The Bitcoin Prize struggled to continue its 2024 speed during the first quarter of 2025 and crumbled during the macroeconomic uncertainty in the United States. While the crypto market seemed to continue its misery in early April, prices look to regain their bicycle heights – thanks to the improved market climate.

According to the latest price details Bitcoin price has increased With more than 25% so far during this quarter, most large assets exceeded the same period. Interestingly, the main Cryptocurrency seems to have more room for further upward growth, with its current high price on all the time that seems like the next immediate goal.

Three important levels to look at this second quarter

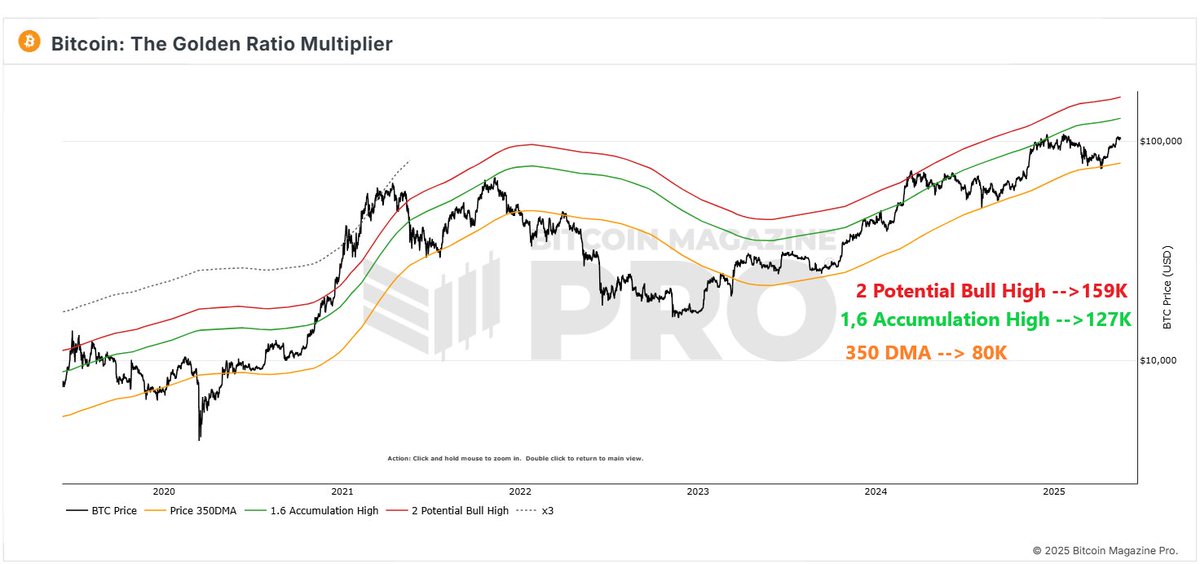

In a 17 May post on the X platform, analyst at the chain Burak Kesmeci evaluated The potential for the Bitcoin price during the remaining weeks in this second quarter. In its latest analysis, Crypto Pundit revealed three levels that can be crucial to BTC’s price track.

The relevant indicator here is the golden multiplier ratio, which is primarily useful for tracking cyclic price behavior and identifying important price levels. This technical analysis tool applies Fibonacci-based multipliers to 350-day sliding average (350DMA) to identify potential prices and bottom.

Kesmeci identified the levels of $ 127,000 and $ 159,000 as resistance regions to look at in this bull rally. Specifically, the level of $ 127,000 is in line with 1.6x multiplier for 350-day motion the average, which acted as a the middle of the bike top in previous bull.

Source: @burak_kesmeci on X

The level of $ 159,000, on the other hand, correlates with 2x multiplier for 350DMA and has historically signaled the bike peaks in the BTC market. However, the Bitcoin Prize would have to break the middle of the cycling top if there is a chance to rally against $ 159,000 level.

In addition, Kesmeci pointed out the most important support level to look at for the Bitcoin Prize during the remaining days of the second quarter of the year. Based on the golden multiplier ratio, this pillow is $ 80,000 around 350-day sliding average, where long-term accumulation usually occurs. A case under this support could invalidate the hausse theory Currently held at the price of BTC.

In the end, Kesmeci noted that the golden multiplier ratio is based on moving averages, and as a result, the marked levels are subject to changes when the Bitcoin price moves in the coming days.

Bitcoin price

From this writing, the value of BTC floats about $ 103 275, without any significant price movement over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.