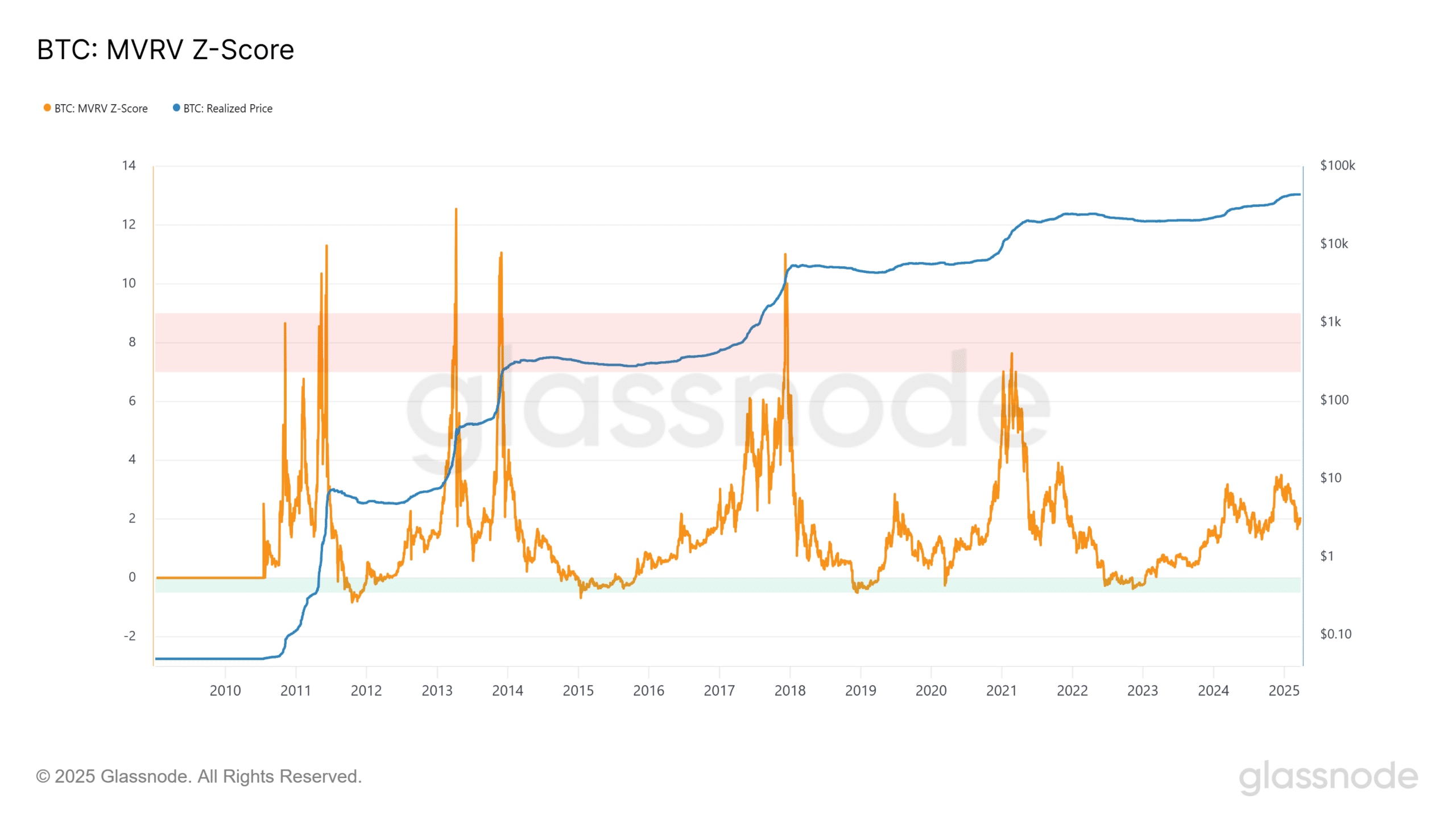

- The realized price continues to rise, but MVRV Z points suggest that the market is cooled, does not capitulate.

Bitcoin’s (BTC) The latest marketing activity emphasized a growing risk for traders who hold long positions when the price measures were raised near a critical level.

The $ 84,000 zone has become the point of contact for institutional positioning and derivative building. If it is broken, it can trigger a quick sale.

Warning signs on the horizon

Data from AlFrakal Show increasing open interest and increase inflows in exchanges and point to increased liquidation risk.

