Ethereum (ETH) has shown a strong recovery after the latest FOMC accessory, with an increase of 5.35%. Historical data shows that the course often quickly spreads after volatility, sometimes with profits up to 34%. Institutional interest also increases, with a net inflow of $ 67.77 million in ETFs, led by Blackrock.

In this article, we analyze the latest price development, the effects of institutional investments and Price forecast for Ethereum.

Ethereum course restores after FOMC

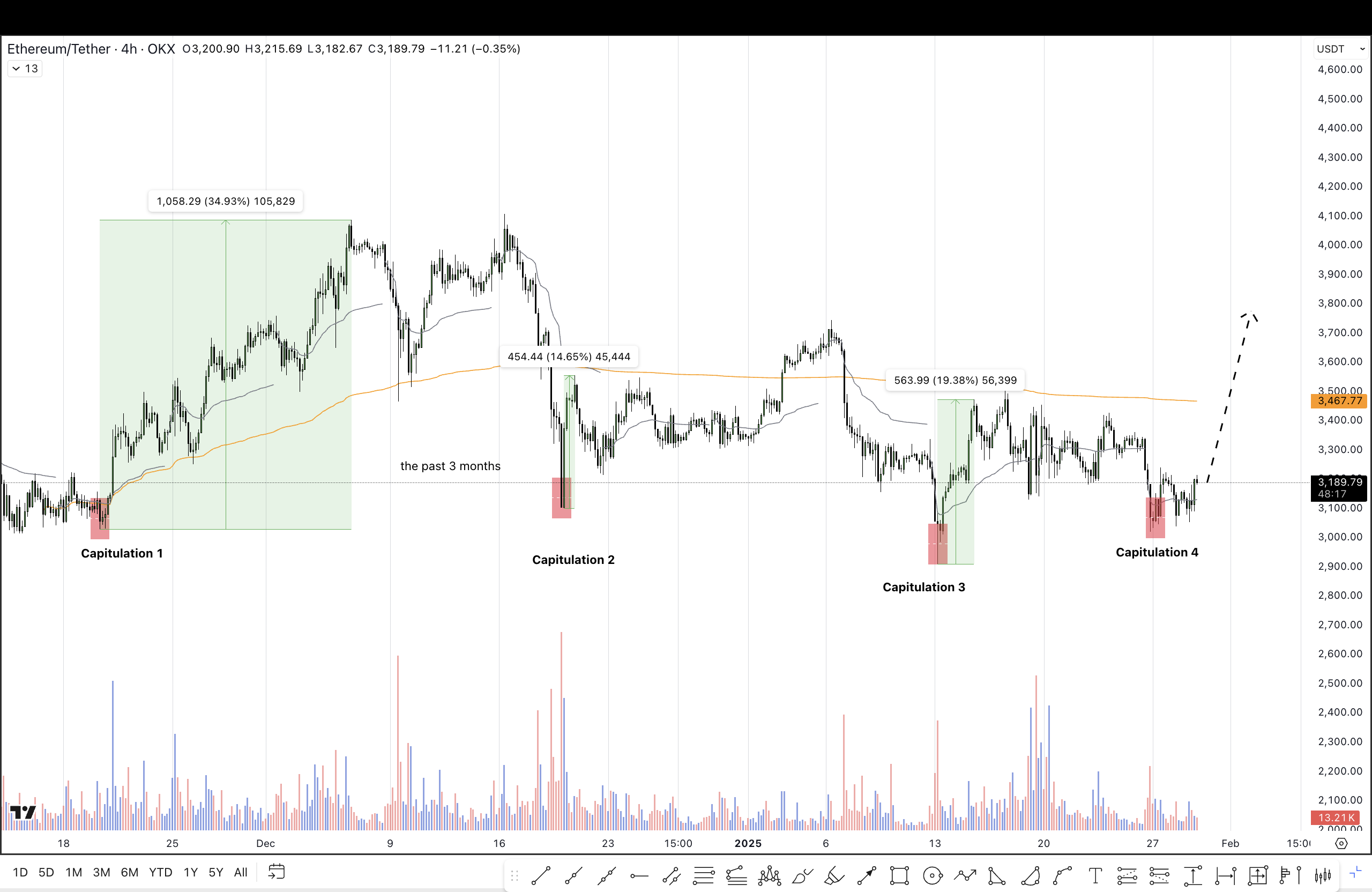

In recent months, Ethereum has shown a striking recovery pattern after periods of market volatility as a result of FOMC sensations. Data from Sentiment Feeds Net realized profit/loss (NPL) Indicator shows that ETH often undergoes a significant price increase during these moments with increased volatility.

Ethereum specifically responds to sudden reductions with rapid recovery movements, whereby the size of these returns varies. In some cases, the price rose by no less than 34%, while the recovery in other situations remained more limited, about 14%.

By overlap Ethereum’s price fluctuations with capitulation data on the graph, this pattern becomes more clearly visible.

Since the last FOMC approach, Ethereum has already increased by 5.35%, which indicates a constantly positive trend. This strong market term can press ETH further up to $ 3800, despite global economic uncertainties.

In addition, institutional demand for Ethereum makes a comeback. On January 30, the total daily net inflow for ETHEM ETF rose to $ 67.77 million. Blackrock was at the forefront with a purchase of $ 79.86 million in ETH.

Other striking buyers were faithfulness and grayscale, with purchases of $ 15.41 million and $ 12.79 million. The only seller on January 30 was the Grayscale Mini-Ethereum Trust, which released $ 40.29 million. The remaining five American Spot -etfs did not register.

