- Bitcoin is approaching a critical support level of $ 63,000 and risks a break in its four -year price pattern.

- A decline under $ 63K could shake long -term holders and trigger increased market vollatility.

Bitcoin (BTC) is spitting at an important time. As it approaches the $ 63K support level – a historically strong zone that has marked important bottoms – investors carefully look at the signs of resilience or division.

For several years, one of Bitcoin has been the most consistent pattern has been its refusal to go through prices from four years before. But if $ 63,000 support cannot hold, that streak may end.

A decisive case below this level can rattle the long -term holder’s conviction and initiate a period of increased volatility. With 2025, this moment can prove to be critical when it comes to designing bitcoin next big move.

Where bitcoin could find his foot

Bitcoin has hovered Just above two key levels – actively realized price at $ 70 730 and the real market average price to $ 64,480.

These levels have previously highlighted large bending points: Sales of May 2021, January 2022 Bear Market Low and the accumulation zone 2023–2024.

The active realized price reflects market behavior through absorbed profits and chain activity, while the real -market average price offers a deeper structurally anchor bound to investor capital and active supply.

Together, they form a bottom area with high probability that can stabilize BTC in the short term.

Bitcoin has never visited four -year prices

Bitcoin has maintained a striking consistent pattern: it has Never reviewed price levelS from four years before.

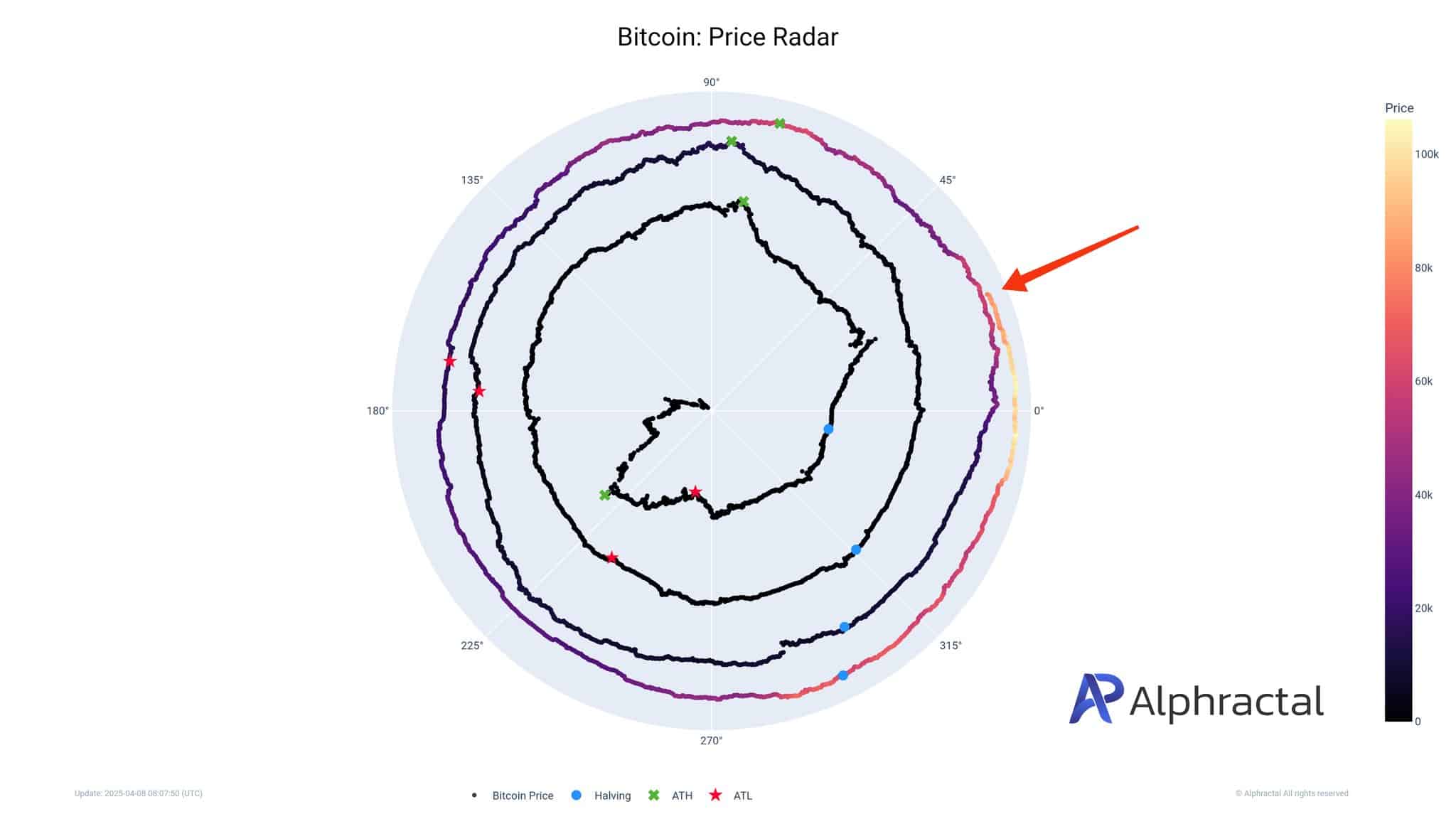

This rule, visualized in the Bitcoin Prize Radia magazine above, forms the basis for Bitcoin’s cyclic nature and long-term appeal.

Each rotation on the radar represents four years, with halving events, holidays and lowness marked around the spiral.

Since BTC is now approaching the support level of $ 63,000, it turns dangerously close to violating this long -standing principle.

An infringement would mark a historical first – to break the psychological and structural rhythm that has shaped investors’ trust and bicycle expectations since the beginning of Bitcoin.

Consequences for LTHS

If Bitcoin Dips below $ 63,000, it would break a precedent that has held in each half -survey bike – never examined prices from four years before.

For long -term holders, this is not just a technical anomaly; It is a psychological shock. Many have anchored their conviction in Bitcoin’s historical texture, with the four -year rule as a compass for time and faith.

An infringement can impose doubts, shake long -term conviction and get a reconsideration of bicycle -based strategies.

In a market that is driven as much by story as by basic factors, violation of this “rule” can worry the feeling and inject volatility into an already fragile macro environment.