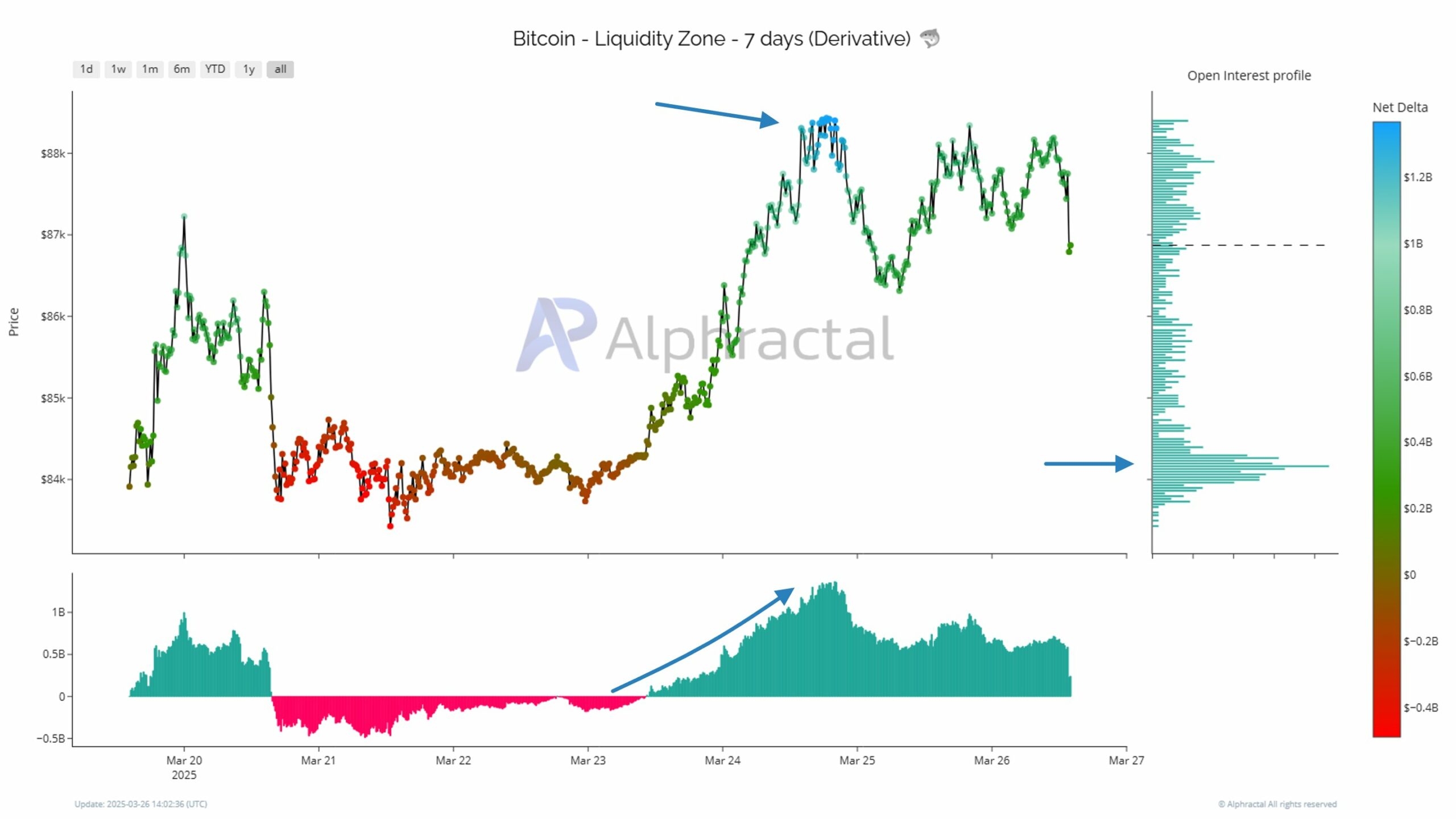

As illustrated in the diagram, we can see how Bitcoin’s price rose above $ 88,000 before they stayed.

Many traders went into long positions during this movement and expect continuation. The open interest profile shows a structure of utilized positions near that price.

Buyers showed up – but then backed down

When prices slowed over $ 88,000, Net Delta began to fall. This suggests that buyers are losing control despite continued long exposure.

If the price turns strongly, the $ 84,000 zone will become a battlefield. Traders who entered long over $ 88K can meet liquidation if prices fall below this level.

The $ 84,000 level has the highest concentration of contracts, making it a main liquidity zone.

This zone serves as both a technical support and a potential liquidation trigger. If prices dip during it, market manufacturers can speed up the move by utilizing captured longs.

This division can result in a wave of forced sales.

These events occur when exploited long positions hit stop loss or liquidation thresholds. Such activity often benefits that traders have short positions, especially if they are stated at higher levels.