ETH Breaks Out After Haussey Reversing

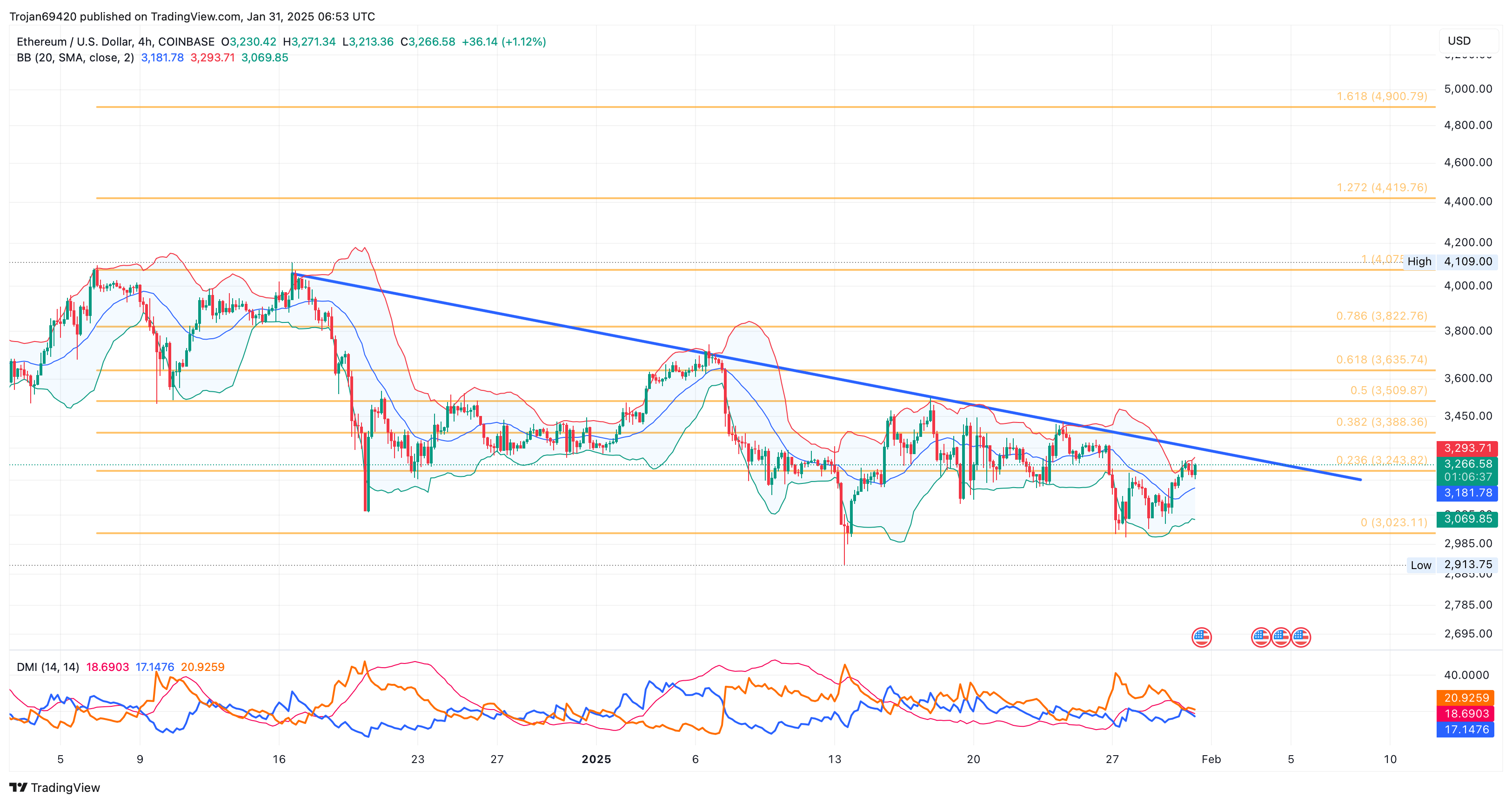

On the 4-hour graph, the ETH price trend shows a hooked reversal with a “double bottom” pattern. As previously predicted, the reversal collection exceeded 23.6% Fibonacci level to $ 3248.

The recovery rally has also stretched the upper Bollinger band, which reflects an increase of 1.12% over the past four hours. Now that Ethereum has completed a reversal after recurring at 23.6% Fibonacci level, the upward trend seems to challenge the overlying resistance trend. With rally that continues, the Bollinger tires suggest a possible outbreak.

Autumn fraction

According to Intothlocks in/out of the money graph, ETH is approaching a crucial resistance zone between $ 3264 and $ 3342. This zone contains 6.26 million ETH, making it a high supply area.

Currently, the “At Money” zone holds 7.85 million ETH between $ 3109 and $ 3264, which points to an important level.

On daily, the Fibonacci levels emphasize decisive targets of 50% and 100% retro level, respectively, and $ 3509 and $ 4079 respectively. At the bottom, the $ 3000 support zone is expected to remain strong during the first quarter of 2025.

Although ETH looks good and with the second place in terms of market cases is the most prominent altcoin, it may be interesting to also discover a new crypto with a lower market value for potentially larger profits. A striking example of this is Mind of Pepe (Mind).

This project combines AI innovation with Meme Coin Charme and acts as an autonomous AI agent in Crypto. It analyzes Altcoin trends and offers exclusive insights to Mind Holders. Sales have already collected $ 4.6 million and also offers the opportunity to strike an APY of 490%.