- 76% of the best Dogge retailers at Binance currently have long positions.

- Exchange has witnessed an outflow of $ 18 million in Dogge.

During the uncertainty of the ongoing market, where most assets experience remarkable price declines and meets sales prints, Dogecoin (Doge)The largest Memereceive significant attention from crypto enthusiasts.

On February 16, investors and intradad dealers were especially Hausse at Memecoin, as the analyst company on the chain Tiled reported.

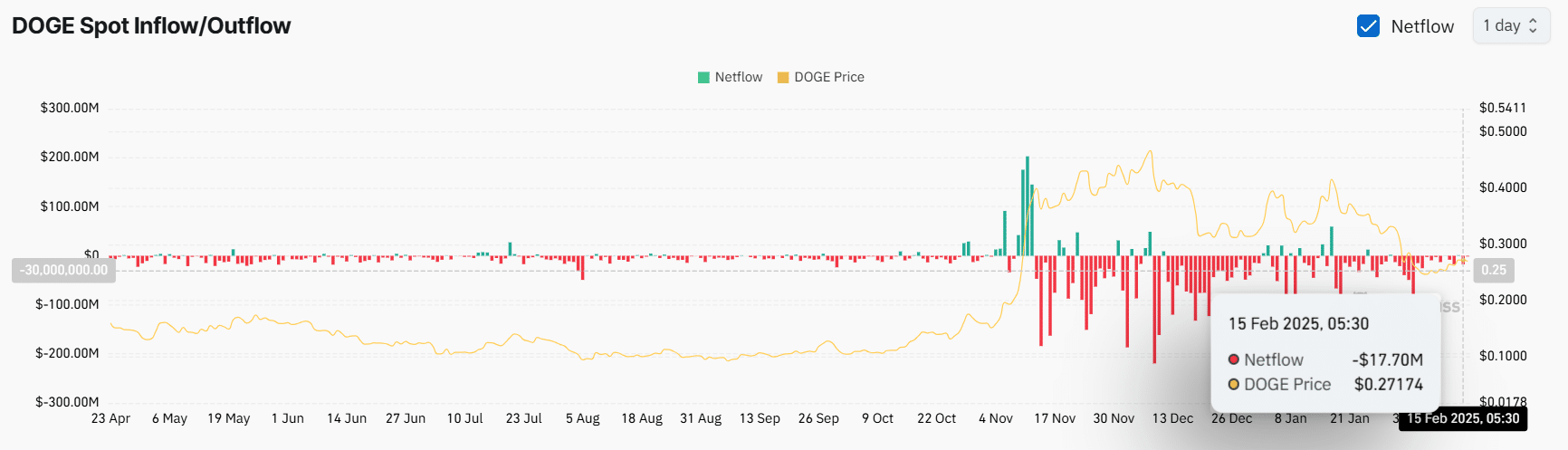

$ 18 million in Dogge outflow

Data from Spotin Flow/outflow Analysis showed that Cryptocurrency exchange has witnessed an outflow of a significant $ 18 million DOGE. The trend indicates potential accumulation.

This significant outflow from exchanges has occurred over the past 24 hours and also has the potential to create buying.

76% of Doge dealers going long

When it comes to whales or long -term holders who make strong haus -like investments, intradad dealers show the same enthusiasm and favor strongly long positions.

Data revealed that Binance’s Dogge/USDT Long/Short Ratio was at 3.15 at press time.

This means that for every 3.15 long positions there is a single short position. The data indicates a strong ravenous feeling among Binance dealers.

Apart from this, 76% of the best Dogge dealers on binance contained long positions from this writing, while 24% had short positions.

Current pricing

However, despite these raised measurements on the chain, they have not affected Doges price. From this writing, Memecoin traded close to $ 0.26 and has experienced a fall in prices of over 3.5% over the past 24 hours.

During the same period, its trade volume decreased by 45%, indicating lower participation from traders and investors compared to the previous day.

