Data on the chain shows that the Ethereum transaction fee has dropped to the lowest level of several years recently. Here is what this can mean for ETH’s price.

ETHEREUM Average charges are now valued at just $ 0.168

In a new insight postAnalytics company Santiment has discussed the latest trend in the average charges for Ethereum. “Average charges“Is a metric that, as the name implies, keeps track of the average amount for fees that the sender in the ETH network is attached with its transactions.

This indicator’s value correlates directly with the amount of traffic that the blockchain has to do with. The reason behind this lies in the fact that the network has only a limited capacity to handle transfers.

When the chain is busy, transfers can remain stuck in wait until the transactions in front of them are cleared out. Those who want their transactions to be treated ASAP can choose to attach a fee than average than the average, so that the validators prioritize them.

In times of particularly high traffic, this type of competition among users can quickly drive the average fees up to significant levels. However, when there is little activity, the sender has little incentive to pay any remarkable amount, so that the value of the meters can remain low.

It seems that Ethereum has witnessed the latter type of conditions recently, as the average fees have registered a decline.

Looks like the value of the metric has declined to a low level in recent days | Source: Santiment

As shown in the above graph, Ethereum has average charges dropped to a low of $ 0.168 recently, which is the lowest it has been since 2020. This means that the activity in the network is historically low right now.

According to the analytics company, this may not be so bad from a trading perspective, as low fee periods can often precede Rebounds in the Cryptocurrency price.

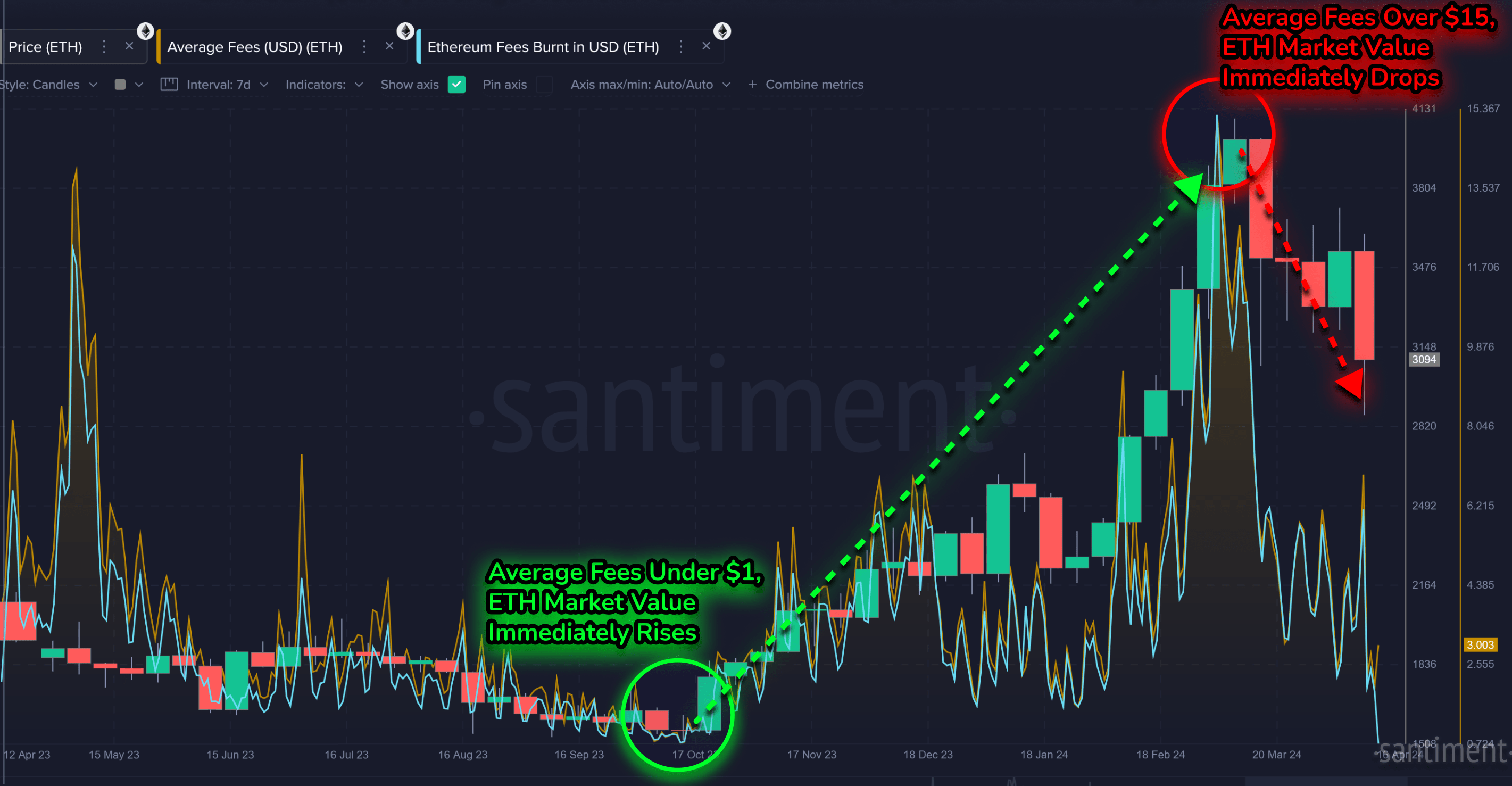

Below is a chart showing an example of this trend in action:

The past trend in the transaction fees of ETH | Source: Santiment

As can be seen in the above graph, the average charges from Ethereum led under the $ 1 mark back in 2023 to haussearted speed for the supply. The explanation behind this pattern may be in the fact that low fee periods may indicate disinterest from the crowd.

Historically, ETH and other digital assets have tended to move in a way that goes contrast to the majority’s expectations. This means that a lack of optimism can lead to rebounds, while excessive hype can result in peaks. From the diagram, it is obvious that ETH’s Q1 2024 top came when the metric surpassed $ 15, indicating a variety of voltage.

“Generally speaking, fee levels under $ 1 are a fairly promising sign that the audience has become uninterested,” notes the analysis company. “Just remember that there is no set of guaranteed” bottom “or” top level every time fee costs violation below or above a certain level. “

Tet price

At the time of writing, Ethereum is about $ 1,600, an increase of more than 1% over the past 24 hours.

Looks like the price of the asset hasn't moved much recently | Source: ETHUSDT on TradingView

Image from Dall-E, Santiment.net, diagram from tradingview.com

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.