- Ethereum reflects its 2023-style breakout bike, with smart money that further supports this opportunity.

- Large headwind remains to be met.

Ethereum (ETH) exhibits aggressively dip purchase from deep pocket investor.

On chain data showed that ETH wallets at the top level collected 130,000+ ETH as evil prices at $ 1,781, which indicates smart money absorption in the event of critical demand.

But with excessive supply that is still on the market, uncertainty remains. Is the current price measure a genuine eruption, or is ETH just establishing a bottom of a key support level before the next move?

Smart Money Flow – signs of a potential dip

A month ago, Ethereum opened at $ 2,147. At the press time it was by 15%, which violates the critical $ 2K support for the first time in two years.

In 2023, ETH underwent a six -month consolidation phase before an outbreak began, with two significant accumulation phases during the fourth quarter, which finally reached a peak to $ 4,012.

Some analysts are predict a potentially repeated rallyAnd draws parallels to Ethereum’s poor Q1 performance as a precedent for a bull bike. Given both micro and macro-actors, this hypothesis seems reasonable.

First, the high-risk-off feel driven by Trump’s financial dumping can move market attention away from bitcoin, which can potentially position Ethereum for upward speed.

In addition, large inflows suggested important support levels the beginning of an accumulation phase, which reinforced the Hausse case for ETH.

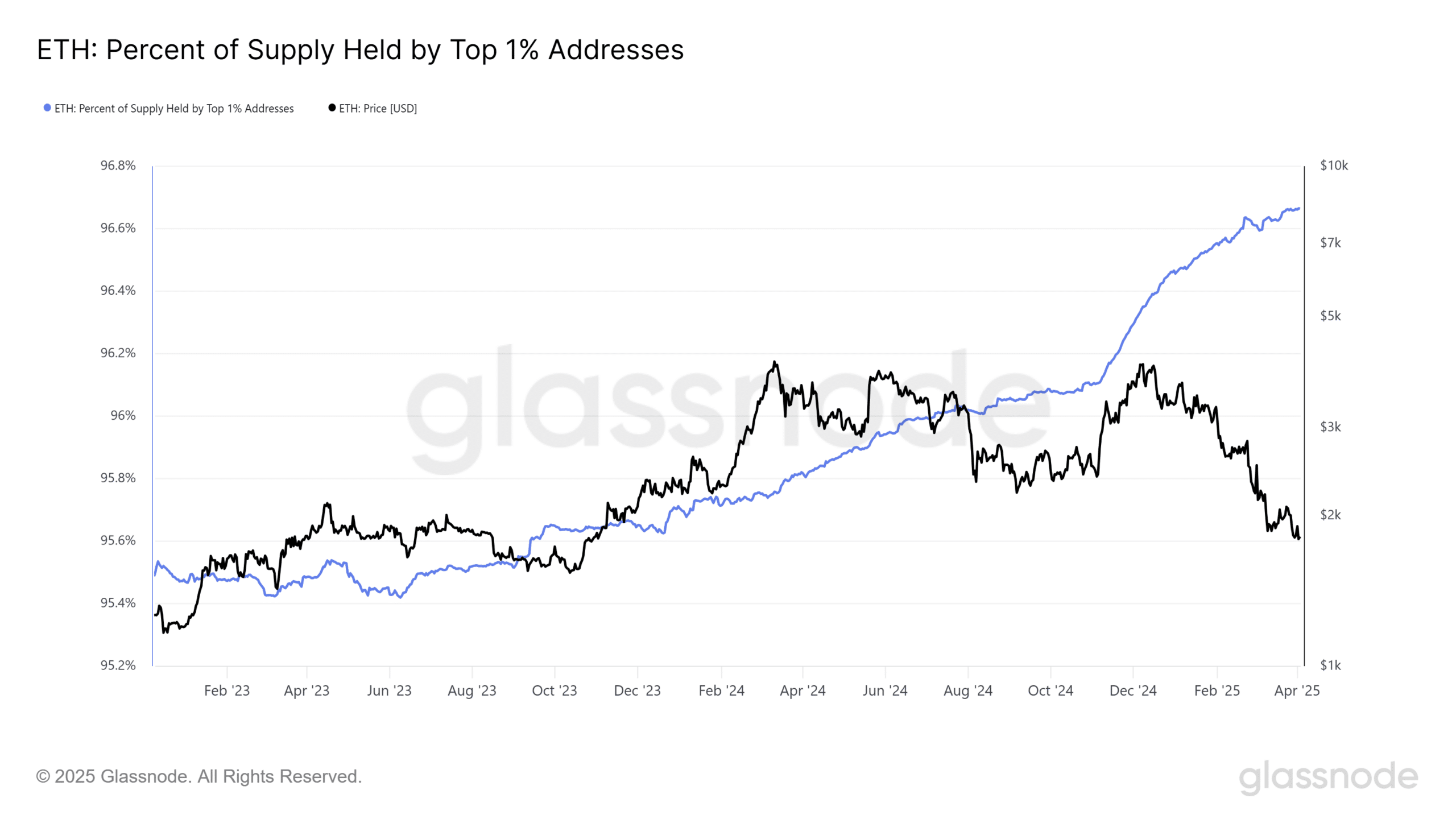

Noteworthy, Ethereum’s percentage of supply, which is held by top 1% addresses, has increased to a maximum period, with a significant 96.66% of the total supply concentrated within the hands on electoral holders.

This concentration topped in the middle of Q4 last year, coinciding with a significant increase in the vaulting, which helped to operate ETH’s 71% quarterly rally override Bitcoin’s (BTC) 61% during the same period.

When the vaulting collection is resumed with ETH dipping to $ 1,780 and showing a 2% bounce to $ 1,830 at press time, these historical patterns and accumulation trends strengthen the case for this as a potential market base.

Can Ethereum position itself for a potential market takeover as the second quarter develops?

Ethereum’s odds for a repeated rally

Unlike two years ago, market conditions have become more volatile. This is exemplified by ETH/BTC pair, which has dipped to a five -year low.

Bitcoin’s resilience in the midst of market turbulence has exerted pressure on Ethereum and contributed to its weak Q1 performance.

Ethereum’s dominance, which kept stable in double -digit figures in 2023 and into Q1 2025, has now greatly decreased to a record low of just 8%.

While the election activity played an important role in ETH’s breakout to $ 4K earlier, the simultaneous top in ETH/BTC pair highlights capital rotation as a key factor.

Investors, who move away from Bitcoin’s high risk/high reward profile, funnel capital in Ethereum and add to haus -like speed to its rally.

But this dynamic has changed dramatically. Bitcoin dominance has risen to a four -year height and broke 61%and suffocated Ethereum’s relative surprise.

Unless this shift turns, the probability of a repeated rally that resembles in 2023 remains.