To sell signals creep in

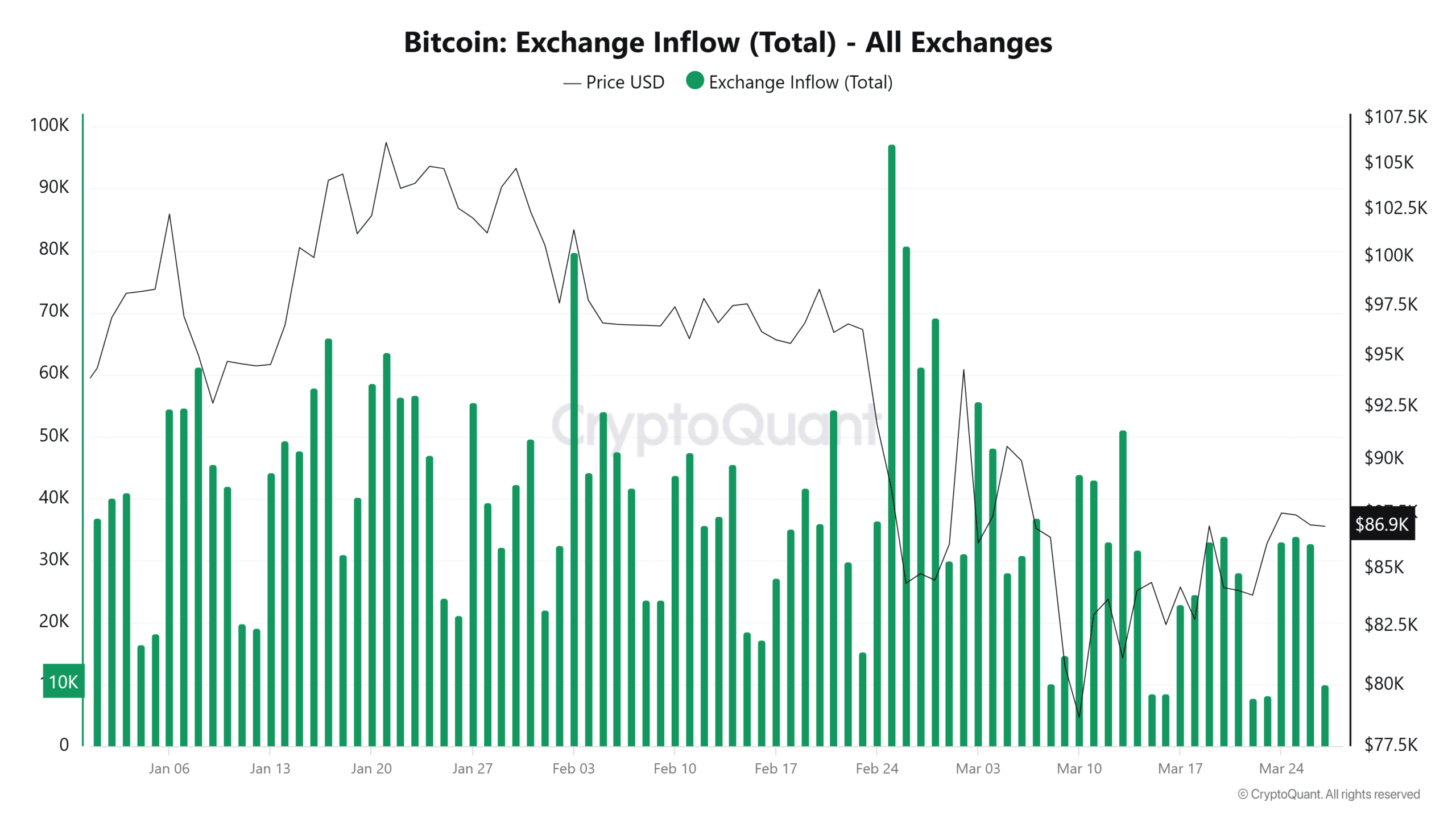

Completing the structural risk is Cryptoquant data, which shows an increase in bitcoin that is transferred to exchanges in March. These inflows signal historical intention to sell.

Between January and March 2025, the price moved from a high of $ 105,000 to $ 86 911. During that time, large inflow nails occurred on days with increased volatility.

For example, on March 3, 31 152 BTC was transferred to exchanges when Bitcoin was priced to $ 84 311. This reinforces the importance of the $ 84K zone.

On March 27, inflows fell to 10,053 BTC. Although lower, this signals doubts rather than renewed optimism. A failure to break higher can trigger fresh inflows.

