- Valks have withdrawn 110,000 BTC in 30 days, which signals aggressive accumulation and possible upward speed.

- Traders are strongly placed on key levels, with $ 496 million in Longs close to $ 102.8,000 and $ 319 million in shorts to $ 104.8,000.

Bitcoin (BTC)The world’s largest Cryptocurrency has changed the overall Cryptocurrency market with its impressive recovery in recent days.

The surge seemed to a large extent driven by choice activity, which has increased over both site and derivatives.

Valks withdrew 110,000 BTC, time to buy?

Since the day Bitcoin started bleeding, whales and industry giants have taken the opportunity to buy the dip.

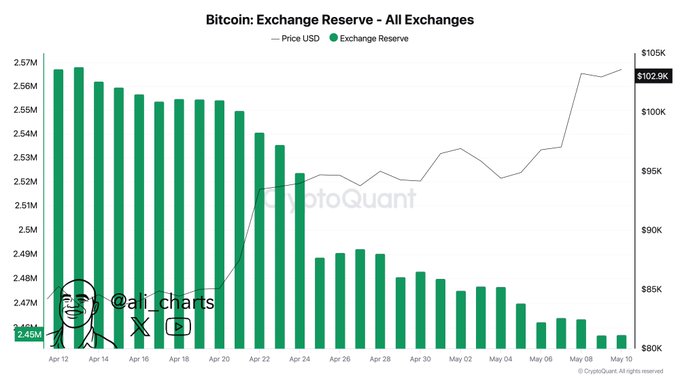

Recently a prominent Crypto expert Shared information about Bitcoin exchange reserves over the past 30 days and revealed that whales have withdrawn over 110,000 BTC during this period.

This significant withdrawal of BTC indicates potential accumulation and can create purchase pressure, which leads to a further upward rally, which explains Bitcoin’s latest increase.

At the same time, whales have not stopped yet, they have continuously collected BTC.

In just 48 hours, Whales brought another 20,000 BTC to its wallets.

This continuous accumulation of BTC reflects the election of the whales and confidence in the long term access.

Dealers least participation

On the other hand, retail investors were largely absent during this period and were seen loosening their holdings due to panic.

According to the chain analystThe retail trade usually returns near market peaks, not during recovery or corrections.

Despite BTC trading only 5% below its previous peak, retail participation stopped muted, possibly limiting foamy speculation – at the moment.

$ 500 million of haussearted bets

In addition to all this, traders seem to be in line with the current marketing entry, which has been revealed by Coinglass on the chain Analytics.

Data shows that traders are currently survived at $ 102,819 level on the underside (Support) and $ 104,871 on the upper side (resistance).

At these levels, traders have built $ 496.55 million in long positions and $ 319.26 million in short positions.

This metric indicates that bulls are currently dominating the market and hopes that the BTC price will not fall below $ 102,819 support levels at any time.

At press time, BTC was about $ 104,300 – up 0.75% in 24 hours. But trade volume dipped 7%and suggested to lower commitment.

Bitcoin price action and technical analysis

According to Ambcrypto’s technical analysis, BTC Hausse operates and is ready for a new height. The daily diagram reveals that the supply is on its way to the most important level of resistance of $ 106,800.

If this upward momentum continues and the price breaks through this resistance, there is a strong opportunity that BTC may experience a remarkable force and potentially reach a new highest time.

The BTC’s relative Strength index (RSI) was at 74, indicating that access is in upper -grade territory.

There is a strong possibility that it may experience a price correction until RSI moves out of the over -bought zone.