Investors’ feeling and trust in EthereumThe second largest digital asset seems to be improved despite the latest worrying market development that has prevented its market dynamics. Important measurement values show a significant accumulation of ETH, which reflects its position as a leading asset in the ongoing cycle.

Market trends change when Ethereum CBD decreases?

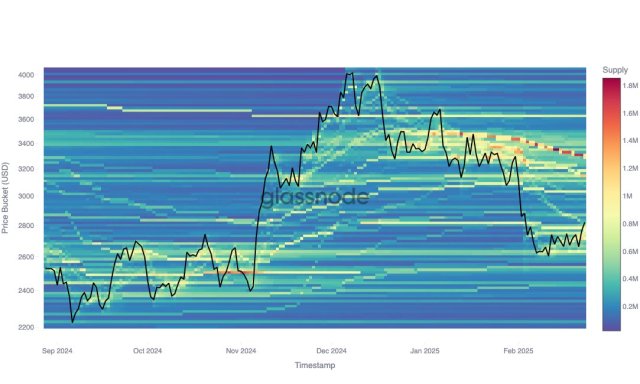

Ethereum’s market dynamics are currently changing even when the asset price is struggling to recycle decisive resistance level. Leading data analysis on the chain and Glassnode for financial platform points to A downward trend in Ethereum’s cost -based distribution (CBD) metric among fluctuating market results.

A reduction in cost base distribution often indicates a broader change in market dynamics or an increase in sales pressure. However, this is not the case for ETH right now.

According to the platform on the chain, the key meter shows that several cost bases have moved lower, which suggests that investors have collected ETH when prices have dropped. Key support for the accumulation zone is at $ 2.632 level, while the resistance is on The level of $ 3,149.

Glassnode data reveals that over 786,660 ETH was purchased by investors at the support zone of $ 2,632. At the same time, more than 1.2 million ETH was acquired by investors at $ 3,149 resistance. Such Massive accumulation reflects investors’ strong feeling and confidence in Ethereum’s future results.

Glassnode noted that investors are on average and buys ETH at lower prices rather than completely selling their coins and leaving positions. In addition, a long -term conviction is reflected in the lowering cost base, a similar trend has been observed in SEK $ million.

When Ethereum’s price surfaces increased volatility, it is crucial to look at this trend as it can affect the Altcoin track in the coming weeks. During these uncertain periods, a large part of ETH has been seen leaving the Cryptocurrency exchange.

Over the weekend, technical expert and Crypto Banter host Kyle Doops reported that there was a significant outflow of ETH, with Netflow on derivative exchanges that fell below 400,000 ETH. The number of net flows marks one of the largest in recent history.

Usually, such large withdrawals signal a potential raisy change in front and reduces sales pressure. With Altcoin Kyle Doop’s emphasized below $ 2,800 and emphasized that market participants can prepare for an upward move as they wait for a change in the feeling.

A rally to new all-time high for eth

After a prolonged weak period, Ethics May be prepared for a large rally to a new highest time in the following weeks. Marketing technician Jonathan Carter anticipate An increase to new levels due to a massive rising triangle pattern on this week’s diagram.

Ethereum effectively holds its position above the multi-year trend line and 100-day ma when trying to bounce from rising triangle support. Carter expects the upward momentum to squeeze ETH’s price against Next goal For example, $ 3,200, $ 4,000, $ 4,850, $ 6,000 and $ 7,500.