Key dealers

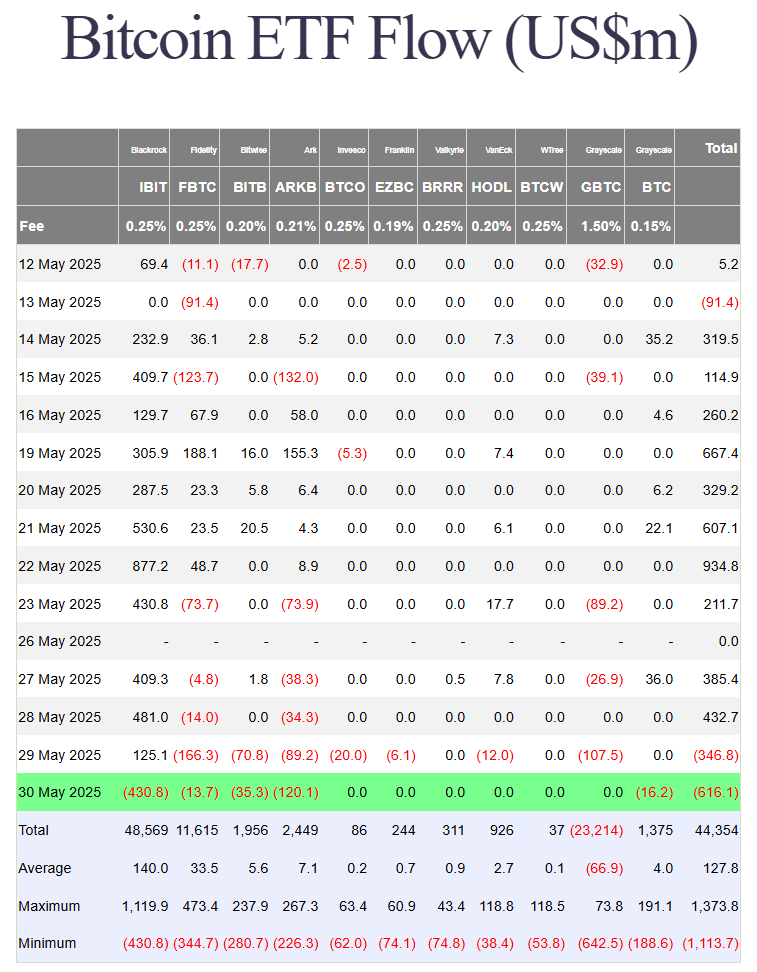

- Blackrock’s Ishares Bitcoin Trust met its largest outflow of over $ 430 million.

- The US-listed Tot Bitcoin ETFS experienced collectively $ 616 million in outflows in the middle of Bitcoin price decline.

Blackrock’s Ishare’s Bitcoin Trust (Ibit) looked over $ 430 million in outflows after the markets closed Friday and snapped a week -long inflow streak that lasted April 10. It was ETF’s largest one -day net outflow since launch, according to Father side Investors.

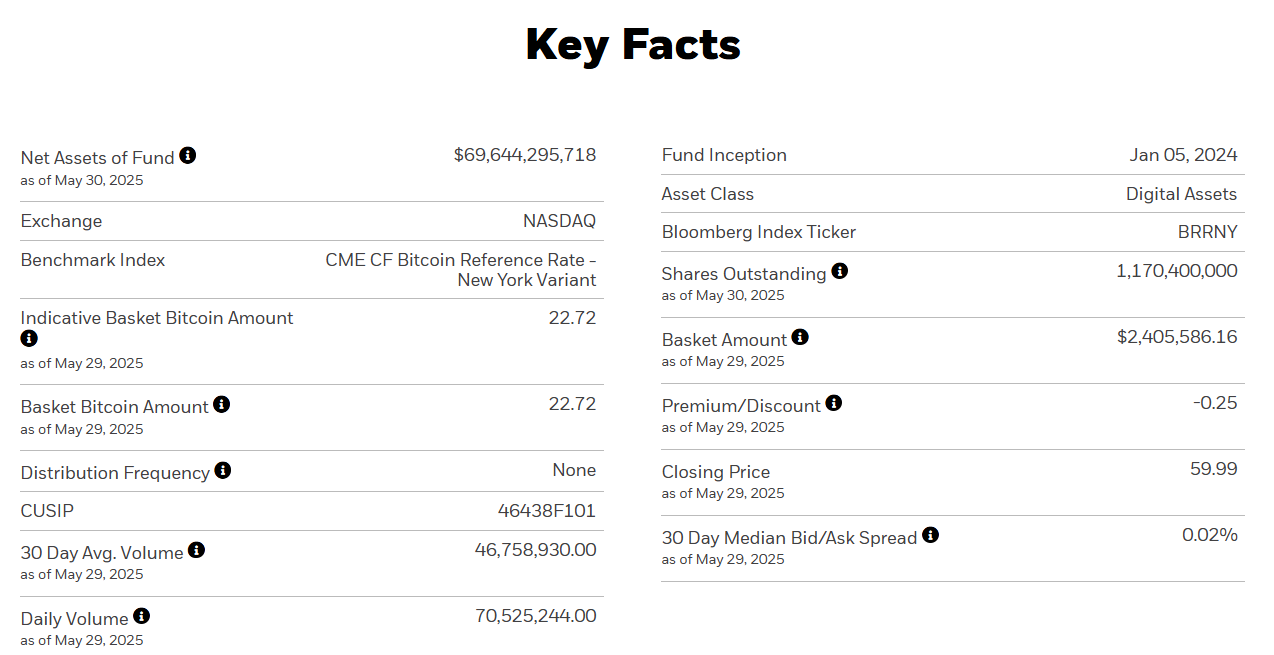

Ibit continues to dominate the global Bitcoin ETF market, despite its recent return. The fund has raised approximately $ 48 billion in new capital since its launch, with assets under management approaching $ 70 billion.

Other competing Bitcoin ETFs also published losses on the last day of trading in May.

Fidelity’s FBTC saw outflows of about $ 14 million, Grayscales GBTC lost about $ 16 million, Bitwise’s Bitb -Swing $ 35 million and Ark Invests ArkB registered the large outflow to $ 120 million.

All in all, the US-listed Tot Bitcoin ETF lost about $ 616 million on Friday and continued its image after $ 346 million in outflows on Thursday.

The return of negative ETF flows coincided with renewed sales pressure on Bitcoin. After reaching a weekly game of $ 110,000, the asset went under $ 105,000 on Thursday and then went almost $ 103,000 on Saturday.

At the time of writing, Bitcoin hovered about $ 103,700 per tradingview data.