Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

Ethereum saw a dramatic turn this week and bounced over 21% from its latest low of $ 1,380 in just hours. The sharp recovery came in response to an unexpected change in macroeconomic politics: US President Donald Trump announced a 90-day break on mutual customs duties to all countries in addition to China, which is now facing a steep 125% duty. The news sent a ripple through global markets and led to a short -term collection in risk resources, including crypto.

Related reading

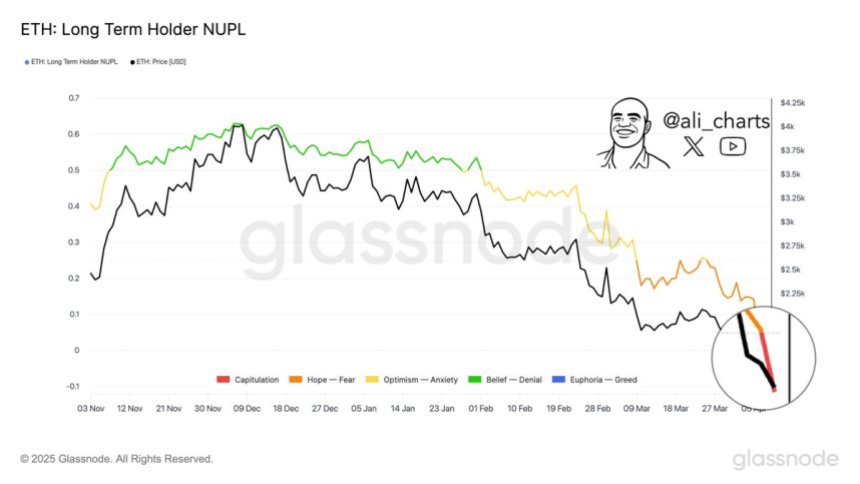

Ethereum, which had been under heavy sales pressure for weeks, seems to have found temporary relief. According to Glassnode data, long-term Ethereum holders begin to fall and unload positions with loss after months of decline. Historically, these moments of long -term holding architulation have often marked bottom phases and preceded meaningful returns.

While short -term volatility remains elevated, some analysts see this installation as a potential opportunity zone, especially for counter -investors who want to gather during top fear. The market is now looking to see if ET can keep its profits Or if broader uncertainty will withdraw prices. One thing is clear: The next few days can be crucial to Ethereum’s trend on the way into the second half of 2025.

Ethereum finds relief in the middle of chaos, but the market remains on the edge

Ethereum is now at an important road crossing after holding weeks with relentless sales pressure and uncertainty. The recent increase from $ 1,400 levels has offered a glimpse of hope when bulls start to push back towards the trend. This bounce follows aggressive volatility not only in crypto but over global shares, with price measures hidden by continued geopolitical anxiety and macroeconomic instability. US President Donald Trump’s unpredictable position on tariffs is still a joke sign and keeps the global markets on the edge.

Since the peak at the end of December, Ethereum has lost over 60% of its value and triggers growing concern that a full -scale bear market can be developed. Many investors have already left positions, while others remain on the page and are waiting for clarity. Still seeing some opportunities.

According to top analyst Ali MartinezLong-term Ethereum holders have now entered what is usually called “capitulation”-one step when even the most patient investors begin to trap under pressure. Martinez believes that this can present a rare window for counter -buyers. “For those who look at risk load dynamics, this phase has historically marked the main accumulation zones,” he shared on X.

While Ethereum’s path forward is still uncertain, the current feeling suggests that a critical test is in progress – one that can determine if this recovery has legs, or if further pain is forward.

Related reading

Bulls looks to confirm recovery with key outbreaks

Ethereum shows signs of short-term strength as it forms an “Adam & Eve” Hausseartat turning pattern on the 4-hour chart. This classic technical formation, which begins with a sharp V-shaped low followed by a rounded bottom, often signals a potential outbreak if price measures hold and follow through. For Ethereum, the first step is to recover the $ 1,820 level to confirm this haus -like structure.

If bulls can drive ETH above this level with conviction, the next Key Challenge is at 4 -hour 200 sliding mean (MA) and exponentially variable mean (EMA), both converge around the $ 1,900 mark. A decisive breakout through this zone would validate the recovery setting and can start a more long -lasting move higher.

Related reading

However, failure to regain the level of $ 1,800 in the coming days can keep ETH stuck in a consolidation area. If it is rejected, the price can remain varied between current levels and the lower support area close to $ 1,300, where ETH recently bounced. At the moment, all eyes are to how the price reacts to resistance levels ahead, as bulls aim to regain control and move the short -term speed to their advantage.

Featured Image from Dall-E, Chart from Tradingview