Key dealers

- Blackrock attracted $ 3 billion in inflows for digital asset product during the first quarter of 2025.

- Digital assets represent a small part of Blackrock’s operations and account for 0.5% of total assets under management.

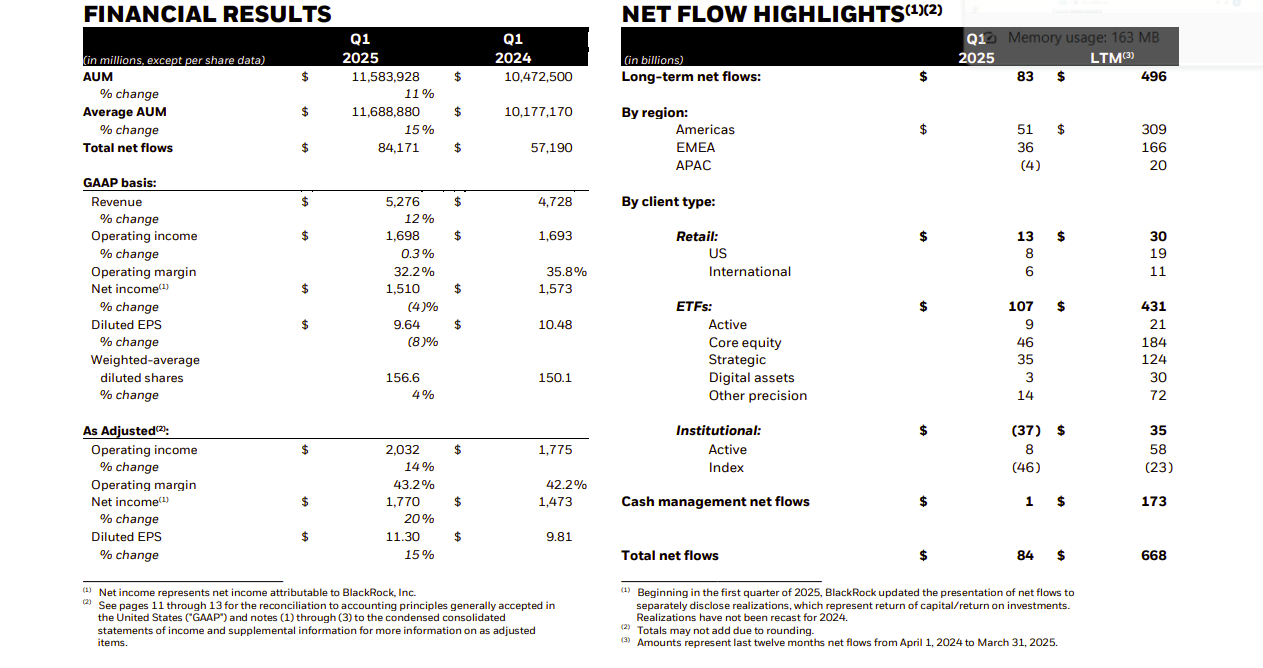

Investors poured approximately $ 3 billion into Blackrock’s digital asset products in the first quarter of 2025, which contributed to $ 84 billion in total net inflows for the quarter, according to the company’s revenue drop on April 11.

Blackrock’s Ishare’s ETF platform brought a strong $ 107 billion in net inflows during the first quarter of 2025. However, the company’s total net inflows came to lower to $ 84 billion, such as outflows in other segments – especially a return of $ 45.5 billion from institutional index funds –

Blackrock’s digital assets under management amounted to over $ 50 billion at the end of the first quarter, up from $ 17.5 billion a year ago, which corresponds to an increase of 187% from year to year. This over -voltage dwarfed growth rate for other asset classes within the company’s portfolio, such as shares, which increased by $ 8% to $ 5.7 trillion.

The first quarter also provided remarkable volatility. Although digital assets attracted over $ 3 billion in net inflows, market depreciation reduced their value by over $ 8 billion.

As of March 31, the global asset manager monitors approximately $ 11.6 trillion of customer assets.

Digital assets make up only 1% of Blackrock’s total AUM, with their net inflows of $ 3 billion, which accounts for 2.8% of the total ETF inflow in the first quarter of 2025. For comparison, private market investments brought in $ 9.3 billion during the same period.

Digital asset -related investment counseling and administrator fees reached $ 34 million in the first quarter, less than 1% of Blackrock’s total $ 4.1 billion in long -term revenue as of March 31.

That figure complies with the segment’s Aum share but emphasizes the low fee structure typical of digital offers.

For example, Ishares Bitcoin Trust (Ibit), Blackrock’s flagship Crypto ETF, which was launched in early 2024, drives a competitive 0.25% fee after the floor.

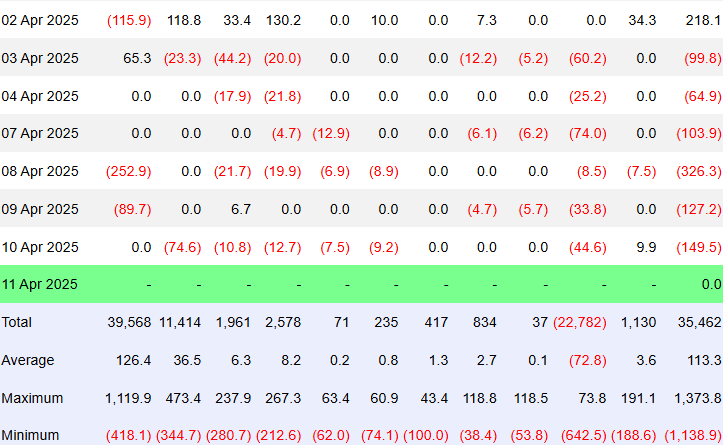

The report comes when the US-listed Tot Bitcoin ETFS saw their sixth straight day of net outflows, with $ 149 million in redemption yesterday, according to Farside Investors.

The withdrawals were led by Fidelity’s FBTC and Grayscale’s GBTC, in the midst of a broader market movement where investors sought safer assets such as gold and cash, affected by increasing customs disputes in the United States and China’s customs dispute and market vollatility tied to US political changes.