Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

Ethereum has finally broken through a key resistance level and traded over $ 1,900 after pushing past the prolonged $ 1,850 barrier. This movement marks the beginning of an outbreak that many hoped for – but few expected to come so soon. After weeks of doubt, baisse -like pressure and unsure momentum, ETH shows renewed strength just as a broader market term begins to change.

Related reading

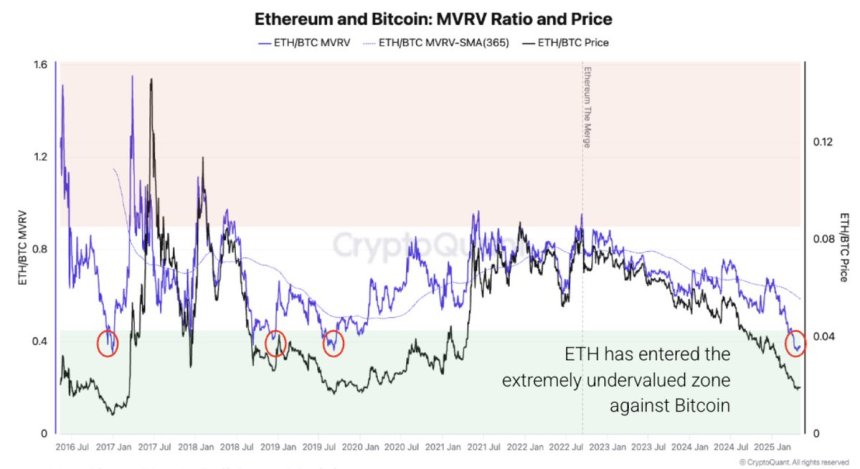

Adding weight to the outbreak reveals new insights from Cryptoquant that Ethereum is now extremely undervalued compared to bitcoin, the first time this has occurred since 2019. Historically, such levels of ETH/BTC sub -evaluation have preceded periods of strong Ethereum design. While the price measures lead the road, data on the chain strengthens the haus -like case, which signals that ETH can enter a favorable phase in its bicycle.

This renewed upside comes in the midst of low expectations and wide skepticism, which makes it all the more influence. Because ETH trading over $ 1,900, traders and investors look carefully for follow -up and potential continuation against $ 2,000 and thereafter. If the story is any guide, Ethereum’s latest move Maybe not just a short-term top-it can be the beginning of a greater trend use, especially when the ETH/BTC evaluation gap begins to close.

Ethereum flirts with $ 2,000 as undervaluation sparks

Ethereum is now approaching the critical brand $ 2000, a level that, if recycled and held, would confirm a technical outbreak and potentially initiate a wider haus phase. After weeks of sluggish movement and baisse -like pressure, ETH gets speed and shows signs of strength over both price measures and measurement values on the chain. An end over $ 2,000 would mark a major change in the feeling, which signals renewed confidence among both investors and traders.

But risks remain. Ongoing tension between US and China continues to inject uncertainty into the global markets, and the US Federal Reserve has shown no signs of swing. With interest rates that are expected to remain elevated and quantitative sharpening (QT), the macroeconomic background still remains a headwind. If these geopolitical and monetary factors facilitate, Ethereum’s breakout can have long -term traction.

According to CryptoquantEthereum-to-Bitcoin MVRV (Market Value to Realized Value) relationship emphasizes that ETH is now extremely undervalued compared to BTC first time this has occurred since 2019. Historically, such conditions have led to strong periods of Ethereum design.

Still, the haus -like attitude is facing some friction. Supply pressure, weak demand for the chain and flat networking activity can stop speeding if the marketing entry is not further improved. While Ethereum’s current push is encouraging, the confirmation will only come up with long -term movement over resistance and stronger basic factors. Until then, ETH remains at a critical time, with the potential to lead the next part of the Krypto rally – or slide back to consolidation if external and internal pressure remains.

Related reading

ETH Price analysis: Technical details

Ethereum is traded at $ 1,933 after a strong outbreak over $ 1,900 resistance zone, which marks its highest level since the beginning of April. On the 4-hour diagram, ETH rose from about $ 1,850 with increased volume and broke for a more week of consolidation area. This movement confirms haus -like speed and sets the $ 2,000 psychological level clearly in sight.

The outbreak is further supported by the price that now trends well above both the 200-period EMA ($ 1,791) and the 200-period SMA ($ 1,700). These long -term moving averages had previously served as resistance, but have now been flipped in potentially dynamic support. The strength of this rally indicates renewed buying interest and a potential change in the market entry.

However, the next challenge lies in maintaining this upward speed. Ethereum must hold over $ 1,900– $ 1,920 level to avoid a false and confirm this outbreak as sustainable. A pure push through $ 2,000 would further validate the hausse -like structure and open the door to higher goals.

Related reading

Overall, the diagram reflects a decisive technical outbreak, with the support of volume and structure. If bulls remain in control and macro conditions remain stable, ETH can prepare for a stronger trend in the coming days.

Featured Image from Dall-E, Chart from Tradingview