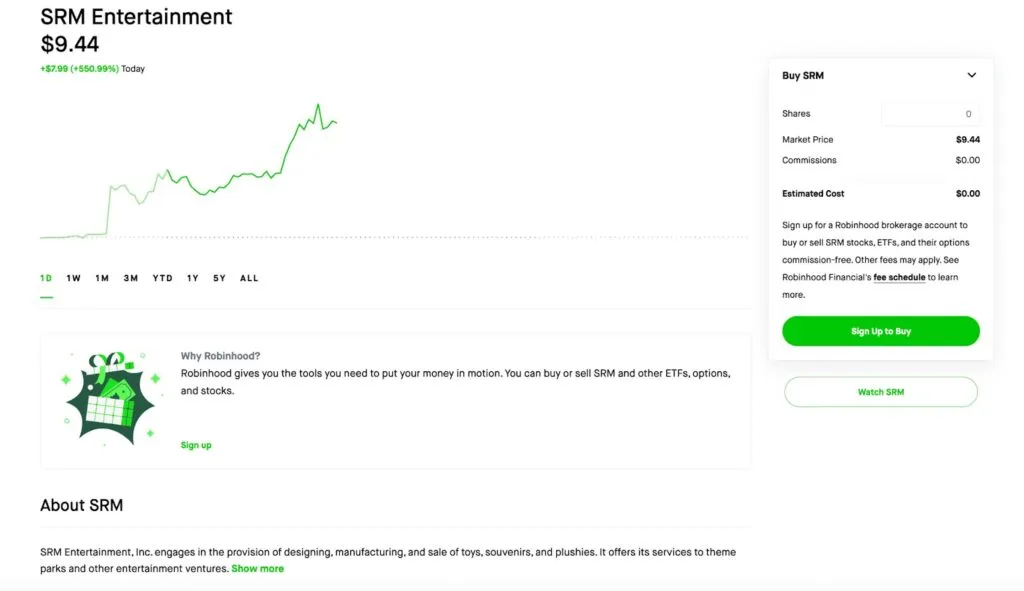

On the heel of Circle’s relatively successful initial public offer (IPO)It didn’t take long for another crypto company to go up to the record and announce their plans to publish in the US stock market. This time, Justin Sun, the founder of the belief, announced that he would be Takes faith public Through a reverse fusion with Nasdaq-Listad SRM Entertainment ($ SRM) (Nasdaq: SRM).

When the deal is completed, SRM Entertainment will change its name to faith, and its business model/strategy will switch to the relatively new, increasingly popular business model to own and operate a crypto tour. When the company has been completed, the company will buy and keep the TRON token.

To start Treasury, the newly formed company plans to issue 100,000 shares in its series B Convertible Preferred share, which can be converted to 200 million shares of ordinary shares to 50 cents per share. In addition, the company will issue 220 million warrants, which means that SRM can acquire up to 220 million shares of ordinary shares at a cost of 50 cents per share. If it is fully exercised, the company will take in $ 210 million, which they will then use to buy faith and start building their treasury.

Why public companies compete to build cryptotassures

Recently, that has become increasingly popular for listed companies to build cryptotassures. Trump Media & Technology Group (Nasdaq: DJt), Gamestop (Nasdaq: GME), and of course micro strategy (Nasdaq: mstr) have all either announced that they are starting to build or continue to replenish their Bitcoin -State boxes.

There are various reasons why a company may want to build a cryptot trip. Some claim that it is one hedge against inflation. Others say it is in line with their companies’ values to be technical and innovative. But no matter what the companies tell the public, no company would do this if it did not think it would be good for its final line.

The obvious economic advantage of a cryptot course is that the price of the cryptocurrency that it holds can estimate, increase its total value and make the company richer.

But so far it has been a secondary effect that has been even more advantageous than Crypto-PRICE estimate. When companies announce that they are building or replenishing cryptotassures, they begin to get media attention. When the headings roll in, the company’s share price usually climbs.

For the most part, the price of the crypto asset they buy as well. Although both the share and the crypto asset are rising, historically this strategy and media attention have been made that comes with it more advantageous for the company’s share price than for the underlying digital asset itself.

