Digital payments In Africa is expected to hit $ 1.5 trillion at the end of the decade, a new report from Mastercard (Nasdaq: MA) says.

While Africa remains the most continuous continent globally, its digital payment sector has increased rapidly over the past decade. According to the study, conducted in collaboration with Johannesburg-based Genesis Analytics, the region is slowly phasing out cash for the convenience and safety of digital payments.

Mastercard attributed to the growth in digital payments to two main drivers: financial inclusion and Internet Impact. With the latter, Africa has registered massive growth over the past decade, promoted by cheaper Asian smartphones and lower data costs. Experts project a 20% composed annual increase in Internet penetration in the next few years.

Economic integration has also greatly improved, increased by digital financial services, the adoption of mobile money and coordinated efforts from African governments to make banking services easier to access. The region is expected to register a 6% composed annual growth rate (CAGR) in economic inclusion.

“Africa is filled with enormous opportunities, and its people have the potential to shape the global economy in the coming decades,” commented Dimitrio’s dose, the president of the Middle East and North Africa (MENA) at Mastercard.

The report is the latest to illustrate the growth of digital payments in the region. A previous report from Mastercard revealed

that small and medium -sized companies (small and medium -sized companies) lead the fee to include these New payment methods; In Nigeria, 99% of small and medium -sized companies accept digital payments, with Kenya and Egypt of 91% and 80% respectively.

This growth is reflected in Start sectorWhere most fastest growing and best funded startups are focused on digital financial services. Last year, fintech -startups elevated Over $ 1 billion in Venture Capital (VC) funding accounts for half of the total amount collected on the continent.

Nevertheless, the region is characterized by strong contrasts. In some countries such as Kenya Digital Finance has driven economic integration to 85%Among the highest in the region, with mobile payment networks M-Pesa Accounting for the majority of the clientele.

But in other countries such as South Sudan and the Democratic Republic of Congo, inclusion is low, with just under one in five citizens who own a bank account. Low smartphone and Internet penetration have hindered growth, with semi -baked initiatives, such as Congos Botched StablecoinDo a little to take advantage of much -needed basic financial services to the people.

In the neighboring Central African Republic, where less than 30% have access to bank accounts, the president has promoted a Memecoin that increased to $ 1 billion shortly after launch Before thoughts 97%.

71% of Kenyans face digital fraud

With the increase in digital funding, digital fraud has, and according to a new report from VISA (Nasdaq: v), over 70% of Kenyans have encountered fraud online, the highest of all countries surveyed. Ivory Coast with 66%, Nigeria with 65%and Oman with 59%, was among the other fraud, The Stay Secure Report found.

The report revealed that most consumers are still susceptible to Common tricks used by fraudstersIncluding clicking on suspicious links and responding to text messages. In fact, 95% of respondents said they think their friends or family would fall for these fraud.

The older generation (mostly over 45 years) is generally believed to be more susceptible to fraudsters. However, Visa found that nine out of 10 gene Zs are likely to click on a fraudster link, much higher than millennials, gen X and boomers, all bound to 85%.

Despite the increase in digital fraud, most respondents said they completely trust digital payments. Seventy -five percent of the previously cheated online had the same level of confidence in digital payments as those who have never fallen for the systems.

“The vast majority of adults (76%) mostly or completely trust digital payments to make transactions, so there is a significant opportunity to deepen this confidence and bridge the gap for those who remain skeptical,” noted Visa.

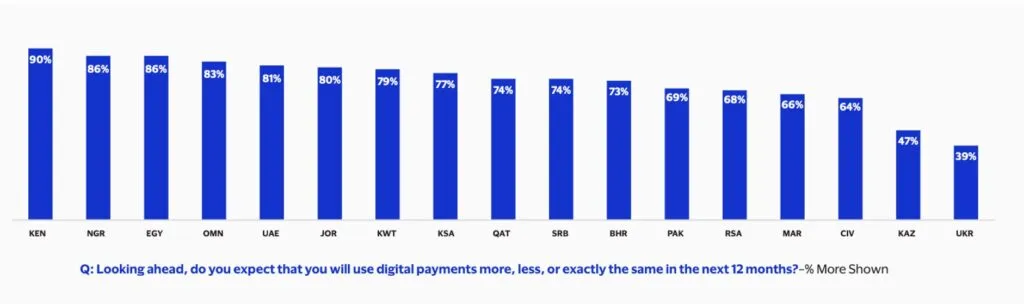

Most of the respondents expect to continue to use digital payments in the next 12 months despite the fraud. Kenya had the highest proportion of respondents who intend to use their digital payments to 90%, before Egypt, Oman and the United Arab Emirates.

Show urged all fintech platforms to focus on consumer education because it is “our best defense against fraud, and industry cooperation makes this possible. When fraud becomes more sophisticated, the struggle for security never stops.”

Watch: Increase financial inclusion in Africa with BSV -Blockchain

https://www.youtube.com/watch?v=3oo8u8imwmc Title = “Youtube video player” Framebord = “0” Allow = “Accelerometer; Autoplay; Clipboard Writing; Encrypted Media; Gyroscopes; Image-in-Image; Web-Share” Reference Policy = “Strict-Origin-When-Cross-ORIGIN” permitted Lorscreen>