Ethereum has been fighting under the $ 2,800 brand for several days, and cannot regain it to start a recovery collection. This key level is still a significant barrier for bulls, and as the price continues to consolidate during it, the Baissian feeling grows. Many analysts require a continuation of the trend, which reflects the beaten mood on the market. Investors, who once believed that Ethereum would gather together with Bitcoin this year, are now showing signs of doubt.

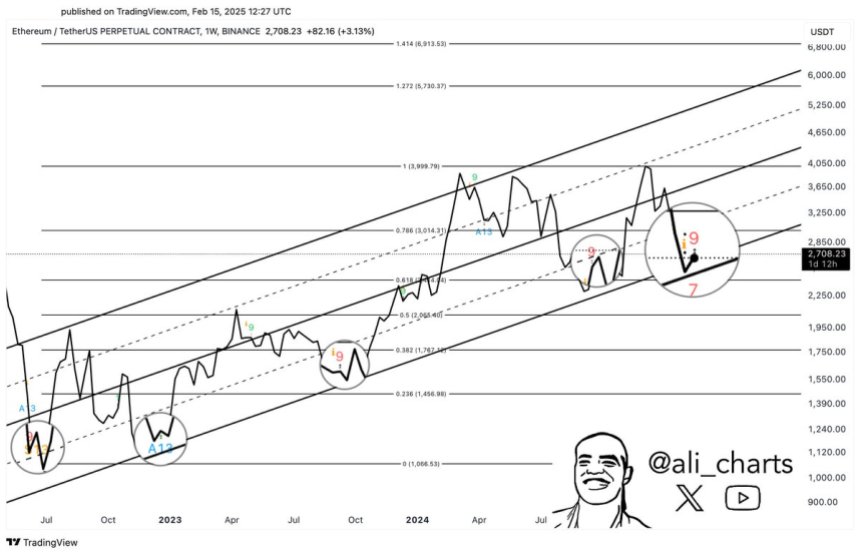

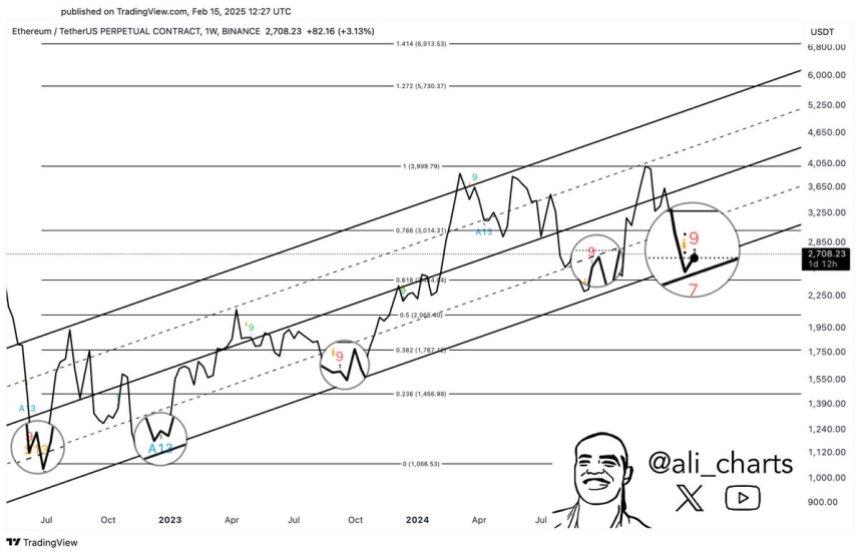

But not everyone is baisse -like. Some investors remain optimistic and point to signs that Ethereum may be on their way to a recovery phase. Crypto analyst Ali Martinez recently shared a technical analysis that revealed that the TD -Evential indicator has blinked a buy signal on Ethereum’s weekly chart. This rare event has historically shown the beginning of significant trend use. Martinez points out that when this indicator is triggered during the weekly framework frame, Ethereum often follows a strong upward speed, which signals a potential haus phase forward.

When Ethereum floats under $ 2,800 resistance, traders and investors look closely. If the story repeats itself and TD -Evential Signal turns out to be correct, Ethereum may surprise The market with an aggressive move to higher price levels.

Ethereum prepares for a recovery phase

Ethereum tests critical liquidity below the $ 3,000 level, a significant psychological price point that analysts believe will determine Ethereum’s performance in the coming weeks. This level has become a stroke between bulls and bears, with emotion in the market that remains very divided.

Retail investors, who lose confidence in the potential for a short term recovery, continue to sell and contribute to downward pressure on the price. At the same time, larger players seem to take advantage of the dip, gathering Ethereum at a faster rate, which signals confidence in the long -term potential of the asset.

Martinez recently shared a Technical analysis on xEmphasizes a significant historical pattern on Ethereum’s weekly chart. Martinez noted that every time the TD-Evential indicator has flashed a purchase signal near the lower limit for Ethereum’s long-term rising channel, prices have historically recovered with strength. This indicator, widely used by traders to detect trend turns, suggests that Ethereum may approach an important moment.

According to Martinez, a similar installation is now developing as Ethereum consolidates just below important resistance levels. If TD -Second Signal plays as it has done before, Ethereum may be on its way for a powerful recovery rally. Recover the level of $ 3,000 and keep it as support would mark the first step towards reverse the baisse -like trend and initiate a long -term trend. In the coming weeks will be crucial for Ethereum when investors are looking at signs of a breakout or a further decline.

Et consolidates before a large move

Ethereum (ETH) is traded at $ 2,690 after days with pages trade and discomfort. This stagnation period has left investors who speculate on the short -term direction for ETH, as the feeling remains divided between haissey recovery and additional neck potential. The lack of speed above key resistance levels has contributed to uncertainty, with both bulls and bears struggling to take decisive control.

In order for Ethereum to initiate a recovery tour, bulls must recover the land of $ 2,800 to support. This critical level has served as a key barrier in recent weeks, and breaking over it would pave the way for pressure against the $ 3000 brand. A successful feature of over $ 3,000, a psychological and technical resistance level, would confirm a turn of the trend and establish haussearted momentum on the market.

However, the risk of further disadvantage remains if ETH does not recover $ 2,800. A retrace can take the price in lower demand around $ 2500, where stronger support can be found. The next few commercial sessions will be critical, as Ethereum’s price measure is likely to dictate the market term and affect its short -term track. Investors look closely for a decisive eruption or further consolidation as the market remains uncertain.

Featured Image from Dall-E, Chart from Tradingview