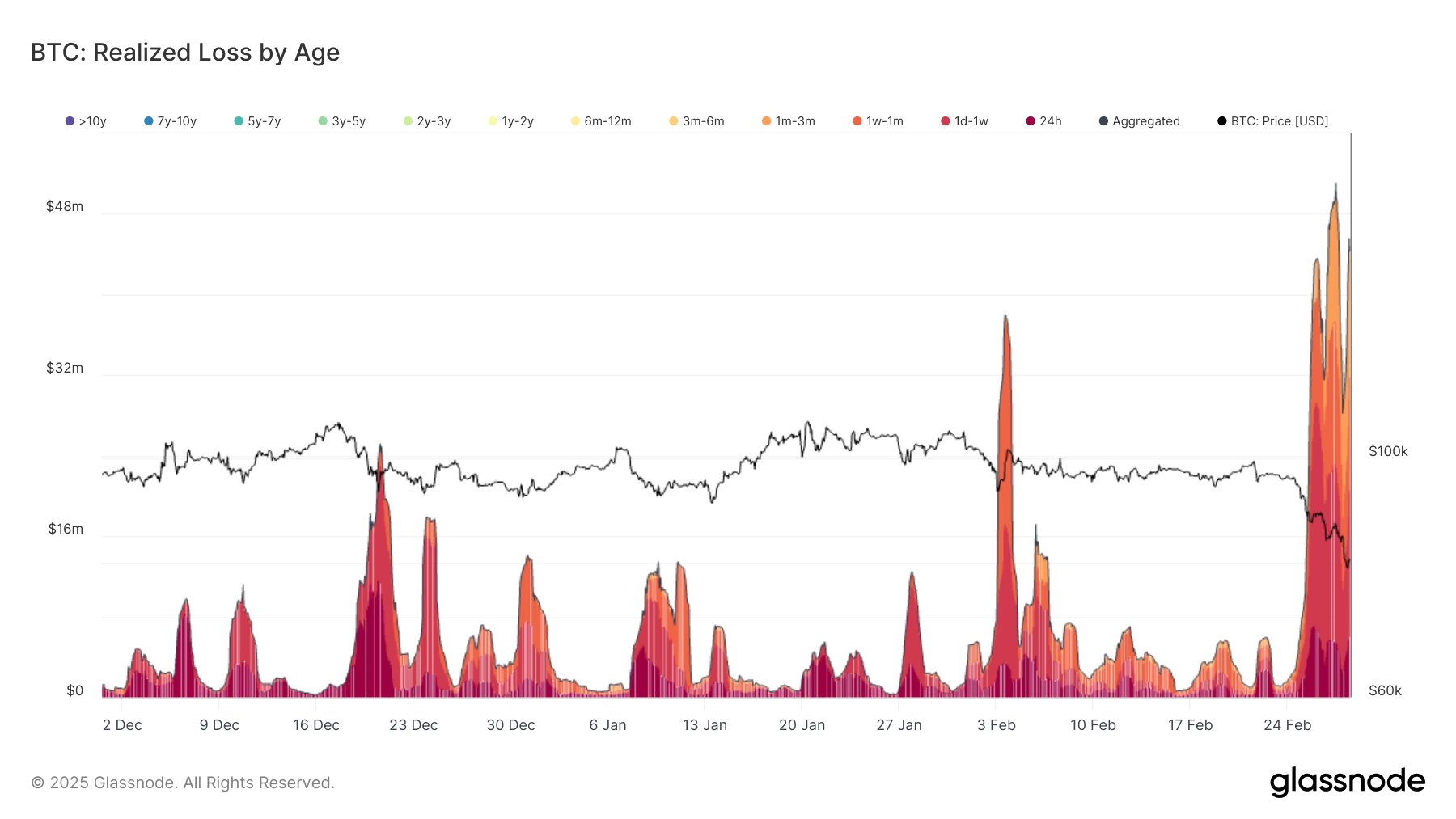

Bitcoin (BTC) market has been very volatile over the past week and under a strong baisse -like influence. During this period Bitcoin has crashed with over 15% falling As low as $ 80,000. Interestingly, Blockchain Analytics Glassnode has provided an in -depth analysis of investors’ behavior in the midst of this price decline that illustrates the cohort with the greatest realized losses.

BTC 1 day to 1-week holders leads market-likeliking pressure

On Friday, February 28, Bitcoin dipped under $ 80,000 and reached a price level that last seen in November 2024. In response, the BTC market registered $ 685 million in realized losses in addition to the first $ 2.16 billion between 25-27 February. On one Last X postGlassnode analysts entered the market from the market on Friday, indicating that this latest capitulation is primarily concentrated Short -term holders (Sth) Who realizes losses at a much higher rate than long -term holders.

From Glassnode’s Report, The Most Affected Cohort of Sth Has Been New Market Entrants Over the Past Week as Indicated in the Following Data: 1-Day to 1-Week Holders with $ 238.8 Million in Losses, 1-Week to 1-Monters ($ 187.6 ($ 132.4 Million) and 24-Hour Buyers ($ 104.9 Million). However, it is worth noting that holders from the last 3-6 months also experienced a significant peak in realized losses. This group registered $ 12.7 million in realized losses on Friday, which corresponds to a 95.4% profit from the previous day.

When you looked further, Glassnode’s report also realized the price on Friday also operated Bitcoin’s average interest rate to $ 57.1 million per hour. The Realization Speed Per Cohort of the Sth-WHO Account for the Majority of the Market Losses is as Follows: 1-day to 1-Week Holders with $ 19.9 Million/Hour, 1-Week to 1-Month Holders ($ 13.9 Million/Hour), 1-month to 3-montth 24-Hour Buyers ($ 8.04 Million/Hour).

As expected, 1-day to 1-week cohort is the dominant force in pushing liquidity pressure with a loss realization almost twice the second largest group.

Bitcoin long -term holders remain determined

According to more data from Glassnode’s report, Bitcoin long -term holders From the last 6-12 months has shown minimal, negligible loss realization despite widespread market capitulation.

This development indicates that long -term investors are largely incredible of recent sales and price correction with strong confidence in a market recovery. At press time, Bitcoin is shopping for $ 85,200 after a certain price recycling on Friday. However, its weekly losses remain of 11.34% indicating the current Baissian feature of the market.

Image from Getty Images, Chart from TradingView

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.