Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

Ethereum is currently traded at a critical level of resistance when bulls try to regain speed and press a new height. The broader market remains under pressure when global uncertainty escalates, largely driven by ongoing trade voltages between the US and China. Last week, US President Donald Trump announced a 90-day customs passage in all countries except China, intensifying anxiety about an extended trade conflict that can destabilize the global financial markets.

Related reading

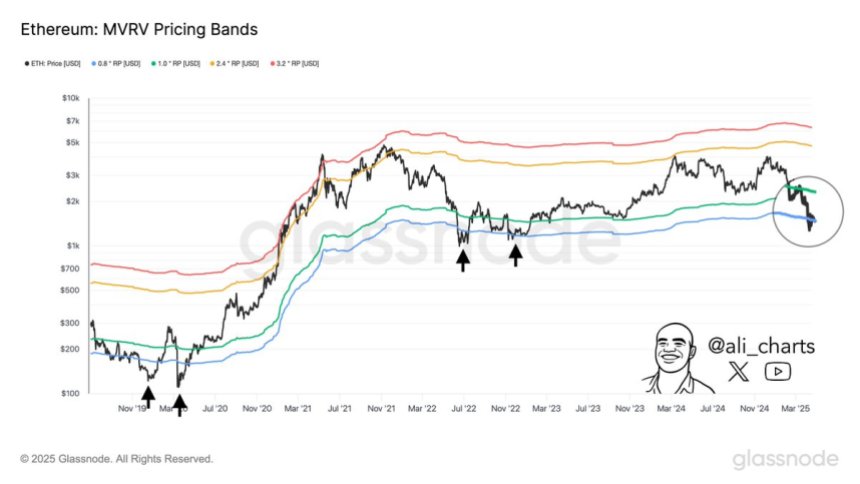

In this environment with high efforts, Ethereum’s price measure draws careful attention from investors and analysts. The best crypto analyst Ali Martinez shared that historically the best Ethereum purchases have emerged when the price drops below the lower MVRV (market value at realized value) price band – a level that signals potential undervaluation. Noteworthy, ETH is now acting exactly in that zone.

This adaptation between technical conditions and macroeconomic instability suggests that Ethereum may enter a phase of accumulation, with long -term investors who want to utilize discounted prices. However, depends on upward momentum on whether bulls can overcome immediate resistance and if macro conditions improve. The coming days may prove to be crucial for ETH as it tests both technical and psychological thresholds.

Ethereum dips into historical opportunity zone

Ethereum currently acts under key resistance levels after enduring several weeks of sales printing and weak market results. Since they lost the decisive level of $ 2,000, ETH has fallen about 21%, a clear indication that bulls have not yet regained control. Wider macroeconomic pressure, especially rising global tensions and uncertain trade conditions between the US and China, has further subdued the market term. These conditions have driven many investors to provide more risky assets such as Cryptocurrencies, which leads to increased volatility and reduced market participation.

Despite this downward trend, some analysts believe that Ethereum may approach an important turnaround zone. According to MartinezOne of the best historical signals for Ethereum accumulation has been a price measure that dipped below the lower limit for the MVRV price band- a metric comparing the market value with realized value to assess whether an asset is over- or undervalued. Ethereum is currently traded under the lower band.

Martinez emphasizes that this positioning has usually preceded strong upward changes, especially during periods of extreme market pessimism. Although short-term volatility can remain, ETH’s entry into this zone may provide a rare opportunity for long-term investors to gather at historically discounted levels-market conditions stabilize and emotions.

Related reading

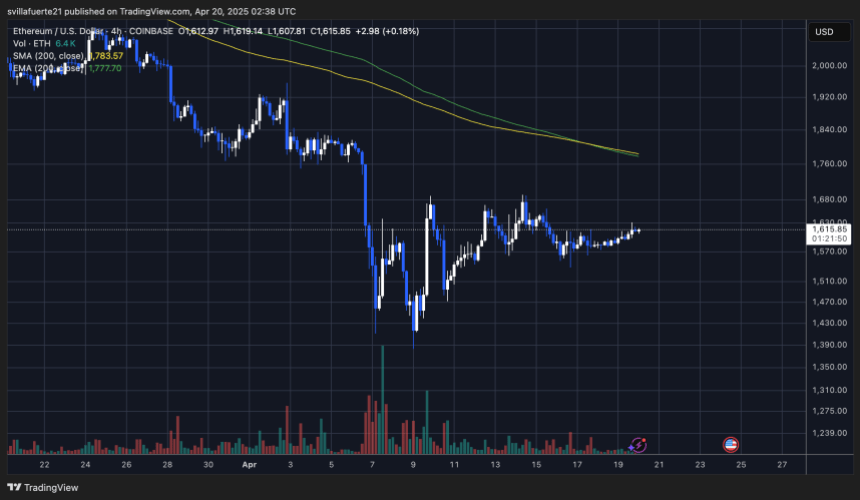

ETH -BOs in crowded range

Ethereum currently deals with $ 1,610 after almost a week of low volatility and sideways. Since last Tuesday, ETH has remained locked up in a hard interval between $ 1,550 and $ 1,630, which reflects the market’s uncertainty and doubt to take a clear direction. This narrow trading zone highlights a period of price compression, often a precursor to a larger feature in both directions.

In order for bulls to regain speed and change emotions, Ethereum must recover the level of $ 1,700 and press decisive over $ 2000 brand. These levels not only act as important psychological barriers, but also represent critical zones for previous support that have now been transformed into resistance. A breakout over $ 2,000 would probably trigger renewed buying interest and set the stage for a potential recovery rally.

Related reading

But if the Bearish print is built and $ 1,550 floors are broken, Ethereum was able to quickly test the support zone of $ 1,500. A division below that level would confirm additional disadvantages, potentially accelerate sales and deepen the current correction. Until a division or division occurs, traders should prepare for more consolidation and volatility when the market is waiting for a macro or technical catalyst.

Featured Image from Dall-E, Chart from Tradingview