Key dealers

- Bitcoin fell 5% to $ 102,900 after Israeli flight attacks on Tehran.

- Gold increased to $ 3,420 when investors sought safer assets in the midst of increasing tensions.

Bitcoin dropped 5% to $ 102,900 early Friday after Israeli flight attacks hit Tehran, while Spot Gold grew to $ 3,429 in a flight to safety, tradingview data shows.

On Thursday, the leading digital asset succeeded in a modest recovery to $ 108 450 from $ 107,000, including as Markets absorbed baisse -like signals From reports that Israel had notified US officials about its intention to initiate an operation against Iran.

Tensions escalated after Israel began “Operation Rising Lion” against Iran, with Israeli Prime Minister Benjamin Netanyahu who says: “This operation will continue as many days as it takes to remove this threat.”

Prime Minister Netanyahu:

“By the time ago, Israel launched Operation Rising Lion, a targeted military operation to roll back the Iranian threat to Israel’s much survival.This operation will continue for as many days as it takes to remove this threat. ” pic.twitter.com/3c8of1gcya

– Israeli Prime Minister (@israelipm) June 13, 2025

US Secretary of State Marco Rubio said Israel took “unilateral measures against Iran” and had informed the United States that the strikes were necessary for self -defense, AP reported.

The military measure comes in the midst of increased concerns about Iran’s nuclear program. The International Atomic Energy Agency’s Board of Directors censored Iran on Thursday because they did not work with inspectors, which prompted Tehran to announce plans for a third enrichment site and deployment of advanced centrifuges.

The United States has begun to draw some diplomats from Iraq’s capital and offer voluntary evacuations for US military families in the wider Middle East region. The Ministry of State issued warnings for Americans to leave Iraq, citing “increased regional tensions.”

Trump’s envoy Steve Witkoff indicated that Nuclear Power Calls with Iran would continue, although Israel’s military measures could escalate regional tensions and affect US interests.

Bitcoin has historically seen Short -term price declines During periods of geopolitical anxiety, as investors tend to switch to traditional assets with the safe seas.

Nevertheless, crypto supply has often recovered quickly, supported by its increasing perception as a digital value store.

At the time of writing, BTC was about $ 103,100.

The crypto market is under pressure when Bitcoin extends losses. Ethereum fell below $ 2500, while XRP fell to $ 2.1.

