Key dealers

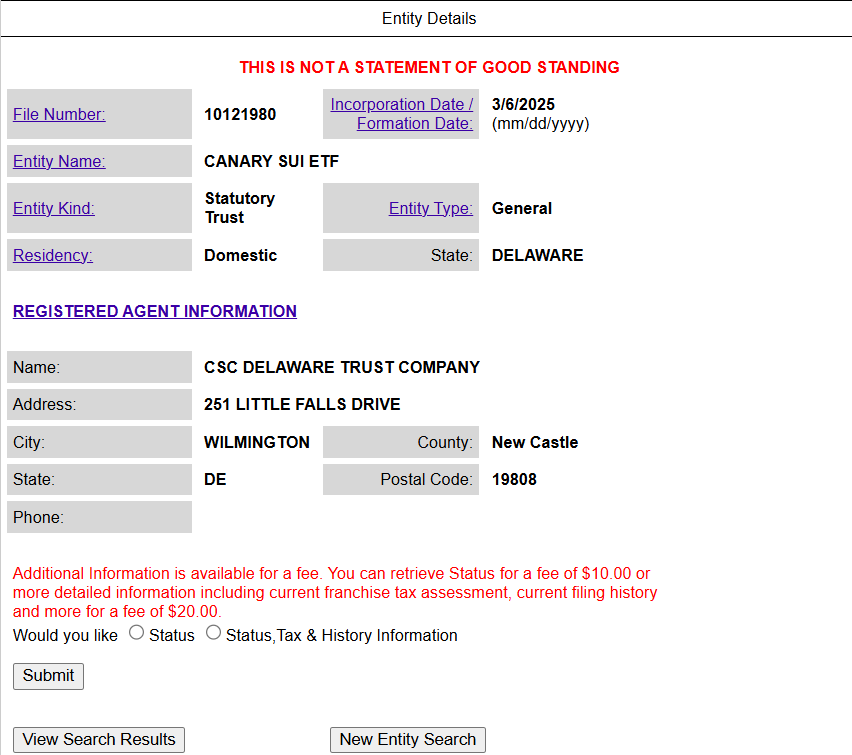

- Canary Capital submitted to create confidence in a SUI-based ETF in Delaware.

- The proposed ETF is a first step towards SEC registration and approval.

Canary capital have submitted Establishing a unit of trust in Delaware for its proposed Canary Sui ETF – a feature that signals a potential SEC submission for legislative approval.

The move comes after World Liberty Financial announced Its partnership with Sui Blockchain, with plans to add the project’s original crypto access, SUI, to its strategic reserve fund “macro strategy.”

SUI jumped over 10% to $ 3 after the announcement of the collaboration. However, digital asset did not immediately react to Canary Sui ETF News.

Canary Capital and Grayscale Investments have emerged as the most active asset managers in the driving force for Altcoin Investment vehicles. In addition to SUI-based ETF, Canary also refers to agents that track other digital assets such as Litecoin (LTC), XRP, Solana (Sol) and Hedera Hashgraph (Hbar).

On Wednesday, Canary Capital submitted an S-1 Registration at SEC for Canary Axl ETF, which Focuses on the AXL token that drives Axelar network.

Once a SEC archiving has been confirmed, Canary Capital officially becomes the first asset manager to propose a SUI-based ETF in the United States.