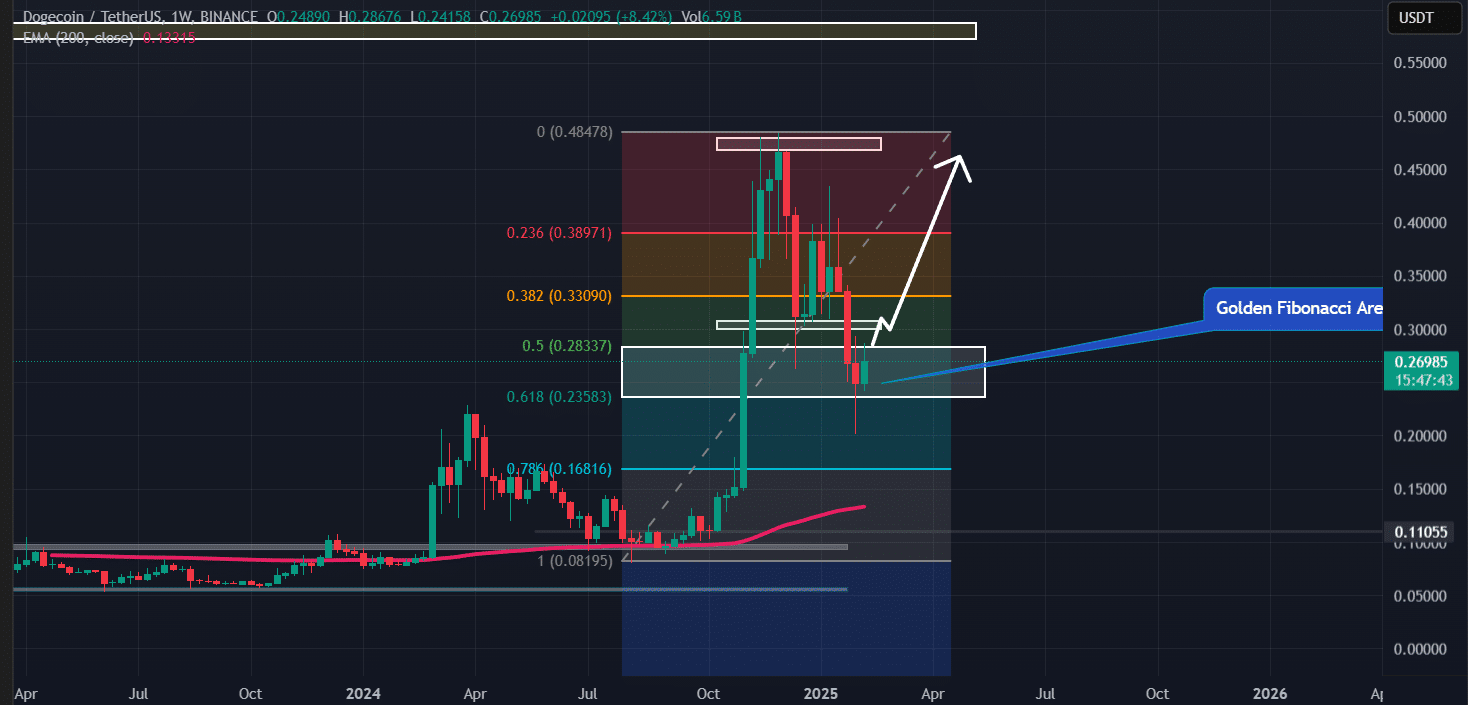

DOGE technical analysis and key level

According to Ambcrypto’s technical analysis, Dogge has traded within the Golden Fibonacci zone, between 50% and 61.8% levels, on the daily time frame.

This may be the reason behind traders and investors’ Hausseian views. In trade and investment, experts consider this level as an ideal opportunity to go long.

However, the current market term seems to create an obstacle, which prevents Doge from breaking the resistance level of $ 0.28.

Based on latest price measures and historical designs, if Doge breaks this resistance and closes a daily light over $ 0.28, there is a strong possibility that it may increase by 35% to reach $ 0.39 in the coming days.

On the positive side, Dogge is traded over the 200 exponential moving average (EMA) on both weekly and daily time frames, indicating that access is in a trend.

When combining these measurement values on the chain with technical analysis, it seems that Doge could soon break the resistance level that has served as an obstacle to the MEME coin.