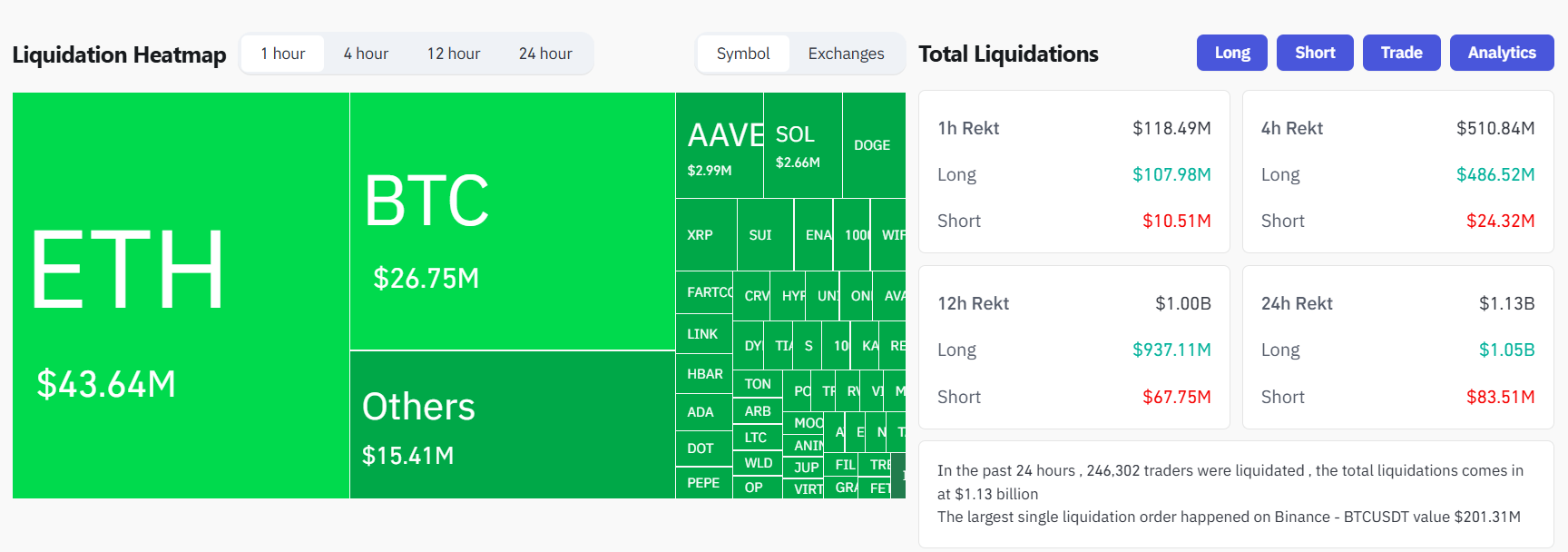

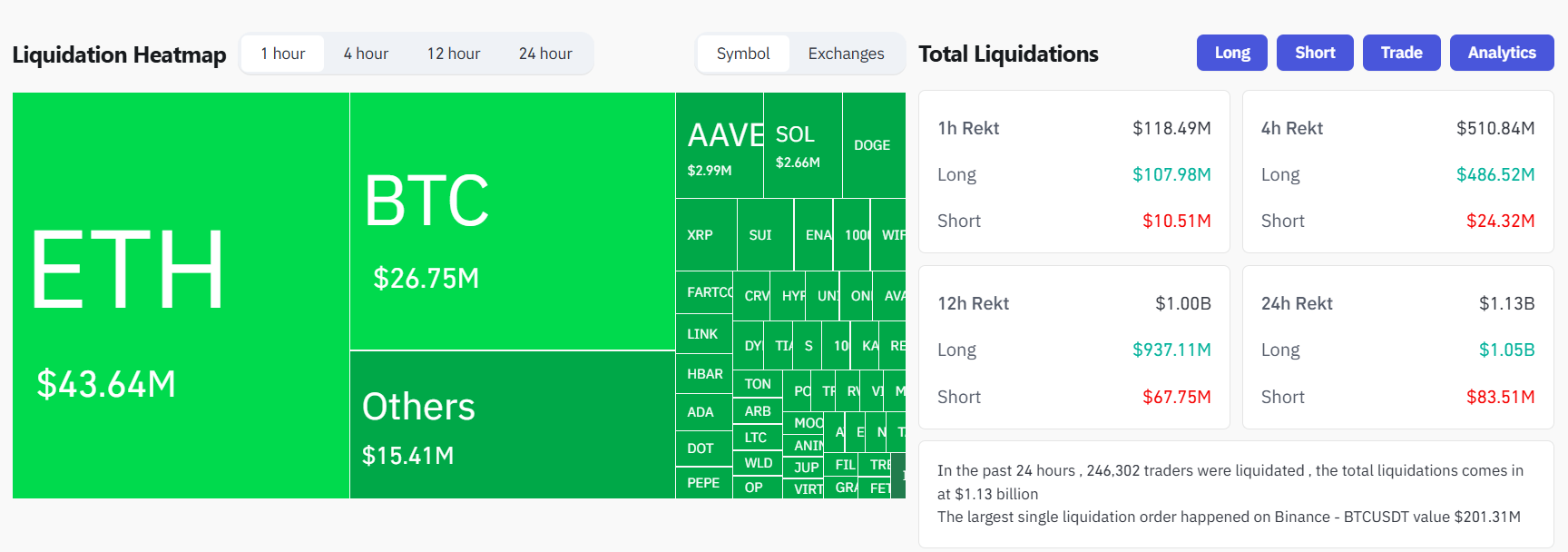

According to Coinglass dataUtilized liquidations over crypto assets increased to $ 1 billion over the past 12 hours. Long positions accounted for most losses to about $ 937 million, compared with $ 67 million for short positions.