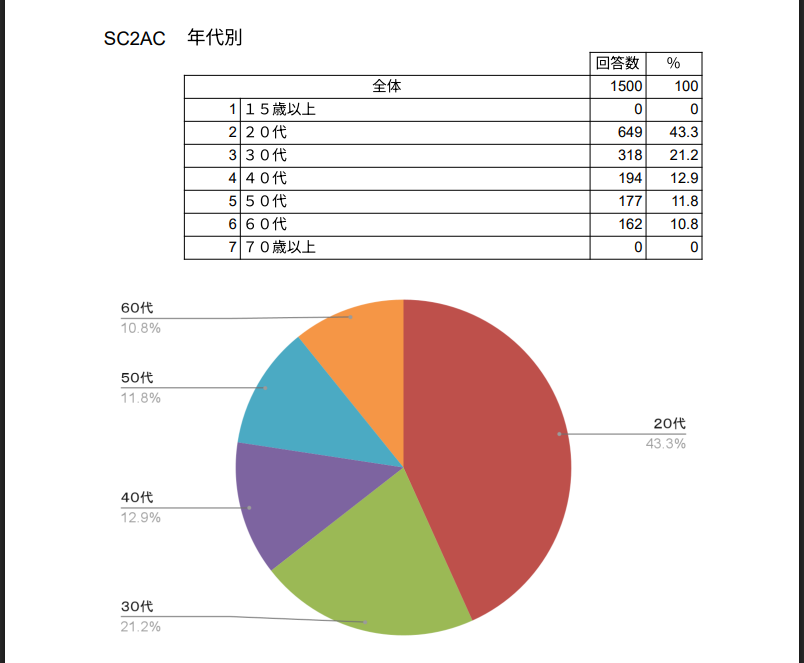

Japan’s tough attitude towards crypto taxes holds back both buyers and sellers. A investigation of 1,500 adults in April found that only 13% currently own BitcoinEthereum or other cryptoassettes. Many people say they would be ready to dive in – if Tokyo relieved the tax burden.

Majority back flat tax

According to Japan Blockchain Association, 84% of the 191 people who already have crypto would buy more if the winnings met a flat 20% fee.

And 12% of the 1,309 non -holders said they would start buying bitcoin or other crypts under the same rule. It is a major transition from today’s system, where crypto gets country under “other income” on tax returns.

Source: JBA

Right now, winnings from Bitcoin or Crypto can be taxed at prices up to 55%, depending on your console. This is much higher than 10-20% fixed interest rates that apply to shares in many other countries.

Based on reports, JBA pushes to move crypto to the same capital gain category and claims that it would increase trade volumes on local exchanges.

Survey shows simple rules appeal

Three -quarters of the survey participants said that they would rather have taxes that are kept on the source when selling bitcoins, instead of handing in separate paperwork.

JBA has asked Tokyo to let traders choose whether to pay at the point of sale or when submitting their annual return. This flexibility can facilitate headaches for both hobby investors and professionals.

BTCUSD trading at $118,826 on the 24-hour chart: TradingView

The survey looked deeper into why some people still won’t touch crypto. Only 8% blamed high taxes, while 61% said they do not feel enough about digital coins.

The test was 60% male and 40% female, with an average age of 38. Students accounted for 5.3% of the group, and 213 people said they were unemployed.

Image: Canva

FSA considers broader reforms

According to reports from the financial controller, Financial services agency Weighs a proposal to move bitcoin in accordance with the Act on Financial Instruments and Exchange.

If approved, it would officially treat digital assets as financial products – and can pave the way for a uniform 20% tax already next year.

Exchanges like Bitflyer already see Ethereum trading for almost half of its volume. Each change can reshape Japan’s crypto market – by making it easier to shop and by bringing more people into the week.

Image from Travel+Leisure, diagram from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.