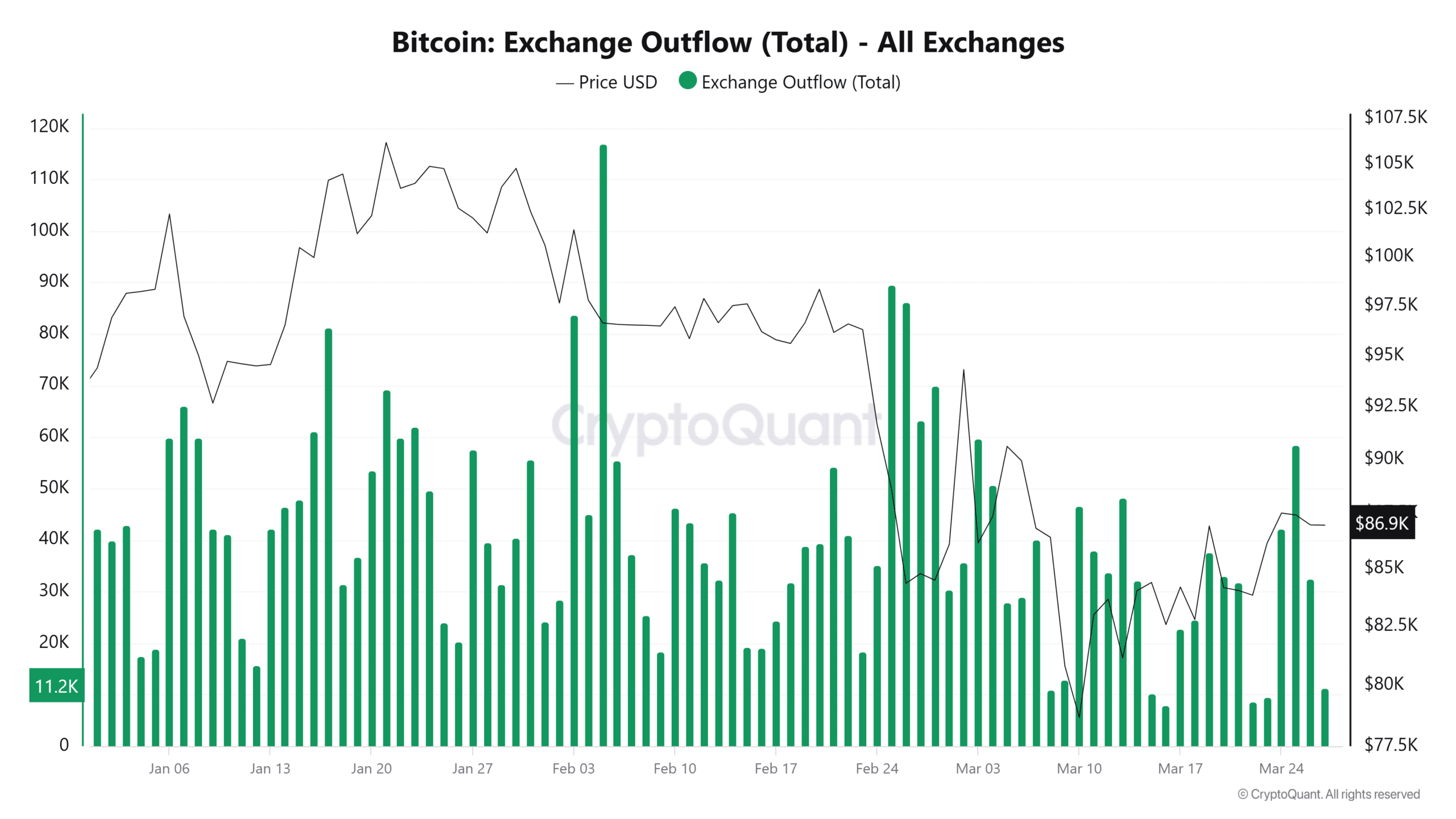

At the same time, outflows decreased from 86,230 BTC in February to 10 186 BTC on March 27. This suggests reduced accumulation and growing caution.

With long -term proprietors who withdraw, haus -like support can be weakened.

Bitcoin Hodlers hit the brakes

Diagrams from Glassnode showing Bitcoin’s Realized price increased steadily from $ 33,149 in November 2024 to $ 43,696 in March 2025.

However, MVRV Z-points fell from 3.42 to 1.99 during the same period. The divergence suggests reduced speculative surplus, not full capitulation. Historically, points over 5 mark tops; 2 means mild overvaluation.

This is the line – who blinks first?

Bitcoin deals with close to $ 86,000 and holds over $ 84,000 support. Exchange data shows cautious accumulation, while derivatives reflect vigorously long exposure.

Indicators on the chain point to weakening speed. A break under $ 84,000 can trigger liquidations. Shorts over $ 88,000 can benefit.

But a strong defense was able to maintain the hausse -like structure for higher lowness. Markets are now increasing this zone for the next big move.