Several Ethereum key figures are witnessing positive sentiment following a renewed upward momentum in the digital asset’s price. Favorable macroeconomic and market conditions are believed to have bolstered the upturn in ETH’s price and market dynamics, reflecting the potential for more price growth.

Bullish build-up for Ethereum

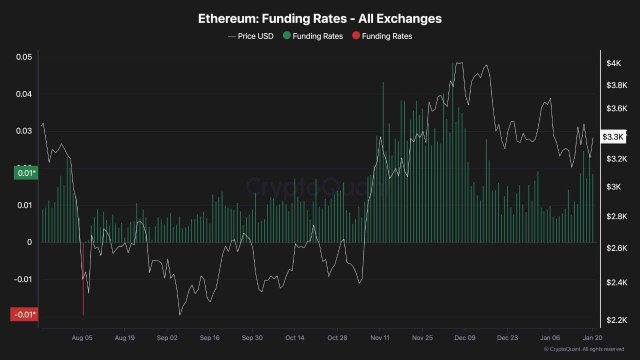

Amid improving conditions, an encouraging trend has been seen in Ethereum’s recent market dynamics. Latest data shows that ETH funding rates has experienced a remarkable upswing, signaling growing optimism among investors and traders.

Market expert and host of the Crypto Banter Show Kyle Doops reported the positive development on the X platform as the altcoin approaches a critical price breakout. The increase in funding rates reveals increased demand for leveraged long positions, indicating that market participants may be preparing for a possible rally.

Ethereum’s funding rate rise comes as ETH is gearing up for a breakout above the critical $3,500 level. This impending move is bolstered by growing sentiment following Donald Trump’s White House inauguration as the new US president, which took place on Monday.

ETH’s encouraging technical setup coinciding with rising bullish sentiment points to a possible breach of this resistance level in the near term. A breakout from the central $3,500 mark could determine ETH’s market direction as the altcoin aims for higher levels.

As rising funding rates are often critical to sustaining any market price rally, ETH’s stability is likely to improve, triggering an extended rally. Still, the altcoin’s upward movement could lose momentum if the metric fails to sustain the trend.

Kyle Doops noted that the optimism in the futures market will be key for ETH to maintain this past the $3,500 resistance zone. As the asset nears this crucial juncture, investors expecting a big rally remain anxious for the next decisive move.

A significant amount of ETH withdrawn from crypto exchanges

When market dynamics change towards a positive sentiment, ETH is witnessing a significant wave of withdrawals from crypto exchanges. Specifically, this large outflow often reflects growing accumulation of holders and reduced selling pressure, which can pave the way for positive price action.

Kyle Doops marked that over 540,000 Ethereum valued at $1.84 billion had been withdrawn from crypto exchanges in the past month, citing data from Glassnode. According to the expert, this is a resounding vote of confidence in Ethereum’s future as it indicates less selling pressure and increased holdings by long-term investors.

Historically, these developments have had a significant influence on ETH’s price outlook, causing the continuation of an uptrend or the beginning of one. If this trend continues, it could fuel altcoins recent upward movement as investors navigate its current market dynamics.