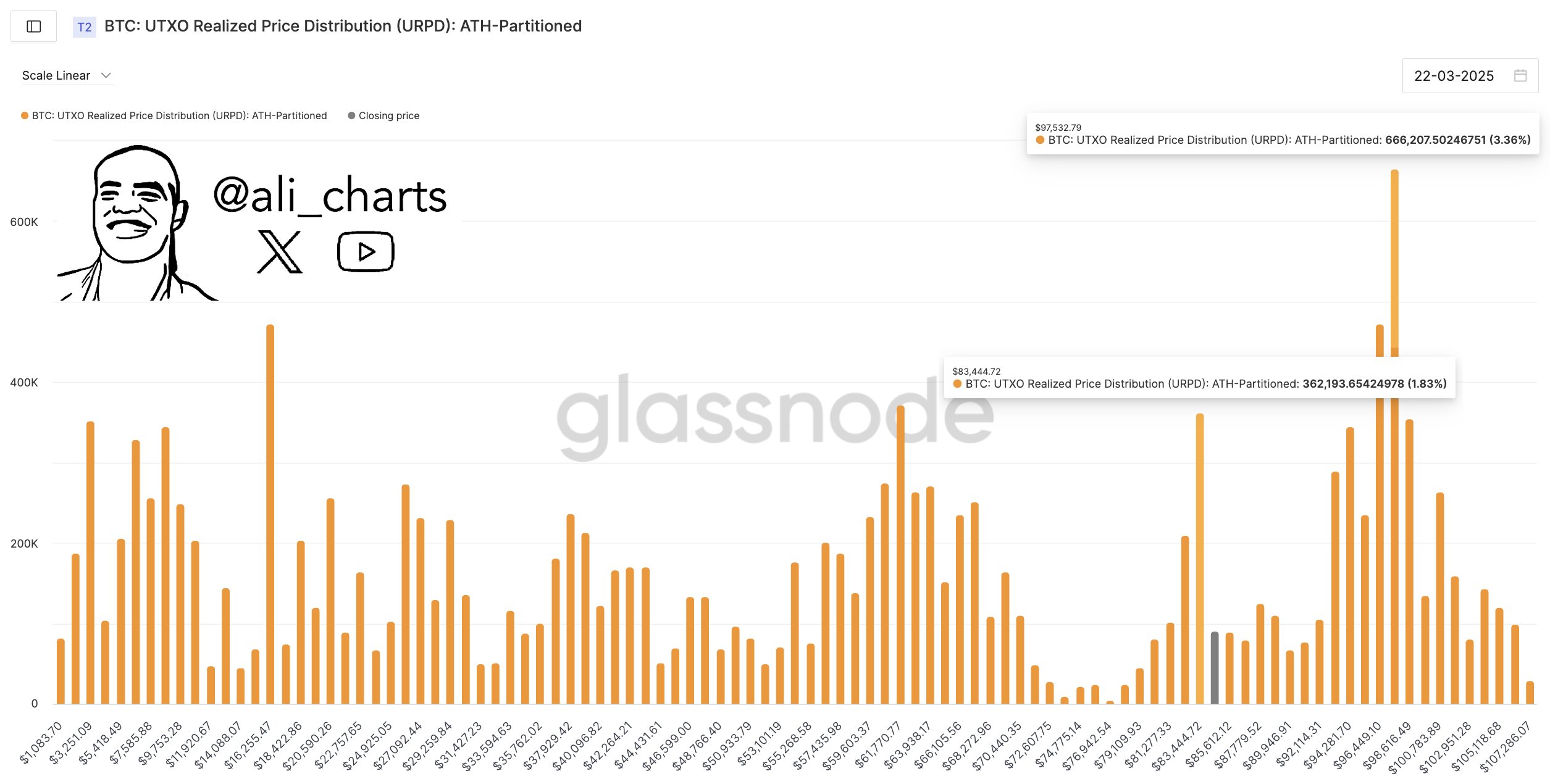

Crypto analyst Ali Martinez has shared some important insights on the current Bitcoin (BTC) market based on UTXO realized price distribution (URPD). With the help of this metric, the famous marketing stake has been highlighted by key support and resistance levels with a potentially strong impact on BTC’s immediate price movement.

After another week of widespread market uncertainty, Bitcoin prices remain in consolidation, and fails to make an effective outbreak over $ 84,380.

Bitcoin Bull Run: $ 97,532 has the key to renewed haussey momentum

In analysis on the chain, Outside transaction exit (UTXO) represents the rest of Bitcoin after each transaction that can be used as input in a new transaction. Therefore, UTXO -realized price distribution analysts allow to identify price levels where Bitcoin’s current supply was last moved. By highlighting price levels with high concentrations of UTXOs, URPD is an important metric to detect resistance and support levels.

In one X post On March 22 by Martinez, data from Glassnode shows a strong cluster of UTXOS approximately $ 83,444 which indicates that many investors have their cost base on this level. At present, BTC’s price is far above this level of support and shows the intention of a potential rise. Martinez, however, notes that a stiff resistance is waiting for market buns to the price level of $ 97,532 which also hosts a huge amount of Utxo.

The analyst explains that a successful clearance of this resistance price level would signal a renewed haussertat momentum in a BTC market that has undergone significant correction in recent months. In a very positive scenario, Bitcoin is likely to grow against new peaks. However, failure to move over $ 97,532 may force BTC to remain in consolidation or even return to lowering the level of support.

Bitcoin breeding to resume upwards?

In the second developments, Martinez has suggested that Bitcoin’s current correction is probably still going on based on the Bitcoin Sharpe relationship. For the context, Sharpe determines the relationship if BTC’s return is currently worth the level of risk at the moment.

The analyst explains The best marketing items have occurred when the Bitcoin Sharpe ratio is at low risk and gives a favorable purchase opportunity. However, the current Sharpe relationship indicates high risk that indicates that potential BTC investors may need to exercise patience.

Martinez said:

We are not there yet, but getting close can signal a main purchase window!

At the time of writing, BTC continues to trade at $ 84,075 after a price increase of 0.27% over the past 24 hours. However, the asset’s daily trade volume has crashed by 46.41% when market engagement falls.

Image from Morningstar, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.