A new report has revealed that three -quarters of global central banks are planning to issue a Central Bank digital currency (CBDC), but an increasing number drives back their launches when challenges emerge.

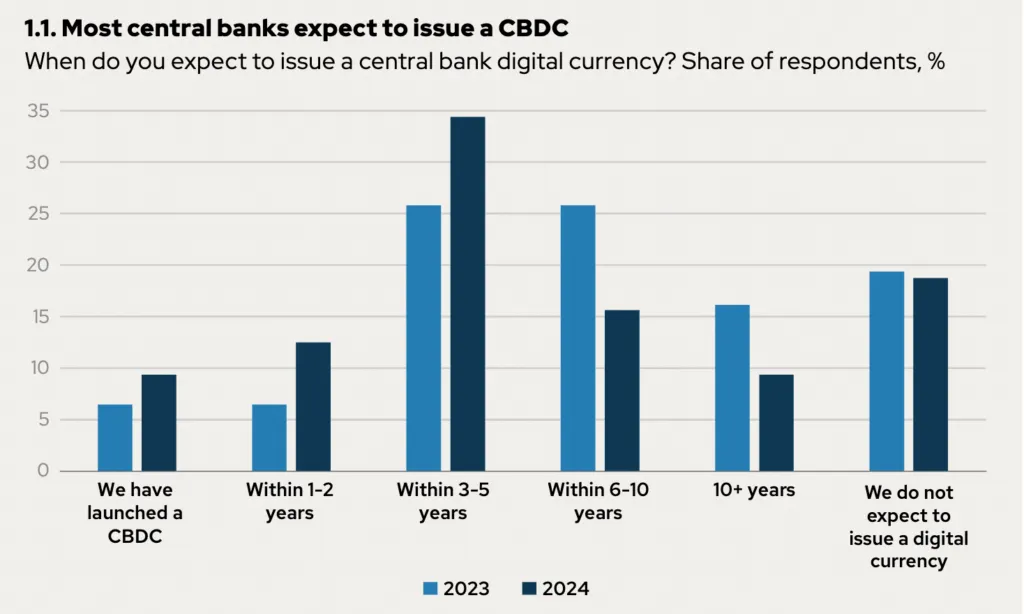

Report Official Monetary and Financial Institutions Forum (OMFIF) Funs that 48% of responding central banks expect to issue a CBDC over the next 3-5 years; 12% strive for a launch within the next two years, twice the number from 2023.

Overall Number of central banks that intend to start a CBDC has reduced slightly. However, the number of those who expect to be launched within the next five years has increased.

Omfif’s study found that emerging markets are pushing harder for a CBDC than their developed counterparts. One in five central banks from emerging economies expects to start a CBDC within the next two years. However, no developed nation expects a digital currency at that time.

The study also found that most central banks have already decided whether to run a CBDC, with the proportion of countries that are not interested in digital currencies that remain constant at 19% over the past two years.

Although their commitment to CBDCs has not changed, some central banks have revised their timelines. OMFIF found that 31% of respondents have delayed the issue, but only 10% reported accelerated timeline. The two most common causes were a lack of enabling legislation and explore other solutions besides digital currencies. Bank managers acknowledged that their hands are bound with the former because legislators have the last word about central banks can issue a digital currency.

Globally, CBDCS has become a sharing political issue and bucking its chances of quick launches. Some political factions, as Republicans in the United States have claimed CBDC is a trick of governments to spy on their people’s expenses and restricts free will. Such political positions have taken the limelight away from CBDC’s technical and financial benefits and made them a party issue.

But not all CBDCs are created equally. The report found that retail CBDCs are facing a tougher battle than their wholesaler counterparts. Respondents who reported delayed their issuing timeline were disproportionately skewed against retail CBDCs, in line with Previous results by Bank for International Settlements (BIS).

The study also found that the most important CBDC functions for central banks were Offline paymentspast integrity. Immediate settlements and programmability are also ranked high, although the latter has proven controversial as critics say it would potentially give central banks control over citizens’ money.

What is the next CBDC after Trump closes the door for digital dollars?

Donald Trump has been one of the toughest critics of a potential digital dollar. Therefore, it was no surprise that among the many executive orders He signed as the new president, an explicitly prohibited US federal agencies from “implementing all measures to establish, issue or promote CBDCs.”

The digital dollar is as good as death, at least as long as Trump is president and Republicans have control over both houses. And if there was any hope left, the Federal Reserve President Jerome Powell sniffed it when he engaged Before the Senate that no CBDC would develop under his leadership.

The US government’s attitude has shared an opinion. Supporters say it was too long after several years of the FED’s unclear position if it were to strive for a digital dollar. Others pointed out that it was only a formalization of what the world already knew: that Fed was not interested in a retail CBDC.

However, critics say that its broader impact will be massive, especially on US fintech leadership.

“The most important effect of the executive order is the signal it sends to the rest of the world. It tells Europe that they have the playing field for themselves to set privacy and cyber security standards through the digital euro, says Josh Lipsky, head of CBDC Tracker at Atlantic Council.

Lipsky is also worried that China can now become the undisputed global leader within CBDC, with other countries that look at the Asian giant for leadership and standards. China has the world’s most advanced CBDC for a great economy with its digital yuan.

Trump’s order also submitted questions about the ban was extended to wholesale CBDC solutions and other currency tokenization Projects where Fed has been involved. One of these is Project nowwhich is led by BIS and focuses on tokenization deposits.

Speaks recently, Federal Reserve Governor Christopher Waller distanced Agora from CBDC links and adds that the project only finds more efficient ways to buy bank reserves.

Waller doubled on Fed’s Pivot from CBDCs and noted that “We have completely stopped using this word.”

Look: Find ways to use CBDC outside digital currencies

https://www.youtube.com/watch?v=1la33ikf8ou title = “youtube video player” Framebord = “0” Allow = “accelerometer; Autoplay; clipboard writing; encrypted media; gyroscope; image-in-image; web-share” reference policy = “strict-origin-short-origin” allow of screen = “”>