Ethereum (ETH) continues to underperform the broader Cryptocurrency market, currently traded just under $ 1,800 after falling 4% over the past 24 hours. Despite a strong start to the year, where the crypto market experienced Hausse, ETH has not succeeded maintain its upward track.

Since we slipped below the $ 3,000 level, access has largely varied downwards and have now broken the $ 2,000 support zone, which signals weakening demand and the feeling.

While bitcoin and other large digital assets still managed to see some recovery efforts In recent weeks, Ethereum’s price decline has been accompanied by reducing network activity and weakening the basics of the chain.

This divergence has caused concern over ETH’s Short -term views and received a new analysis of the underlying causes that drive the performance of the asset.

Toll decrease and networking Inactivity Fuel Inflation Pressure

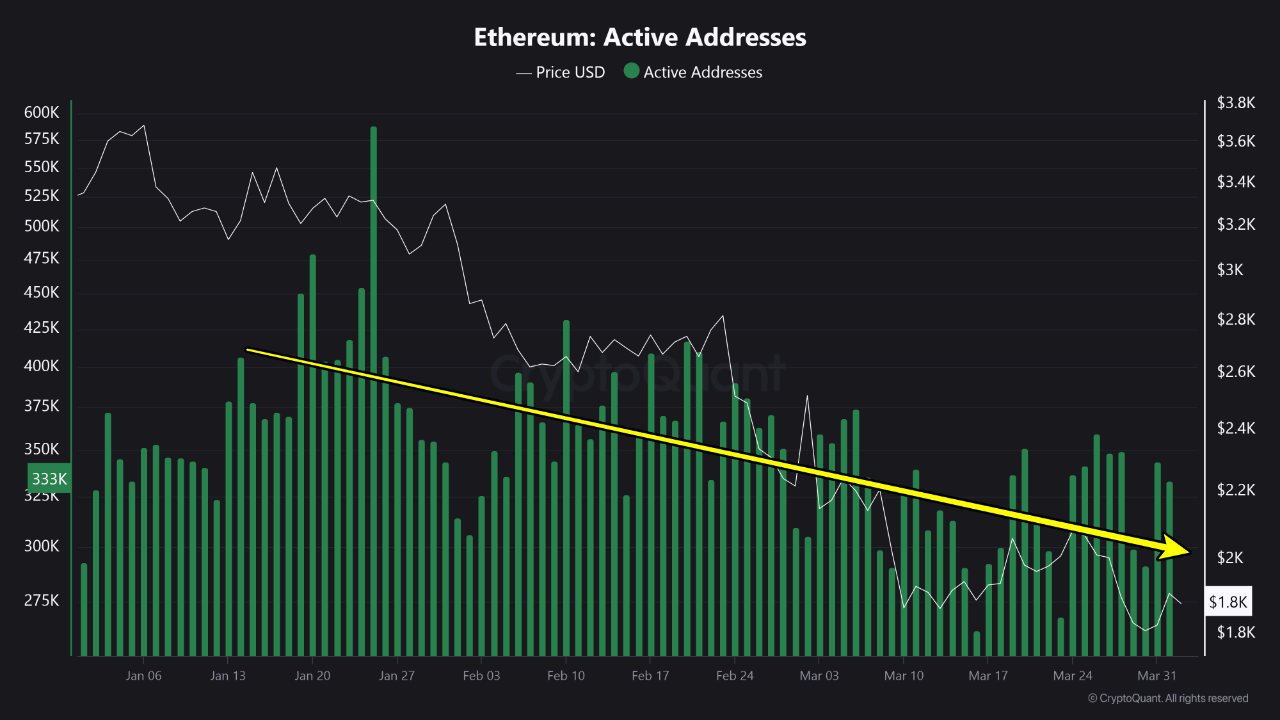

Cryptoquant -analyst Egyhash recently published a Report Select key measurements on the chain, which suggests that Ethereum’s current market weakness is closely linked to its declining tax economy and user activity.

According to the report entitled: “Why Ethereum is bleeding value: Fee Crash meets hyperinflation Hellscape.” Ethereum’s network has been experiencing its lowest level of activity since 2020.

Daily active addresses have steadily declined since the beginning of 2025, and average transaction fees have dropped to register lowness. This decrease in activity has led to a strong case in Ethereum’s focal speed, a metric decision to compensate inflation pressure after the network’s transition to proof-of-stake.

The Dencun upgrade, which was expected to improve network efficiency, has coincided with a longer period of low transaction volumes, which further reduced fee revenue and contributes to higher net -th emission.

Egyhash concludes that the confluence of weak networking commitment, reduced burning speed and high token inflation is central to Ethereums diminishing valuation.

Why Ethereum bleeds value

“Ethereum’s latest sub -performance can largely be attributed to reduced network activity, as evidenced by declining active addresses and reduced transaction fees.” – by @Egyhashx pic.twitter.com/fgqjycroin

– Cryptoquant.com (@cryptoquant_com) April 3, 2025

Ethereum Technical Outlook signals potentially support

Despite the headwind in the chain, some technical analysts have a gently optimistic view. Trader Courage, a technical analyst at X, noted The fact that Ethereum is currently testing an important support zone and can recover against the upper resistance in its current commercial area.

Back at the green support line. It seems we may be heading towards the top of the range.

The key levels are on the chart.#Eteum pic.twitter.com/rrx8b3b6nw

– Trader Courage

(@Cryptocourage1) April 3, 2025

Another market analyst, Cryptoelite, shared A long -term rising trend line that ETH has historically respected. Based on this trend, the analyst believes that ETH may still have the potential to collect to $ 10,000 later in the year, provided that wider Market conditions are improved.

Featured Image Created with Dall-E, Chart from TradingView