Given EthereumDeclining performance, even though they are the second largest digital asset, crypto enthusiasts are beginning to show increased uncertainty against ETH. At present, ETH’s marketing term has witnessed a significant decline when Altcoin’s weak price measure remains, triggered by a wider cryptom market decline.

The market becomes careful with Ethereum’s short -term prospects

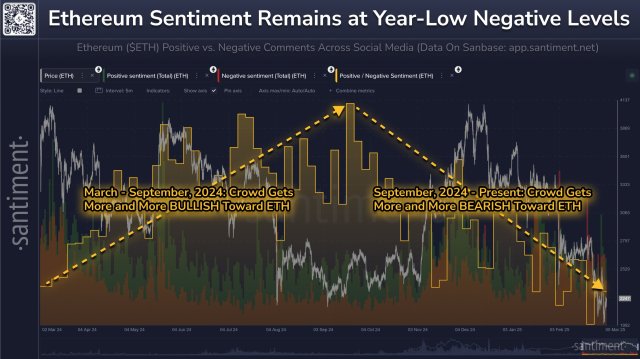

Ethereum’s market term has witnessed a sharp decline, with baisse -like comments about ETH that quickly emerges within society. The template in the emotion reflects uncertainty among crypto participants Due to ETH’s persistent weak price movements since the beginning of the year.

The leading data on the chain and marketing platform reported That audience’s feeling against ETH fell to annual levels when Altcoin underperformed in comparison with other leading crypto assets. Data from the platform shows that the audience between March and September 2024 was extremely Hausse against ETH’s future measures.

Meanwhile, from September 2024 to the present, crypto enthusiasts have been significantly Baisse about the Altcoin outlook. Specifically, this change in the feeling suggests that investors and traders are becoming more cautious, with A struggle to keep over key support levels.

Although the majority of crypto participants become Baissey towards EthereumIt may be a good sign that the asset may be moving up soon. This is because the market has historically moved in the opposite direction of the crowd.

Santiment stated that the negativity produced on social media platforms suggests that once Cryptocurrency is normalizedThere may be a comeback, which is encouraging for individuals hanging on their ETH holdings. However, short -term volatility and broader market uncertainty still affect the price movements of Ethereum, which raises concerns about potential further disadvantages.

ET chain measurements approach positive territory

In spite of the continued downward trend ETH’s price For a longer period, several measurements on the chain begin to go closer to positive territory. One of the measurement values that gradually approaches a positive area is Ethereum market value at realized value (MVRV) Z-points.

Informative platform IC news marked that ETH MVRV Z-points metric approaches the green zone often linked to undervaluation. This development means that ETH can be traded at a discount price in relation to the network’s total capital inflows.

With lower trade volumes and a decline in hausse activity, it has become quite difficult for traders to decide ETH’s next track. ETH’s price currently drops towards the $ 2,100 level, which triggers speculation about an extended decline.

Delva in Ethereum’s latest price action, IC News noted that Altcoin has entered the “spring phase”, which suggests a Hausse effect. It moves into the spring phase indicates a possible bear trap where a rapid decline below support levels deceives sellers and can pave the way for a rally. When ETH has made a comeback from this level, IC News predicts an upturn to recycle the important $ 4000 brand.

Featured image from unsplash, charts from tradingview.com

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.