Key dealers

- Two Ethereum whales risks forced liquidations due to declining ETH prices.

- A total total of 125,603 ETH on the manufacturer protocol can be liquidated if the price contract values are broken.

Ethereum’s price fluctuations have placed whales on Makerdao in a vulnerable position, with a combined 125,603 ETH worth approximately $ 238 million with the risk of liquidation.

Data Tracked by Blockchain Analytics Platform Lookonchain Exhibitions One of the elections, which controls about 64,793 ETH, is close to its liquidation price of $ 1,787.

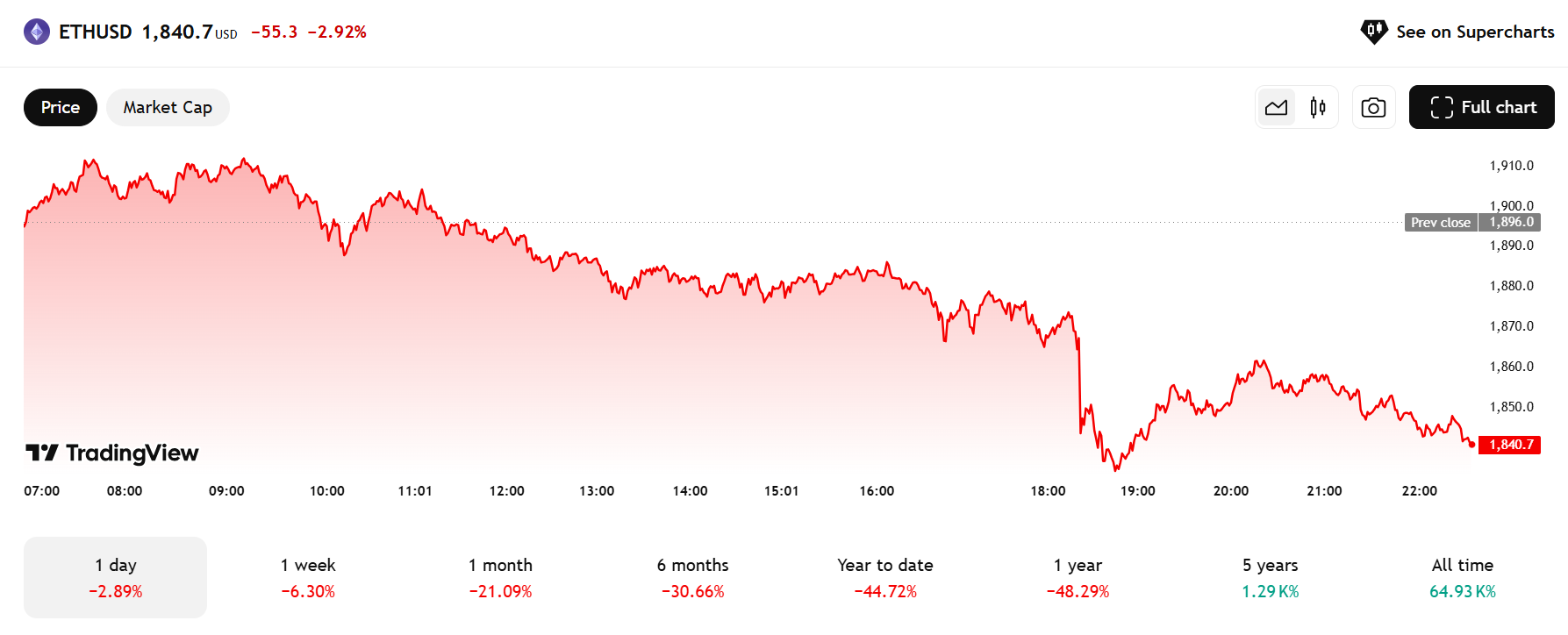

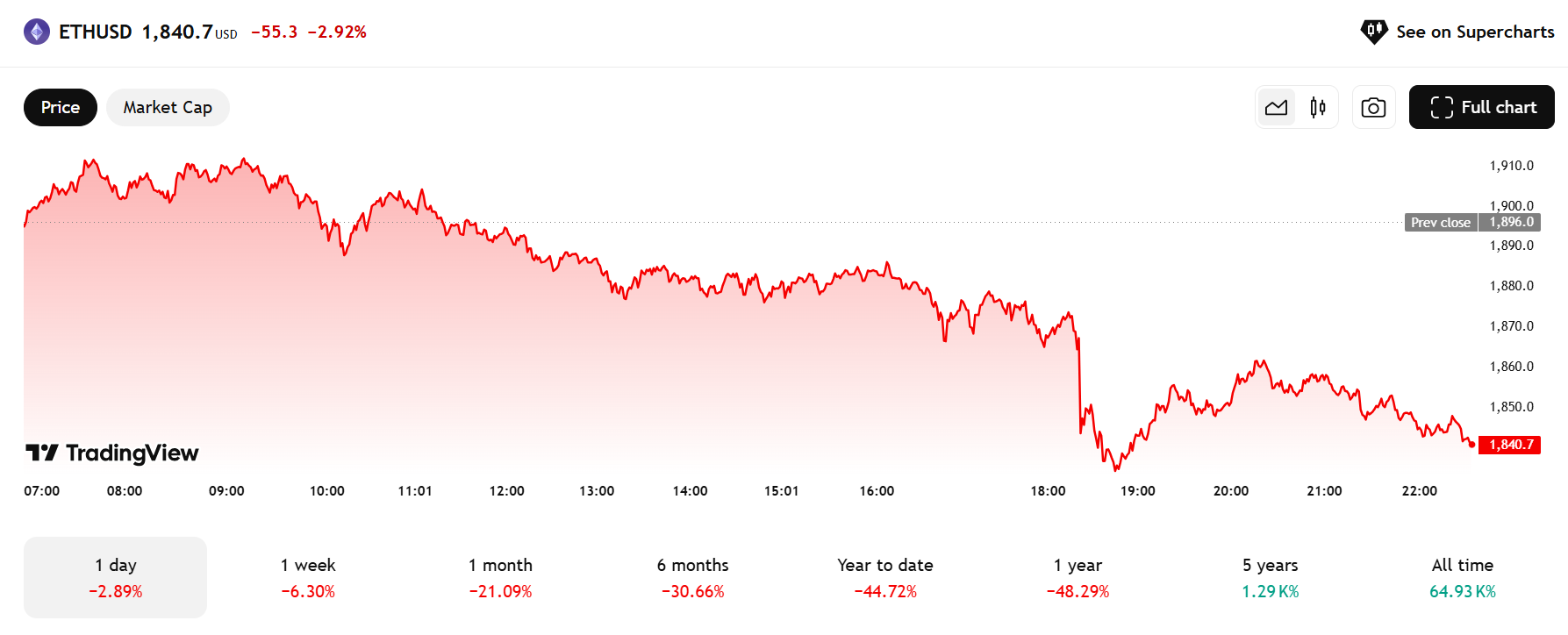

With the ETH trade to $ 1,841 at press time, this choice is only $ 54 from its liquidation price.

The trader avoids narrow liquidation on March 11 by partly repaying his liabilities after a sharp ETH price fall.

However, the current decline has put its position back in danger, with the health dress now at 1.04. Continued price reduction can trigger automatic liquidation.

Another choice deposited 60 810 ETH As collateral to borrow 75.69 million Dai, with a liquidation threshold of $ 1,805. The position is facing automatic liquidation if the ETH prices fall below this level.

ETH DOPS UNDER $ 1,900 in the middle of ETF features, hacker dumps and market slopes

Ethereum has dropped below $ 1,900 and registered a 6% decrease in the last seven days in the midst of market -wide turbulence. Apart from that, a series of negative catalysts have weighed heavily at Crypto’s price.

