Key dealers

- Bitcoin experienced its worst weekly performance due to a strong dollar and Trump’s potential customs plans.

- Despite short -term challenges, long -term structural rear winds for bitcoin and digital assets remain intact.

Bitcoin’s increase by over 45% in the aftermath of the presidential election on November 5 had already lost the steam. Analysts expect more turbulence in the future when elected President Donald Trump’s proposed customs plans and robust employees drive bond interest rates higher, strengthen the dollar and put pressure on digital assets.

“Bitcoin problems at the moment are the strong dollar,” Zach Pandl, research manager at Gråskala Investments, told CNBCNote that the Fed’s latest signal partly helped to strengthen the dollar.

Bitcoin was on a strong start this week and recycled $ 102,000 on Monday, Cooikecko data shows. Rally, however, was short -lived; Flagship scrappy -supply fell below $ 97,000 the next day and extended its picture towards the end of the week.

“I would attribute the reduction for the last two days to the market that began to estimate that not all aspects of Trump policy will be positive for Bitcoin,” Pandl treated the latest decline and added that Trump’s proposed customs plans introduce uncertainty into the market.

Trump is considering explaining a national economic emergency to facilitate his plans to implement universal customs, CNN reported Wednesday. This, in combination with related economic politics, can create a number of inflation pressure. Yet no final decision has been made about this explanation from now on.

Although there was initial optimism with regard to a pro-crypto environment under Trump’s administration, contradictory signals about the extent of customs can create volatility and negatively affect the risk of bitcoin.

Continued high interest rates

Stronger than expected salary figures in December 2024 indicates that there may be less urgent for Fed at lower prices to stimulate the economy. Following the report, investors have reduced their expectations of interest rate cuts in the short term.

