Key dealers

- Bitcoin approached $ 120,000, with strong ETF inflows driving price.

- Legislators are considering major legislative changes that affect the crypto market.

Bitcoin hit one new record high $ 121,000 on Sunday evening after breaking through $ 119,000 earlier in Day and cleaning The mark of $ 120,000, according to TradingView data. Bitcoin hovered about $ 120,835 at the press time, an increase of 30% since the beginning of the year and more than twice its price from a year ago.

Bitcoin’s latest rally caps a week with steady profits, driven by trends on the chain, increased institutional participation and growing confidence in a more supportive regulatory environment.

According to Glassnode, long -term holders currently absorb more bitcoin than miners. Wallets that hold less than 100 BTC have gathered approximately 19,300 BTCs per month, while monthly mining is only 13,400 BTC.

The persistent Netabsorption, spread across a wide base of holders, contributes to a structural delivery press that can provide additional support for upward price.

Look at accumulation by wallet size: shrimp, crabs and fish with <100 $ BTC – Accumulates ~ 19.3K BTC/month, while miners issue 13.4,000 BTC/month.

Persistent netabsorption over a wide base of holders creates measurable supply on the supply side. pic.twitter.com/ajurut5hlpqv– glass node (@glassnode) July 12, 2025

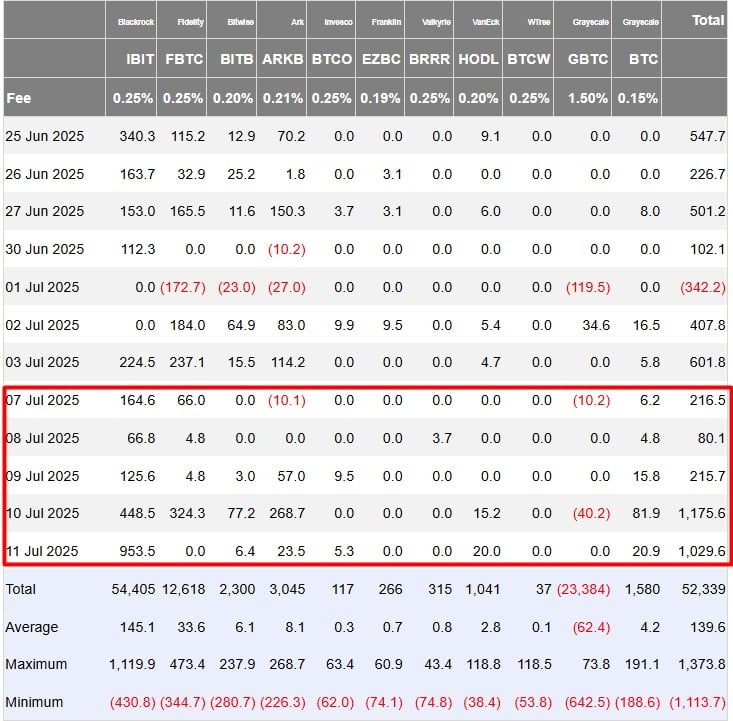

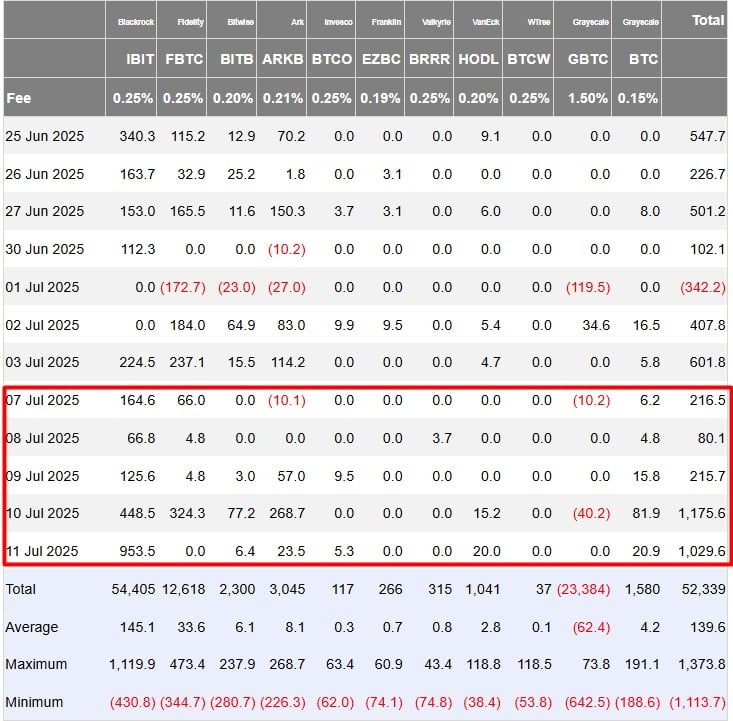

According to data From Farside Investors, US Tot Bitcoin ETF collected over $ 2.7 billion in net inflows this week, with daily inflows exceeding $ 1 billion on both Thursday and Friday. Blackrock’s Ishares Bitcoin Trust (Ibit) dominated the flows and registered more than $ 1.7 billion in inflows for seven days.