Rising inflation fear and a disappointment of US financial data have led to investors reducing exposure to risk resources, including crypto assets. President Trump’s announcement of mutual tariffs, which will come into force on April 2, has further increased the market’s uncertainty.

Bitcoin dipped briefly below $ 82,000 in early Saturday trading before recovering slightly to $ 82,800.

At present, BTC is about $ 82,400, which reflects an almost 2% decline in the past week, according to TradingView data. Bitcoin Pullback also pulls down altcoins, including Ethereum.

In the ETF market, US-listed Spot Ethereum funds showed continued sluggish performance.

According to Farside Investors’ dataBetween March 5 and March 27, investors deducted over $ 400 million from these funds. The trend turned yesterday when the ETFs collectively withdrew almost $ 5.

While the slow uptake has subdued investor enthusiasm, there is expectation that the potential enabling operating function can help increase ETF demand. A number of ETF managers are looking for SEC approval to add their existing Spot Ethereum ETFs.

Another factor that potentially affects ETH’s price is the sale that is triggered by a hacker that dumps a large amount of stolen Ethereum.

According to an early report from Lookonchain, hackers recently unloaded 14,064 Ethereum from Thorchain and Chainflip.

Hackers dump $!

2 new wallets (probably related to hackers) received 14 064 $ from #Thorkchain and #Chainflipthen dumped in 27.5 m $ Dai at an average sales price of $ 1,956.https://t.co/hsp1prgpulhttps://t.co/6AXVL6D7DG pic.twitter.com/7roycgmdwd

– Lookonchain (@lookonchain) March 28, 2025