Ethereum Met increased sales pressure for a long period due to volatility in the wider crypto market, causing the price to undergo a sharp backback close to the $ 1,400 mark. The latest trends, however, show that ETH seems to enter a quieter phase as bulls gradually take control of the market pending a recovery.

Diminishing Ethereum sell-press pressure on binance

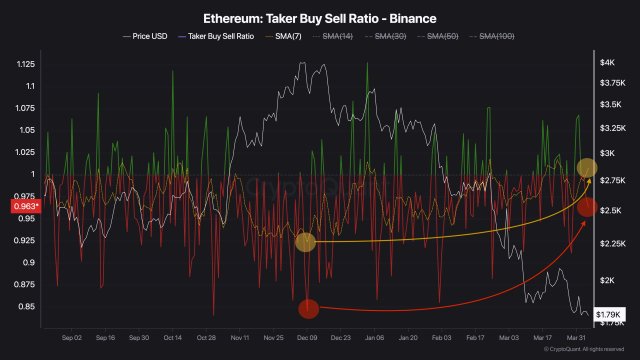

Although Ethereum’s price has dropped sharply below important levels of support, investors’ feeling begins to switch towards a more positive view. A Report From Darkfost, information reveals information on the chain and technical expert, Haussertat behavior from investors at one of the world’s largest Cryptocurrency exchanges, Binance.

As reported by Darkfost, ETH shows early signs of a potential turn to a quieter phase on BinanceThe Because sales pressure seems slowly fading. This suggests a decrease in the amount of ETH that is unloaded by traders and investors on the platform, which marks an encouraging moment for Altcoin and its price track.

The template in the sales side of the crypto change is a sign that bears or sellers are losing control of the market after a period of intense movement downward in ETH’s price. Darfost revealed developments after a thorough examination of Ethereum take -buy sales relationship Metric at Binance.

Specifically, the Takes Buy-Sell ratio is a key survey that compares the volume of purchase orders with the volume of sales orders in the order book. In addition, it helps to visualize the prevailing tendency, which seems to be changing right now.

A 7-day simple moving average (Sam) view of the roof-purchase-purchasing ratio shows that the volume has turned into a positive territory, rises above level 1. When looking at the chart marks the last step above the level of the third time since the beginning of this year, which indicates Investors’ resilience in volatile periods.

Meanwhile, the easing sales pressure can act as a starting plate for price stabilization or a short term price recycling when Hausseartat Momentum takes up. Darkfost emphasized that it can contribute to the formation of a bottom and at least temporarily stop the carnage in Ethereum if the pattern remains.

However, the expert noted that the trend is still too weak to make some clear conclusions, although it is an encouraging sign of Ethereum’s price dynamics. So far, investors carefully monitor if bulls can benefit from the change and drive ETH for a short -term recovery.

ETH breaks out of a multi -year pattern

The easier sales pressure may have increased the possibility that ETH experienced a short term recovery. But Altcoin‘S palletback is more likely to extend after its latest case during a key diagram pattern.

Following his examination of Ethereum’s price action, Ali Martinez, a experienced crypto analyst, has identified A massive perennial triangle formation, which ETH has fallen below. According to the analyst, its interruption during the pattern would lead to an extension of the ongoing pullbacken, with Ethics Releases as low as $ 1.105 in the coming months.

Image from Unsplash, chart from tradingview.com

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.