Historically, the Bitcoin price is an indicator of blockchain’s health, with high activity that often correlates with a strong and positive price measure. But the largest Cryptocurrency market seems to have witnessed a significant change, with prices that are now less responsive to changes in Activity on the chain.

For example, the Bitcoin price continues to hold over $ 95,000 and looks to recover the level of $ 100,000 despite the long -term dip in blockchain activity. An analysis company on the chain has weighed in how and why this is possible for the flagship Cryptocurrency.

Why BTC price is less correlated with activity on the chain

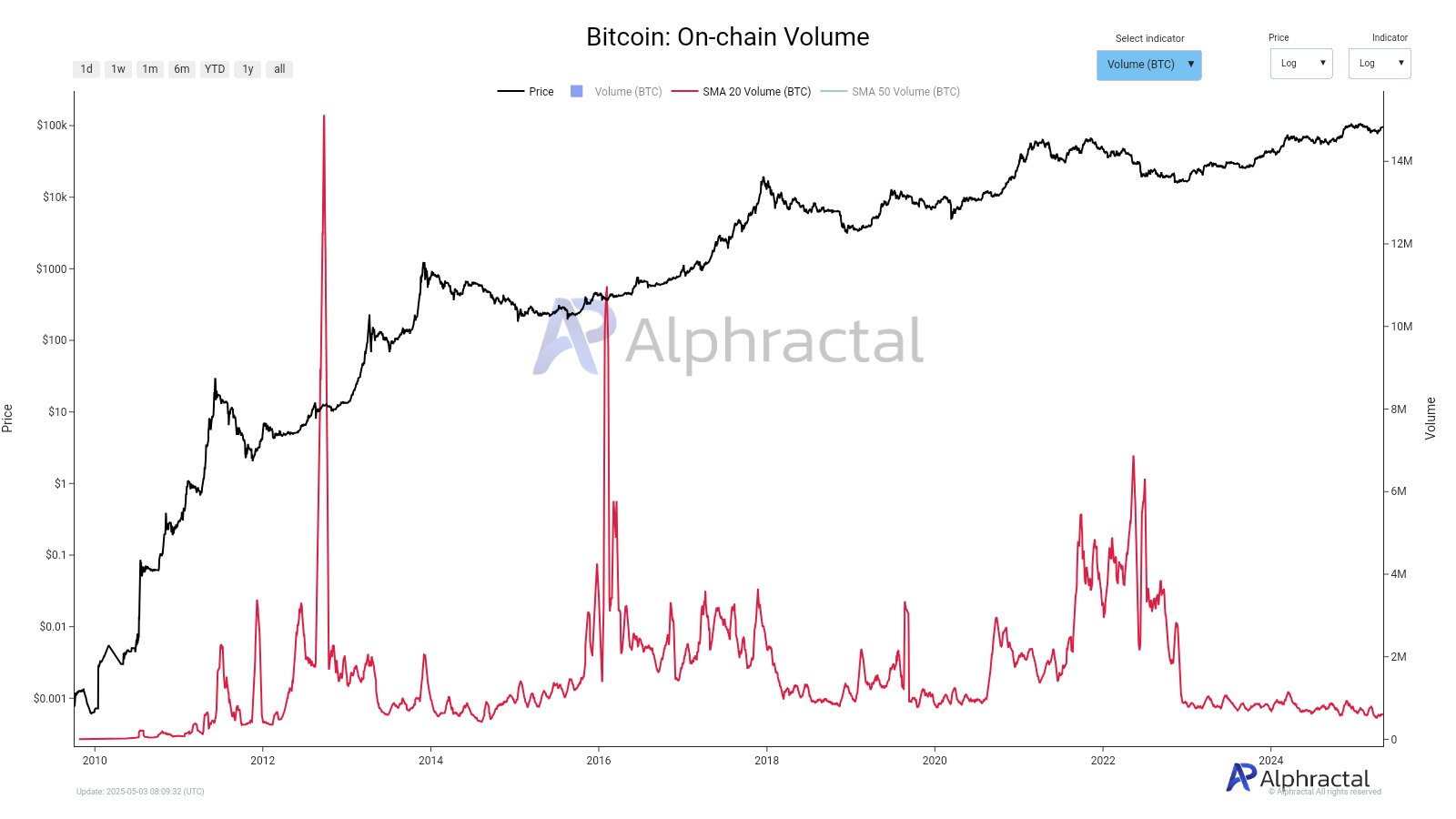

Crypto Analytics Platform Alphractal shared In a new post about X the most important reasons why the Bitcoin price has managed to stay afloat despite transaction volume and active addresses are at low levels. According to the company, BTC’s price increase does not necessarily correspond to increased blockchain use.

First, Alphractal acknowledged that the Bitcoin market experienced a dynamic shift when the US spot exchange traded funds (ETF) was approved in January 2024. The value of BTC is now operated by capital inflows through these financial products rather than blockchain activity.

Source: @Alphractal on X

Company on the chain also mentioned that Historically low volatility In the market has had an important part to play in the low Bitcoin network activity. With relatively small price movement, trader is less incentive to take new positions, leading to lower activity on the chain.

In addition, Alphractal mentioned that the Bitcoin Prize has been largely abandoned by the activities for speculative traders through derivatives and other financial instruments. As a result, there has been a reduced everyday adoption and limited practical demand for the Bitcoin network.

Alphractal also referred to the macroeconomic uncertainty that has obscured the global financial markets in recent weeks. According to the analytics company on the chain, this market conditions have, even if they are improved, most investors waiting for clearerly haus -like signals before doing any move.

Finally marked alphractal artificial exchange volumes among the main causes of Bitcoin price that remains fluid. “Some exchange volume can be inflated, creating a misleading sense of activity while real network use remains modest,” added the platform on the chain.

Bitcoin price

From this writing, BTC’s price is about $ 96,50, which reflects an over 1% decline over the past 24 hours. Despite the choppy price measure this weekend, the foremost Cryptocurrency is still increased by almost 2% on the weekly time frame, according to COOKEKO data.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.