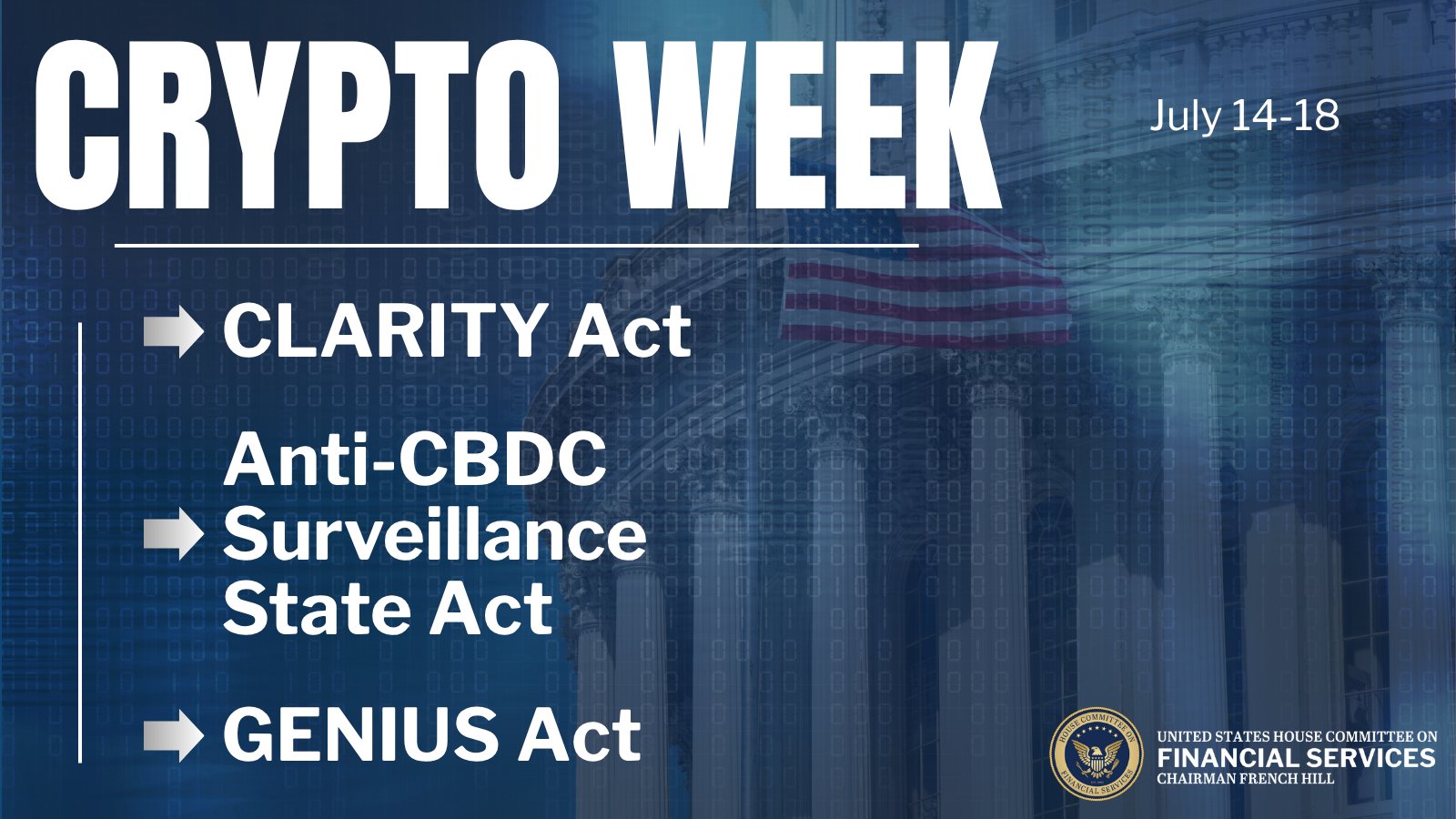

Optimism is also built around regulations, with “Crypto week” in focus as a possible turning point for the crypto sector.

Legislators will debate three important bills that can finally provide clarity to digital asset monitoring, including measures that deal with Stablecoins (Genius ACT), Blockchain infrastructure and jurisdiction for supervisory authorities (Clarity ACT).

Ledn Chief Investment Officer John Glover propose The Bitcoin’s latest price surprise supports the commencement of the final bull run phase.

He projects Bitcoin is likely to reach $ 130,000 at the end of this year, potentially followed by a short -term correction and then a final rally to $ 136,000, marking the completion of a perennial bull bike.