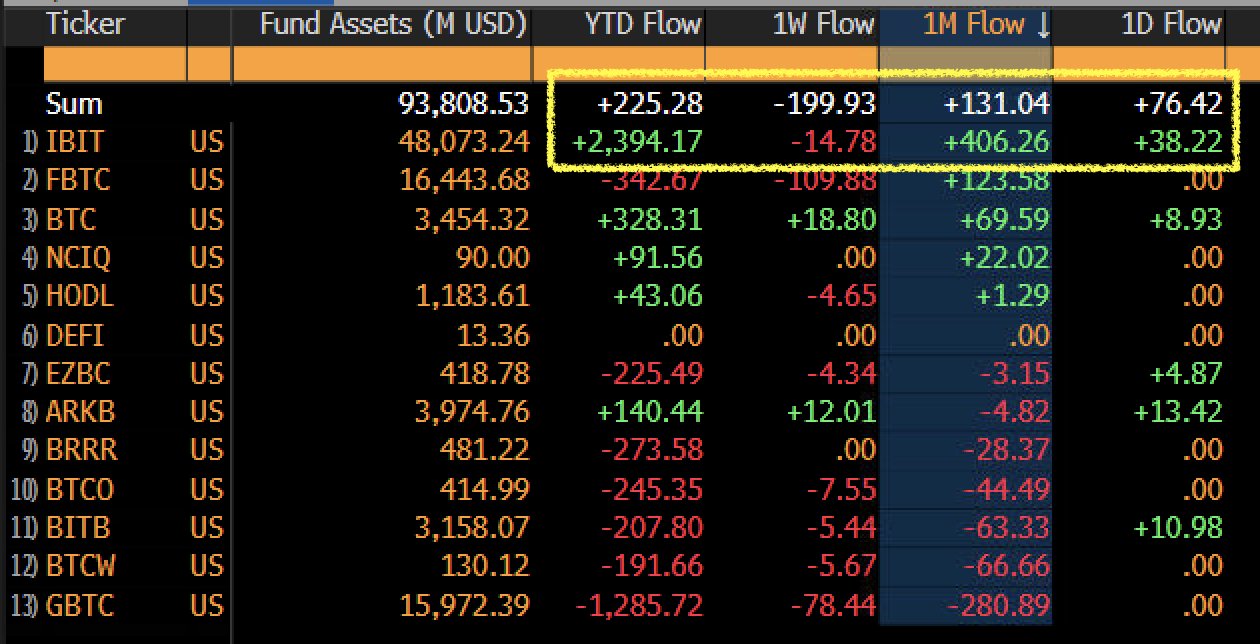

- Bitcoin ETFs have shown stable inflows this year, with Ibit leading the package to over $ 2.4 billion YTD.

- Strong ETF participation contributes to the reduction of long-term volatility.

Bitcoin (BTC) Have found an unexpected source of stability – ETFs. In the last month and the year before (YTD), American Tot Bitcoin ETFs have experienced positive, steady inflows.

Bitcoin gets stability when ETFs absorb the sales page

The leading fee is Blackrock’s Ibit, with an astonishing $ 2.4 billion in flows this year so far. According to Bloomberg ETF data, this places it among the best 1% of all ETFs YTD.

These inflows highlight strong institutional demand for bitcoin, even in the midst of market vollatility and skepticism – a clear sign of growing investors’ beliefs.

New holders replace weak hands

The latest ETF demand seems to replace “weaker hands” that have sold over the past 15 months.

Sellers include FTX-Collapse victims, former GBTC Arbitrage retailers, recipients of unlocked legal coins and state assets unloaded on the market.

At the same time, Michael Saylor and Micro Strategy have continued to gather BTC and help absorb the sales side. This has contributed to Bitcoin’s resilience in the range $ 60k – $ 70,000, which limits volatility.

Unlike short-term traders, ETF holders tend to avoid panic sales and maintain a long-term way of thinking.

In combination with Saylor’s unmatched strategy, BTC has become less reactive to daily macro events and Altcoin speculation. This shift is clear in the rising concentration of whales and dedicated holders, while the retailer’s dominance has decreased.

What is next for bitcoin?

In addition to decreasing volatility, this structural change may have broader consequences.

As more BTC is held through regulated ETFs, its correlation with risk resources can be weakened. Over time, Bitcoin can adapt more to traditional capital flows rather than crypto-in-born feeling.

The effects of large ETF inflows are clear in Bitcoin’s price measure. Historically, BTC has undergone several consolidations before staging outbreaks.

At the press time, BTC hovered just over $ 80k. If ETF inflows continue at this rate, a Breakout for Bitcoin may be imminent.