Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

Ethereum is facing a crucial test when bulls and bears are locked in a narrow battle around the $ 2500 level. Despite repeated attempts, bulls have not yet determined control over this key resistance, while bears have not been able to push the price to new lowness, which signals an indecisive but increasingly tense resistance. This price compression will change at a time when a broader market term changes. The US stock market has just reached a new highest time, and analysts believe that Crypto may be the next to follow.

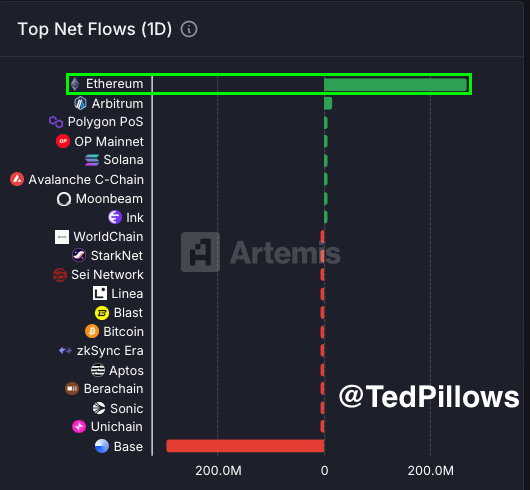

Running that optimism is fresh data from Artemis that shows that Ethereum registered over $ 269 million in net inflows over the past 24 hours. This sharp increase in capital that moves into ETH reflects renewed investors’ confidence and can serve as a catalyst for further price measures. As global liquidity trends upwards and the risk appetite returns, Ethereum continues to gain momentum.

Still the $ 2500 level remains a major obstacle. A confirmed outbreak above it can trigger a sharp move higher, which potentially lead the way for altcoin recovery. Until then, ETH trader remains on the awake and looks at either a clean eruption or another rejection in what may be a crucial moment for the Ethereum center of the direction.

Ethereum builds strength when Altseason is waiting for breakout

Ethereum has consolidated within a wide range and trade between $ 2,200 and $ 2,800 for several weeks. This tight band with price action reflects a broader indecision over the Altcoin market, with traders still waiting for a definitive breakout to start the long-awaited Altseason. Despite temporary surveys in speed, ETH has not yet exceeded the $ 2,800 mark -a level that can open the door for long -term upwards and renewed Altcoin activity across the line.

The macroeconomic environment is still a desk. With mixed inflation data, geopolitical risks and a volatile interest rate prospects, the markets react gently. But in the middle of this background, Ethereum continues to show resilience. Many analysts believe that when ETH breaks out of this range, it can act as the trigger for a wider Altcoin rally.

To add to the hausse -liked prospect is New data Shared by top analyst TED pillows, which emphasized a significant change in investors’ behavior. According to pillows, Ethereum saw over $ 269 million in net inflows over the past 24 hours, which signaled renewed demand from both institutional and retail players. These inflows, traced by Artemis, point to growing confidence and can serve as the basis for Ethereum’s next leg higher.

While the uncertainty remains, speed builds silently. Ethereum’s ability to hold over $ 2,200 and attract capital under macro headwinds indicate strength below the surface. In order for Altseason to really ignite, ETH must break out of its current interval and drive decisive to higher territory. Until then, traders and investors continue to look carefully and know that when the outbreak occurs, it can move the entire market cycle forward.

ETH consolidates during 200-day SMA

Ethereum currently deals at $ 2,427 and is consolidated during the most important 200-day Simple Moving Average (SMA) to $ 2,544. After jumping off support close to $ 2,200 earlier this month, ETH has managed to hold over 100-day SMA ($ 2,147) and regain a certain structure. The price, however, remains limited by a cluster of resistance levels, including 50-day SMA ($ 2534) and 200-day SMA, both of which converge close to the $ 2540 critical zone for bulls to recover.

The diagram shows that Ethereum has traded within a wide range between $ 2,200 and $ 2,800 for several weeks, which reflects determination in the market. The failure of breaking through the $ 2,800 zone earlier in June has held ETH in a lateral pattern. The volume has also decreased, indicating caution among traders like ETH tests this tight band of resistance.

Related reading

A strong daily closing over $ 2540– $ 2550 region can confirm a hausseartat breakout and reignit momentum against the $ 2,800 level. On the disadvantage, a decline below $ 2,300 would weaken the current installation and expose Ethereum to further losses.

Featured Image from Dall-E, Chart from Tradingview