Argentina President Javier Miler controversial $ wave tweet

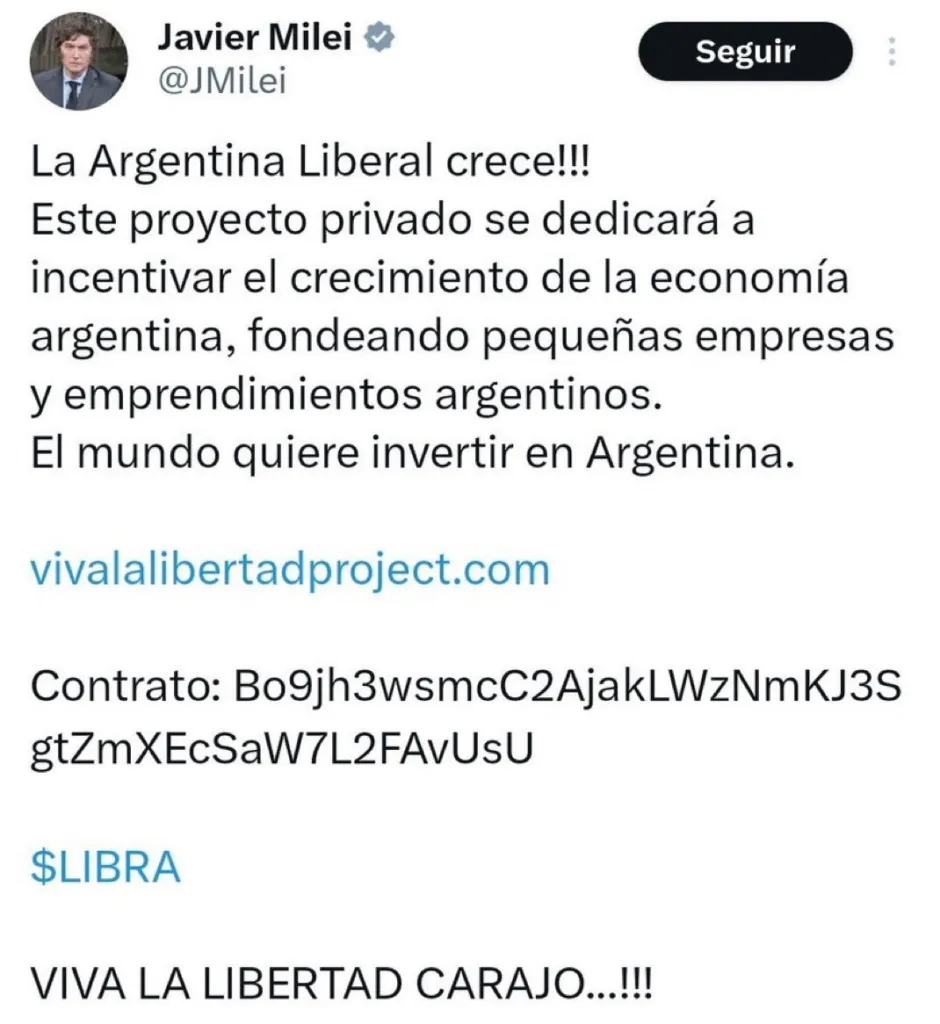

This week, Argentina President Javier Milei Accused of playing a crucial role in a “crypto” food. On February 14, the president tweeted a project called $ Libra and shared details about the project, its website and its contract number so that potential investors could find the token and the “support” initiative.

But all “support” would have been extremely short -lived. Within 45 minutes after Mileis Tweet, the price of $ Low Skyrocketed, tops $ 5.54 per symbol. The first buyer bought the $ wave to about $ 0.21 per symbol, but only 37 minutes later, that buyer dumped most of its symbols and shook a net gain of $ 6.5 million. But their massive sales in a relatively small liquidity pool sent the market to free fall, with $ wave crashed 70% within an hour, which fell from $ 4.74 to $ 1.44. It was later discovered that a significant number of profitable business on the $ Vibra token came from Token’s Development Team, which led not only to allegations of fraud against Milei, but also insider trading accusations against Token’s launch team.

