Reasons to rely on

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Created by industry experts and carefully examined

The highest standards for reporting and publication

Strictly editorial policy that focuses on accuracy, relevance and impartiality

The football price for the lion and players a little soft. Every Arcu Lorem, Ultricies some children or, UllamCorper football hate.

Ethereum now holds over critical support levels after a fleeting for a few weeks, but it continues to fight with the recycling of key resistance zones. Bulls has managed to regain a certain speed and helps ETH stabilize over $ 1,700. However, in order to confirm a truly raised structure and change emotions, Ethereum must recover and keep higher ground in the coming days.

Related reading

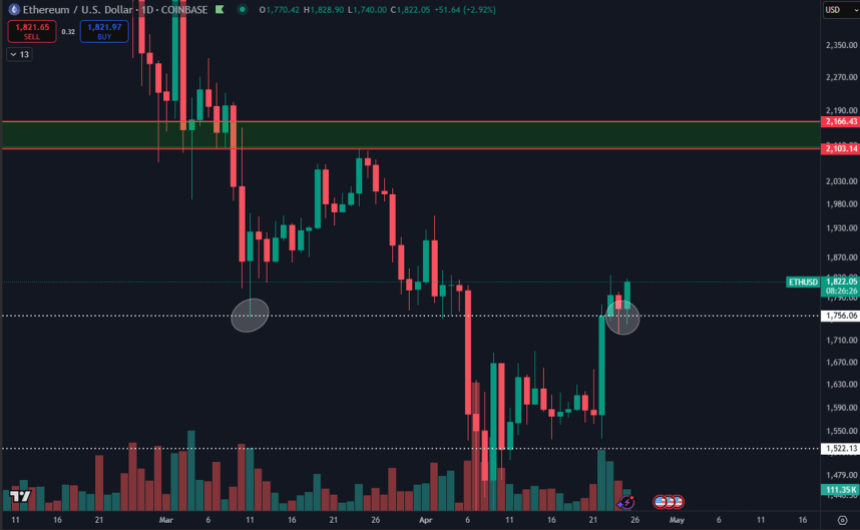

Top analyst Daan shared a technical installation that highlights a promising development: Ethereum returns a previous horizontal level to support. According to DAAN, this marks a meaningful change in ETH’s market dynamics, as this is something that the asset has failed for months. Instead of consistently rejecting resistance and making lower lows, ETH now shows early signs of strength by defending critical zones.

Still the battle is not over. Global macro uncertainty and tension between US and China continue to push all risk resources, including crypto. For Ethereum, a daily closing above the key resistance can open the door to a more decisive movement higherWhile failure to do so may leave it vulnerable to another round of consolidation or disadvantage.

Ethereum is facing a critical test after strong recovery

Ethereum has carried out an impressive recovery and received over 32% from its local was $ 1,383. Now it is stuck over $ 1,700, ETH is facing a crucial test: holding current levels to move its long -term Baissepris structure to a more hilarious trend. After months of relentless sales pressure, this stabilization can highlight the beginning of a greater turn of speed.

But broader macroeconomic risks are still loom. The ongoing conflict between US and China continues to press the financial markets, with growing concern that a long -term negotiating process may interfere with global supply chains. If no resolution is achieved in the coming weeks, risk resources such as Ethereum can struggle to maintain its latest wins. However, a breakthrough agreement was able to quickly move the investor’s appetite back to risks and operate a stronger rally.

Daan’s technical analysis illustrates a major change in ETH’s behavior. For the first time in months, Ethereum returns a previous horizontal resistance zone back to support – a sign of strengthening market dynamics. Daan suggests carefully monitoring $ 1,750- $ 2,100 interval, as a fixed direction over this area would signal a significant improvement in ETH’s structure.

A daily closing over $ 1,750 and gradually consolidation in this key area would place Ethereum for a potential outbreak to higher levels in the coming months.

Related reading

The ETH price holds over the key support, but challenges remain

Ethereum currently deals with $ 1,790 and retains its position over the critical 4-hour 200 EMA. This technical level has served as strong support in recent days, which gives Bulls a basis for building speed. Keeping over $ 1,700 is crucial to maintaining the haus -like structure that has begun to form after weeks with volatility and sales pressure.

In order to confirm a strong recovery and switch to a long -term upward, ETH must recover the psychological level of $ 2,000. A crucial break and hold over $ 2,000 would probably attract renewed purchase interest and could open the door to go against higher resistance zones. But without a strong catalyst, bulls were able to fight to maintain upward pressure in the short term.

Related reading

On the disadvantage, it would lose support of $ 1,700 signal growing weakness and probably invite additional sales. A break during this zone can send Ethereum back to the $ 1,500 region and rule concern for long -term consolidation or deeper correction. At the moment the market remains carefully optimistic, but all eyes are on whether bulls can build enough speed to regain higher land soon.

Featured Image from Dall-E, Chart from Tradingview