Ethereum (ETH) has been under intense sales pressure and caused concern among investors over the coming weeks. The trend remains baisse -like, and if this momentum continues, ETH can fight to find support on key levels. Compared to bitcoin and other altcoins, ETH has underperformed and pushed a negative view of traders.

Unlike previous market cycles where ETH moved synchronized with Bitcoin, recent price measures suggest a link between the two assets. Key measurements from Intotoblock reveal that ETH remains largely uncorrelated to BTC, which shows a 30 -day price correlation of just -0.06. This lack of correlation means that Bitcoin’s Haussearted Momentum has not been translated into strength for ETH and contributes to investors’ uncertainty.

With the ethereum lugging after Other major crypto courses, an analysts warn that further disadvantage is possible if ETH cannot regain critical resistance levels. The market looks closely at whether ETH can find support and reverse this overwhelming price measure or whether the Baisse trend will continue in the coming weeks. When ETH struggles to regain speed, investors remain cautious and wait for a clearer signal before making their next move.

Ethereum -correlation with the market

Ethereum has been stuck in a trend since the end of December and dropped over 28% from its local height of $ 4,100. Despite Bitcoin’s Haussearted Momentum, ETH has not succeeded in getting traction and has left investors worried about its overwhelming price measure. Many are now speculating whether Ethereum can face another disappointing year, as Altcoins such as Solana, Avalanche and Polygon continue to surpass ETH in terms of price movement and investors’ interest.

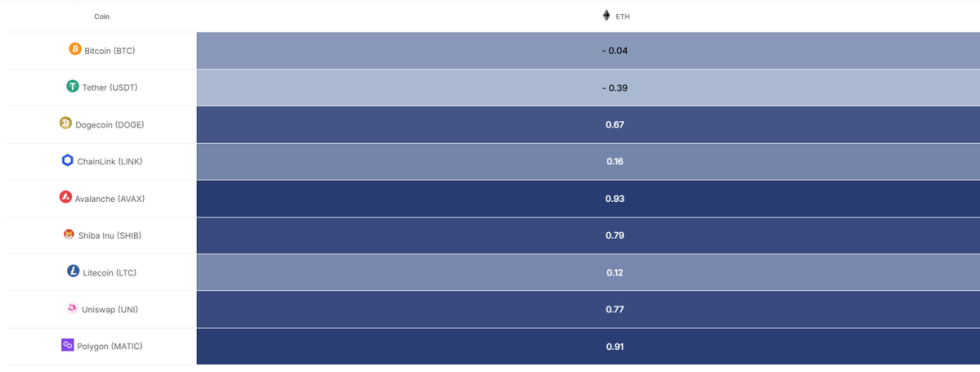

Key measurements from intotheblock Provide an interesting insight into Ethereum’s market behavior. Unlike in previous cycles where ETH followed BTC, it now seems largely uncorrelated, with a 30 -day price correlation of just -0.06.

This means that even when Bitcoin moves higher, Ethereum has struggled to gain momentum. However, other large assets such as polygon (0.91) and avalanche (0.93) remain closely correlated, suggesting that ETH’s price measure is unique in this cycle.

In the future, February can be an important month for Ethereum. Historically, this has been a hooked period for ETH, and many investors hope for a trend change. If ETH can break key resistance levels and regain lost ground, the feeling of its performance this cycle can change rapidly. However, failure to gain momentum can lead to continued stagnation, which means that other altcoins can take the limelight.

Ethereum fights under the key support when bears take control

Ethereum is traded at $ 3,090 after failing to stay above 200-day exponentially variable average (EMA) to $ 3,137. This key level was a crucial support zone for bulls, but now that it has been lost, the bais pressure is mounted.

Bulls are in trouble, as the price measures suggest that ETH is on its way to another leg down. If this sales pressure continues, ETH can set a new local low and test lower demand around the $ 2,900 mark. A division below this level would signal a deeper correction, which could potentially lead to extended consolidation or additional reductions.

In order for Ethereum to regain speed, bulls must recover the level of $ 3,300 and drive higher. This zone has served as a strong resistance in recent weeks, and turning it to support would confirm a trend use. But if ETH does not recover this brand, the next critical level is to look at less than $ 3,000, where additional buying interests can show up.

With marketing terms inclined Baisse, ETH must keep over important demand zones in order to avoid a more significant decline. If bulls cannot go in soon, Ethereum may continue to stay behind Bitcoin and other top altcoins.

Featured Image from Dall-E, Chart from Tradingview