When the token collapsed, Milei deleted his tweet and claimed: “I was not informed about the fine details of the project and after learning I decided not to continue spreading it (that is why I deleted the tweet).” But at that point, the damage was done. Token was already dead due to liquidity issues, and moods soon followed. Investors were aimed at the development group and all high-profile individuals tied to the launch-incrimiling the president of Argentina himself, accused him of fraud and played a central role in what turned out to be a Pump-and-dumping system.

Unfortunately, from 2025, this incident is not an outlier, and I actually think it is an indication of what we will see more of in the short term; High -profile figures and celebrities are launching increasingly symbols, most branded goods such as “Memecoins“In the end, it works as a short -term pump and dumps. The winners are always insider dealers and those who buy early and sell quickly, while the losers are the majority of retail investors who leave the bag.

And for US takes a hands-off strategy for “crypto” regulationEspecially with Securities and Exchange Commission (SEC) Scaling Back Enforcement efforts, North America will be the perfect situation for this type of fraud to spread.

SEC, Coinbase and Binance: Crypto moods in Limbo

This week Sec made a move that could signal the end of its high -profile moods toward Coin base (Nasdaq: Coins) and Binance-Set that began during the Biden administration when Gary Gensler led the agency’s breakdown of crypto.

In a new archiving, Sec requested A 28-day extension to respond to Coinbase’s appeal argument and a 60-day approach to Binance. SEC justified these delays by pointing to a new Crypto working group created by Trump administrationwhich aims to develop a clear regulatory framework for the industry.

“Work on this working group can affect and facilitate the potential solution in this case,” stated SEC’s movement regarding binance. While the courts have not yet decided these requests, the applications signal major changes that take place in Cryptocurrency’s regulatory landscape.

When Trump entered the serviceThere was speculation that he would be a “crypt -friendly” president. With many long -term cryptos supporters who believed that his administration would hired the industry to maturity, giving blockchain and digital assets the legitimacy they lacked. But reality is very different. I would even go so far to say that the industry has developed outside the companies’ progress when it comes to its consumers.

This is because Trump’s legislative change is not aimed at strengthening everyday crypto investors. Instead, it is increasingly clear that the recipients of these political changes will be large companies and technical giants who want to get value from retail investors while offering a little in return in addition to speculative opportunities.

The greatest proof of this is Memeco search. Since these pump-and-dump fraud masks when news collecting items flood the market, retail investors are often left with the bag with little to show it, while on the other side of the table, established crypto giants such as Coinbase and Binance, can take advantage of the regulatory shift and rake in more money for their businesses.

How important is crypto globally?

When you are deeply involved in a niche industry, it is easy to believe that what you are working on is the most important thing in the world. You assume that people generally share your knowledge and interest. But sometimes the information tells another story.

Despite noise and headlines, crypto -owning shockingly remains low. Only about 6.8% of the world’s population owns any cryptocurrency.

These statistics translate into a massive challenge for the industry. Since the start blockchain And Cryptocurrency, a small but dedicated group has worked to commercialize and produce the technology and aim to build legitimate companies and financial systems. But this industry undergraduate group is extremely exceeded by speculators, people who treat crypto as a casino, hoping to make a quick money on token volatility.

The result is that the larger, higher group of Memecoin players dominates the story and shoots the speculative side of crypto into mainstream. At the same time, builders and innovators who work to legitimize the industry are drowning to a greater extent.

To give an insult to injury, the entire demographics of crypto owners and builders are already small, so when we talk about the people who do legitimate work, we stop talking about a niche in a niche.

All in all, this statistics, however, indicate an imbalance that has had and will continue to have long -term consequences. Since this group is so small, governments and supervisory authorities see crypto as a French question, with little incentive to prioritize any meaningful regulation to help the industry mature. But without serious intervention, space risks in a doom loop where Ponzi-like token launches continues to dominate headings while meaningful blockchain applications are fighting for legitimacy.

Watch: Convergent IPv6 & Bitcoin for decentralized future

https://www.youtube.com/watch?v=3msdvccxquq title = “youtube video player” Framebord = “0” Allow = “accelerometer; Autoplay; clipboard writing; encrypted media; gyroscope; image-in-image; web-share” reference policy = “strict-origin-short-origin” allow of screen = “”>