- Bitcoin price increased to $ 102K when the purchase pressure increased, which signaled upward speed

- Strong marketing and positive feeling suggested bitcoin can soon challenge new resistance levels

Bitcoin -Price: Recently implemented performance and market dynamics

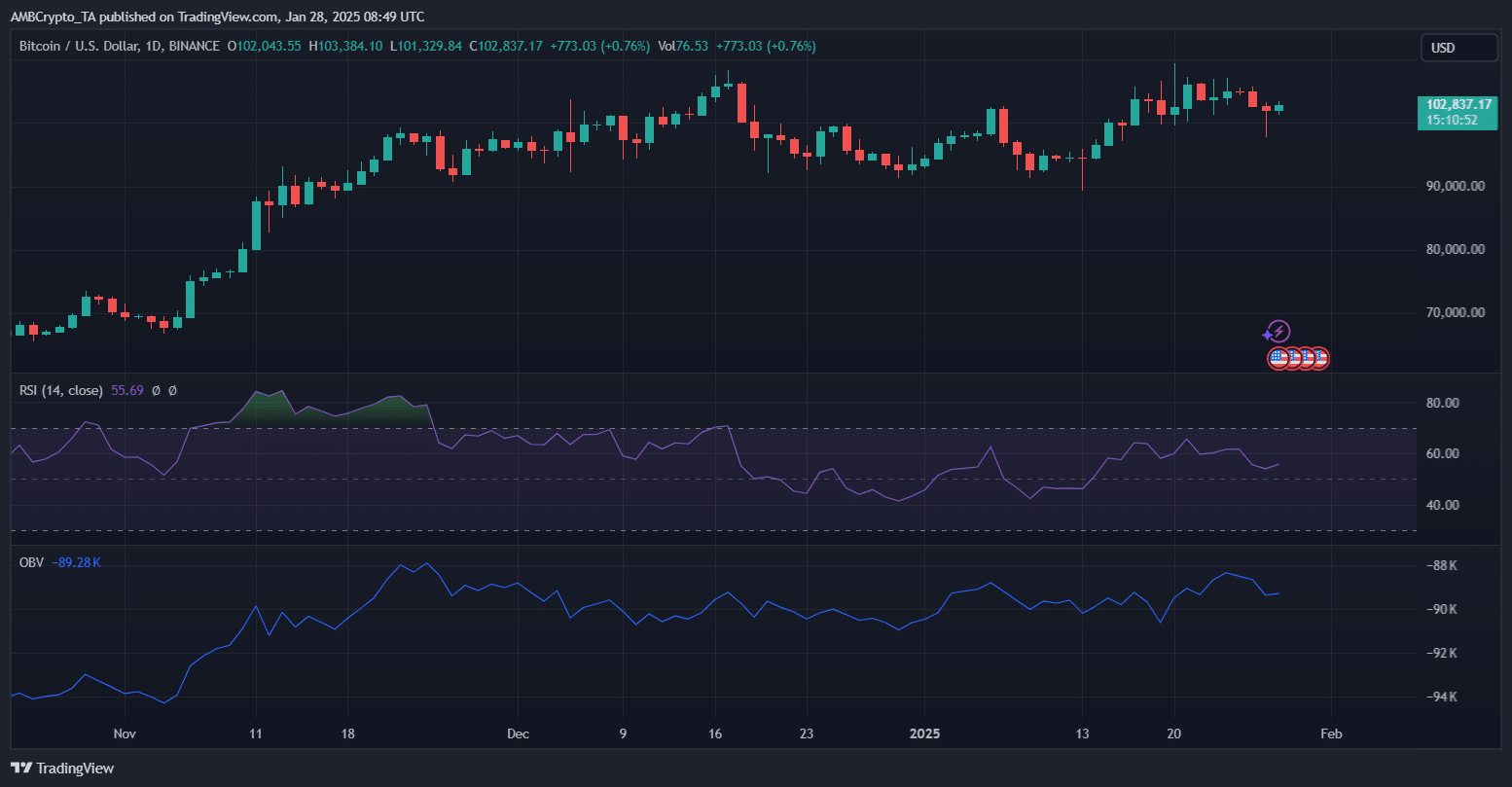

Bitcoin has shown resilience, with its price climbing to $ 102,837. It has been a gradually upward since November, characterized by consistently higher lowness. RSI is currently 55.69, which indicates neutral momentum with growth space.

OBV trends indicate to increase the accumulation, possibly drive the purchase pressure.

The recent increase can be attributed to the new Pro-Crypto-American administration, which gives renewed interest rates.

Historically, January often acts as a shallow month for bull runs, which sets the scene for potential rally.

Together with positive emotions and historical patterns, Bitcoin’s upbringing can soon meet tests around psychological resistance levels.

Buy pressure recovery

Buying/sales printing -diagram shows significant fluctuations in the market entry over the past few days.

This was especially a sharp increase in purchase pressure on January 24 and coincided with a price increase against $ 106,000.

However, this momentum was short -lived when the sales pressure intensified, which led to a sharp decline under $ 100,000 on January 27. This drop was accompanied by high trade volume, which indicates heavy liquidation and potential stop losses.

As Bitcoin approached $ 98K, the Buy printed significantly, adapted to the current recovery to $ 102K. This suggests that buyers go to key support levels, which reinforces market confidence.

If this trend continues, Bitcoin can stabilize over $ 102K and try another outbreak to the $ 106K resistance level.

Trade volume is in line with these changes, which indicates strong market participation during both rally and corrections. This suggests increased investment activity.

Read Bitcoin’s (BTC) Price Presence 2025–2026

Marketing Entiment analysis

Bitcoin’s exchange inflows provide valuable insight into the feeling of investors. New information indicates a relatively stable trend.

Historically, large spikes in exchange inflows often precede sales, as investors move BTC to replacements for potential liquidation.

However, the current inflow remains moderately despite Bitcoin’s rally over $ 102K, which indicates that the holders do not rush to sell, which reinforces Hausse.

At the time of writing, the Fear & Greed Index was 72 and placed the market in the “greed” zone.

This strongly suggests investors’ confidence but also arouses caution, as high levels of greed can precede corrections.

If inflows remain stable and greed not overex end, bitcoin can maintain its speed, with the potential to challenge new heights.