It is barely weeks into the second half of 2025, and it is fair to say that Bitcoin and the global financial markets have almost seen it all this year. From Global trade war For actual disputes between nations (involving serious military measures), the markets have been the subject of various forms of external pressure during the year.

As a result, the world has seen a pure amount of correlation and direct relationship between the traditional financial markets and the crypto market. While the US stock market and Bitcoin have not been particularly moved in Tandem in recent months, there is no occurrence of a relationship between the asset classes.

What does the falling traditional volatility for BTC mean?

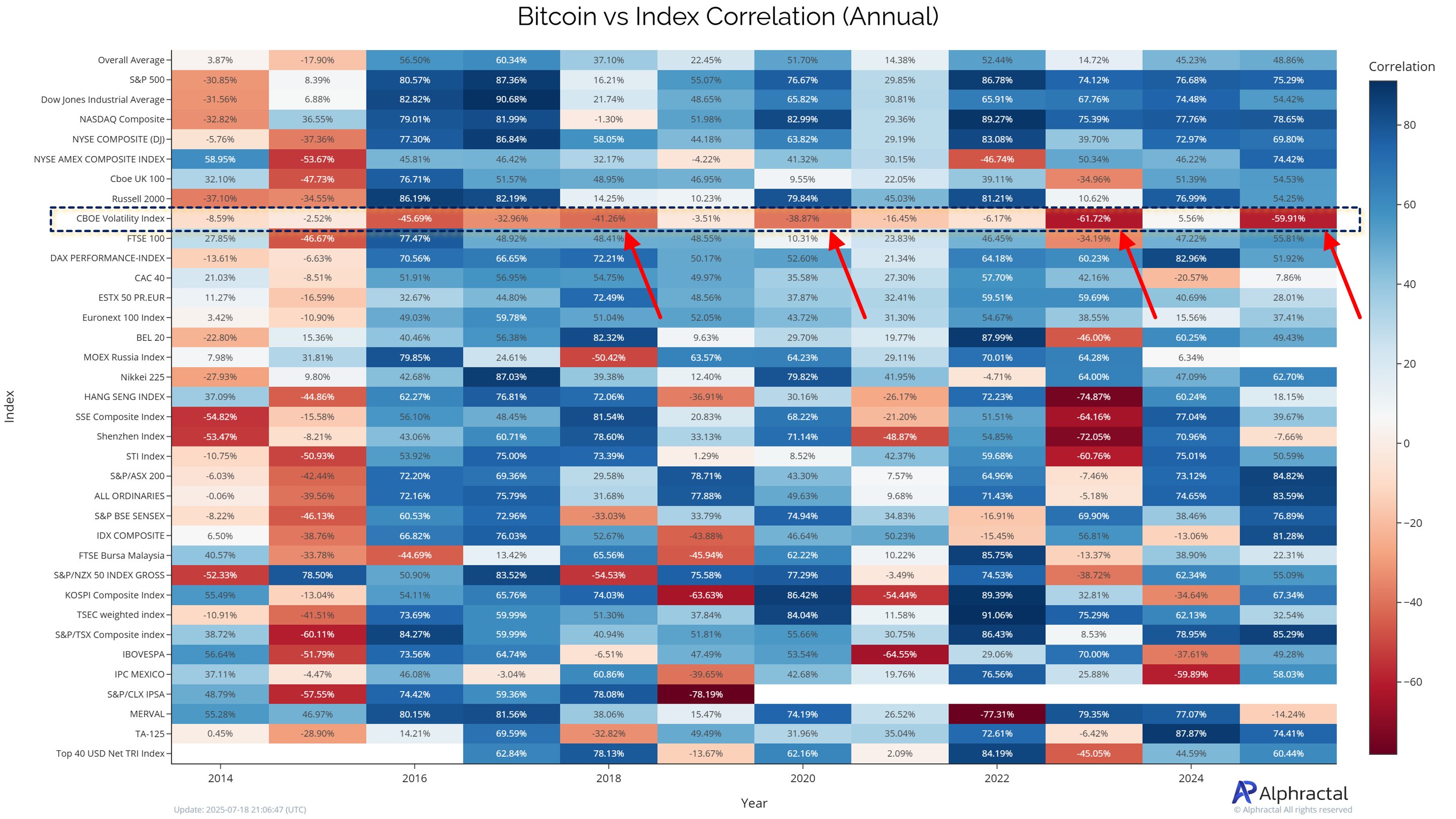

In a new post on social media platform X, Alphractal CEO and founder Joao Wedson deep into the relationship between bitcoin and the US stock market (through the S&P 500 index). According to the Krypto expert, the main Cryptocurrency has low correlation with the CBOE Volatility Index (VIX), which traces the market’s expectations on the Volatility of S&P 500 index.

For the context, volatility refers to how fast prices change within a short period and are often seen as a way to measure the marketing term. Weddon mentioned that the VIX index, also known as the FEAR Index, is generally used as a risk thermometer among the participants in the traditional financial markets.

According to Wedson, the price of Bitcoin tends historically Moving more independently and significantly the year after when it is negatively correlated with the S&P 500 index, especially during periods of low VIX. This increased volatility has often been translated into significant pricing in the past, according to the analyst.

Wedson said:

In other words: do not waste hours analyzing BTC versus the S&P 500 when BTC’s correlation with VIX is low or negative – it is usually when BTC has a greater chance of entering an explosive phase.

Source: @joao_wedson on X

The analyst on the chain said that on the back, when VIX is high, it is worth looking at the relationship between Bitcoin and American stock markets, such as fear in the latter can affect the behavior of the former. However, Wedson noted that VIX is currently decreasing, and as such, the S&P 500 index may not offer much help to analyze Bitcoin next move.

Wedson concluded that the more BTC dissociates from traditional volatility (Vix), the stronger it is as an independent asset. In the end this may be a positive sign for bitcoin Price and present new opportunities for investors who want to get out on the market.

Bitcoin price

From this writing, BTC is valued at about $ 117,888, which reflects no significant price movement over the past 24 hours.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Image from iStock, chart from tradingview

Editorial process For Bitcoinist is centered on delivering thoroughly investigated, correct and impartial content. We maintain strict purchasing standards, and each page undergoes frequent review of our team of top technological experts and experienced editors. This process ensures integrity, relevance and value of our content for our readers.