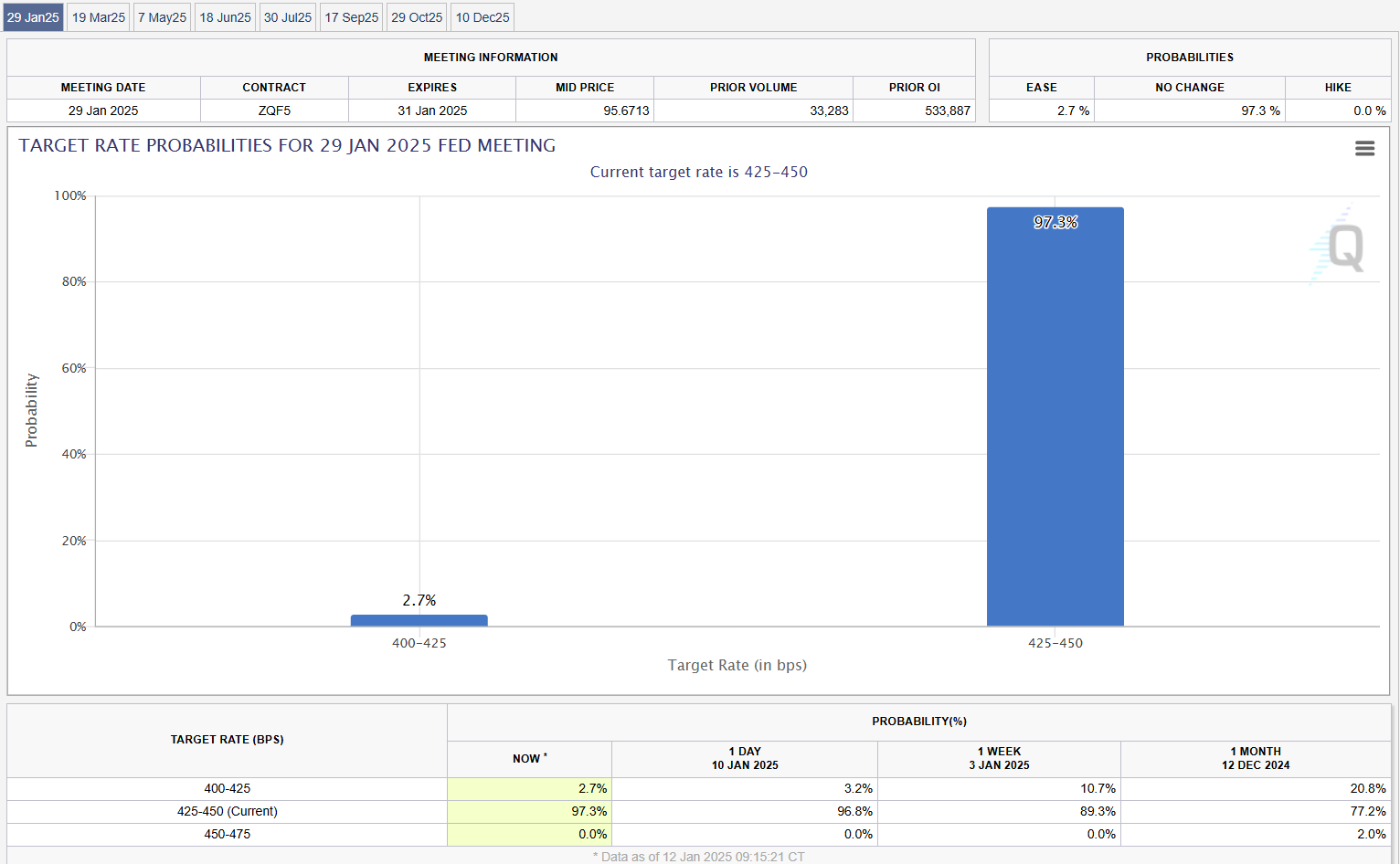

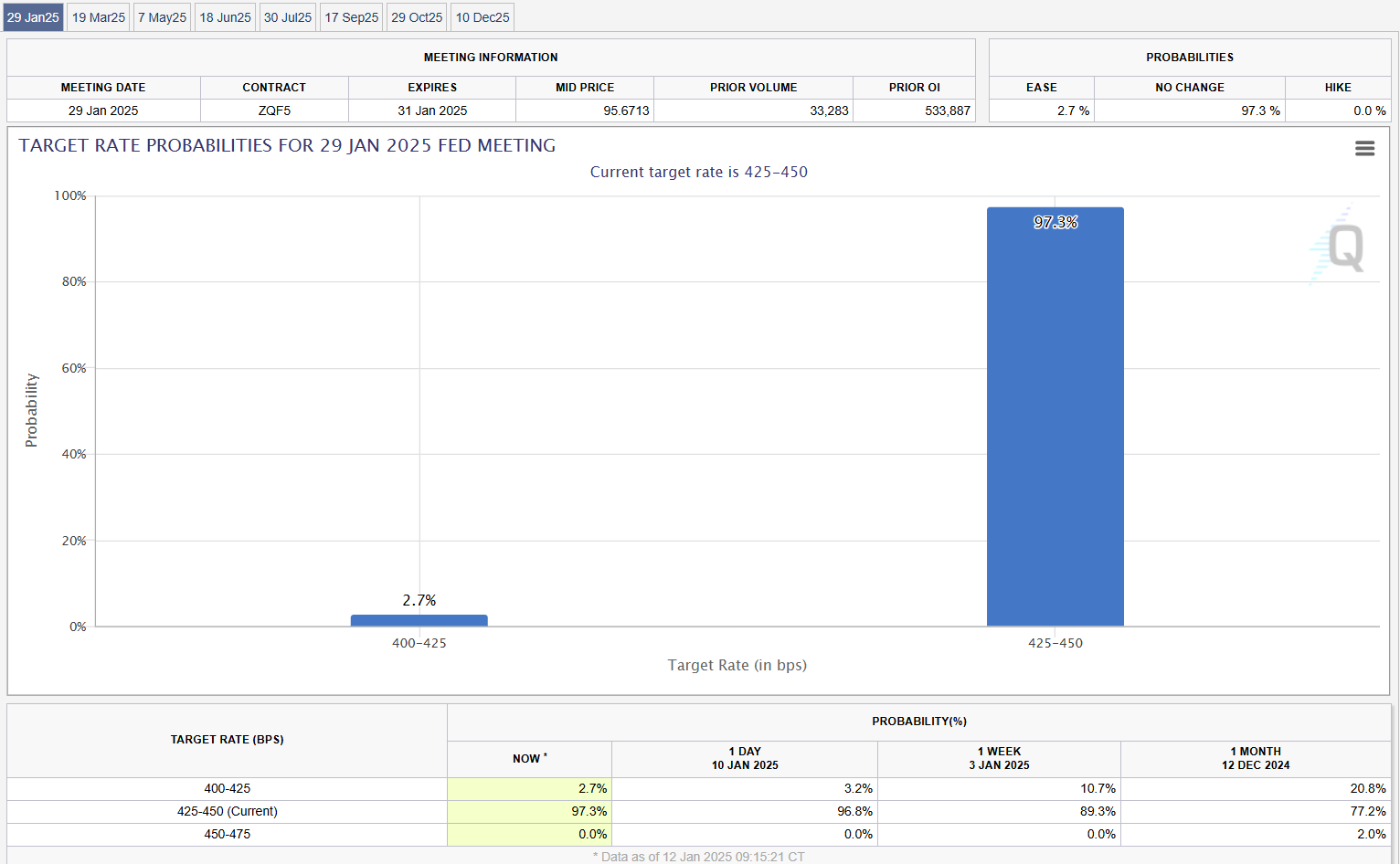

From the latest data From the CME Fedwatch tool, the market participants are leaning towards the probability that the Fed will keep interest rates unchanged during the upcoming meeting January 28-29, with a probability of 97%.

Fed lowered prices by 25 points last month, but it also delivered a Hawkian message that showed a cautious setting forward. The central bank projected only two interest rate reductions this year, from previous forecasts of more reductions due to ongoing inflation and economic conditions.

With a cautious fed and uncertainties about Trump’s economic agenda, “there are possible risk resources will face hack in the short term, despite long -term structural weaves for bitcoin and digital assets that remain intact,” according to Alex Thorn, research manager at Galaxy Digital Digital.

Pro-Crypto legislation can take some time

Potential positive effects from pro-crust legislation may not be realized rapidly as Congress is expected to prioritize non-crypto issues over the next three months, according to JPMorgan analyst Kenneth Worthington.

Nevertheless, Worthington is convinced that Congress will eventually move its attention back to digital assets and take an important crypto-related legislation, such as potential framework for Stablecoins and market structure.

The New York Digital Investment Group (Nydd) has the same point of view.

In a new one ReportNydy’s research manager Greg Cipolaro suggests that immediate changes in cryptop policy are unlikely. He points to various state processes, such as official appointments and confirmations, which can delay the implementation of new policies.

The analyst also notes that other legislative priorities may take precedence, which further delay crypt -specific initiatives despite a generally positive view of digital assets from Trump’s future appointments.