Speculation about Ethereum’s potential for a large rise To a new highest time in the ongoing cycle, it swells in society because many people wonder why ETH has underperformed compared to other altcoins. Several factors have been considered to have hindered the ETH’s long -awaited rally including weak choice activity.

Are great investors’ interest in ethics fading?

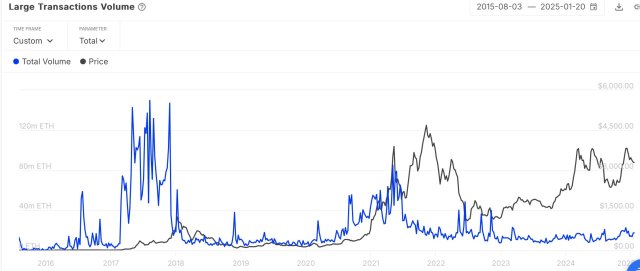

Euphoria among elections Ethereum Investor’s Sparks worries as large -scale transaction volume does not show a significant increase in the ongoing market cycle. Verified Author on Cryptoquant On-Chain Platform IT Tech underlined The negative trend, which indicates a lack of strong election activity.

The development means that high net worth and institutional investors are still cautious as large ETH transfers remain at a low interval. With large transactions fading, ETH may face significant obstacles since Valing activity Usually fuels increase.

This technology believes that Ethereum’s major transactions are low in contrast to previous cycles such as 2017 and 2021, where these transfers were widespread. This says that the market is more retail -driven and organic, rather than speculative mania.

Although there have been small increases in electoral activity, the expert described that they are not at levels that would indicate a sale or parabolic movement. Meanwhile it is urging the technology investor To look for unexpected nails in choice activity because they usually come before significant price changes.

According to the expert, Ethereum experiences a gradually upward trend. However, the next significant change in market dynamics will be determined by electoral movements. At present, Altcoin has recycled the land of $ 3,000 as prices recover after a general market proposal, which gives the next decisive resistance to $ 3,500.

In order to confirm an interruption $ 3,500IT Tech claims that it must increase the large transaction volume. If ETH does not see an increase in these transactions, it may witness a consolidation phase or a remarkable relapse.

The tech expects a return to the level of $ 2,800 and $ 2500 if the large transaction coincides with price weakness, which can lead to electoral distribution and cause ETH to sink. With this muted movement, ETH’s durability is questioned, which triggers uncertainty about its next great price measure.

ETH’s set to meet volatility?

ETH floats between $ 3,000 and $ 3,200 with lightly haus -like momentum. Yet crypto -expert and traders, Titan of Crypto identified A trend that can strengthen Ethereum’s upward movement in the coming days.

Examination ETH’s price On the daily diagram, Titan of Crypto expects an upturn after an outbreak from a falling wedge pattern. This pattern is supported by an imminent RSI Haussey divergence, which can drive more price nails against important resistance levels.

Although Ethereum demonstrates upward potential, the expert believes that volatility can develop shortly after the recently completed FOMC meeting.