Bitcoin (BTC) has moved to regain the price level of $ 86,000 after a profit of 2.65% over the past 24 hours. Noteworthy, the foremost Cryptocurrency has maintained a raisy form during the last climb by over 15% since he took about $ 74,000 rice zone. In the midst of a potential resumption of the wider bull roller, prominent crypto analysts have highlighted a remarkable development in bitcoin short -term holders MVRV (market value at realized value).

Bitcoin Market Recovery Awaiting Final Signal: Analysts

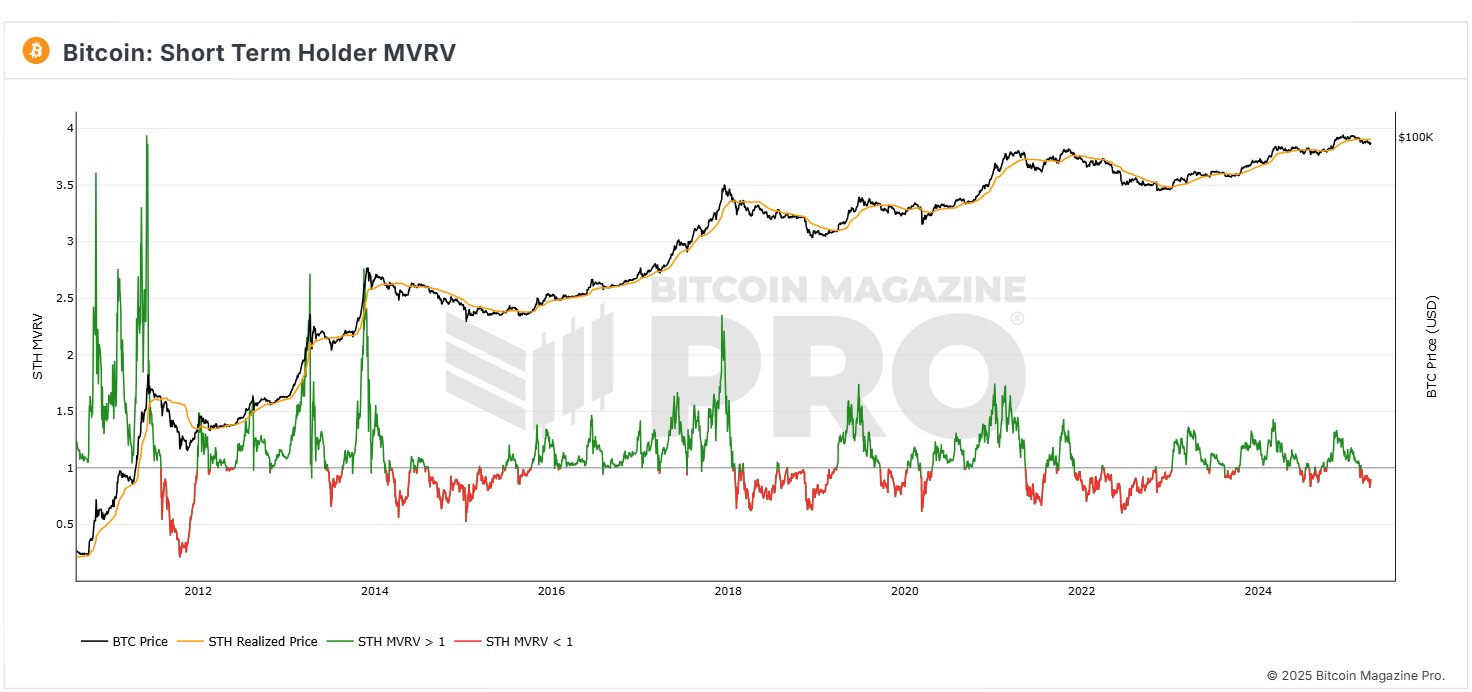

On one New post At X, Kesmeci explains that Bitcoin shows early signs of a marketing recovery after the latest developments in Bitcoin MVRV for short -term investors. For context, MVRV measures investors’ profitability by comparing the market value for access to the price it was acquired. An MVRV score below 1.00 indicates that the average holder is lost, while a point over 1.00 suggests profit.

MVRV for Bitcoin short -term holders, ie addresses that have kept Bitcoin for less than 155 days, is particularly important as this cohort of investors is usually the most reactive for price changes. In particular, Sth MVRV provides insight into market term and potential price direction.

According to Kesmeci, Bitcoin Sth MVRV is now at 0.90, close to a profit level above 1.00. Sth MVRV had hit 0.82 in the middle of Last crisis “Tax Tariff Poker”ignited by international customs changes by the US government. Noteworthy, this decline falls lower than the levels seen during the Japan-based transport crisis on August 5, 2024, when Sth MVRV dipped to 0.83.

In recent days, Sth MVRV has risen to 0.90 in line with the resuscitation of BTC prices, but Kesmeci warns that Bitcoin still has to cross 1.00 to confirm the potential for all significant price profits for short-term investors. Although the increase from 0.82 to 0.90 remains a positive development that indicates an ongoing change in the marketing entry.

BTC price views

At the press time, bitcoin is traded at $ 85,390 after a small pricing over the past few hours. In the middle of recent daily gains, the main Cryptocurrency is increasing by 2.11% on its weekly chart and 4.33% on the monthly chart when Haussearted Momentum continues to build among investors. However, marketballs must compensate for 38.98% reduction in daily trade volume if the current upward must continue.

Noteworthy, BTC investors should expect to meet good resistance at the $ 88,000 price zone that has served as a strong price barrier in previous times. At the same time, the immediate price support in the advent of all price falls is about $ 79,000.

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.