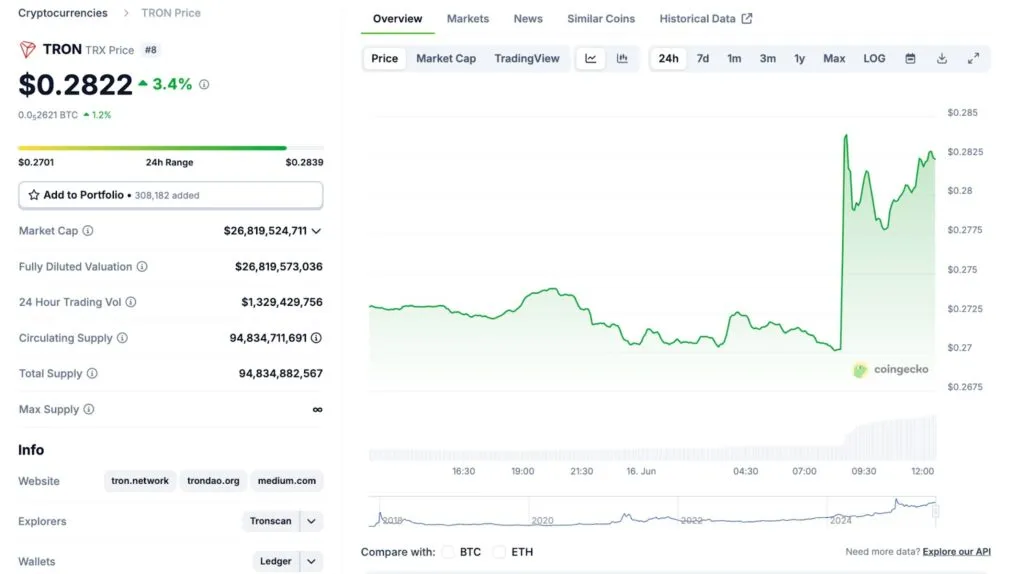

ThroneWhich has not completed its merger with SRM yet, is a perfect example. When the company announced its plans to merge and build a faith Treasury, the price of $ SRM increased by over 500%, while the price of the TRON token increased by only 3.4%.

Why cryptotassures are a double -edged sword

Admittedly financial technology. The companies that own and operate them have found a way to pump bags and essentially double-dip on Income production Since their share price and crypto chamber rise when they announce that they are adding their treasury.

But we haven’t really seen this long -term game; Just as there are supporters of Crypto boxesThere are critics that have reviewed the strategy since August 2020, when micro strategy became the first listed company to add Cryptocurrency to its corporate funds.

Cryptocurrency is notorious for their volatility. When a listed company builds a crypto tour on top of its second business (if it has even other business operations), suddenly is exposed to Cryptocurrency Price fluctuations. Depending on the size of the cryptotrate cash register, this can put companies into significant risks. When times are good, they will thrive. But when the market takes a decline it is possible for these companies that incur It damages the economic health of the business, all thanks to their crypto chamber.

For example, earlier this year, Micro strategy reported an unrealized loss of $ 5.91 billion due to a decrease in BTC’s price. If a smaller company follows this strategy and gets stuck on the wrong side of a price wing, it can lead to them having to close the store.

All this raises the question: Are cryptotassures sustainable on a sufficiently long time horizon? The answer is that we do not know yet.

The oldest cryptotass from a listed company, Micro Strategy, is approaching five years old. Although unrealized losses have been reported in the past, the Treasury is still there, it is still filled and micro strategy is still fluid.

At the same time, the economy in a company whose only “product” is not a cryptocurian. When a company does not create anything of value, something that solves a real problem in the worldAnd therefore, the customer’s demand does not generate or builds a reliable customer base, the entire business model becomes shaky. The company’s “value” is reduced to a speculative idea: that it will be worth more tomorrow as the crypto they keep is expected to go up.

These incorrect economics put companies with crypto boxes – especially those whose only product is the Treasury itself – at extreme risk. They live mainly and die from the price of crypto which they gather.

Tesla sold his BTC; What happens when others do?

One thing that we have seen very little of is companies that express their starting strategy. Each company undoubtedly sees its Crypto Treasury strategy as profitable – but if they don’t one day Exit The position, that profit will never be realized.

Only a listed company has explicitly collected Bitcoin for its crypto chamber and then sold it for a realized revenue. On March 31, 2021, Tesla (Nasdaq: TSLA) sold ~ 4,320 BTC, which represents about 10% of its holdings, generated about $ 272 million, and then, a little more than a year later, in July 2022, Tesla sold about 75% of its remaining BTC and claimed that they did this to prove the liquidity in BTC as an alternative to containing cash, as they did, it was essentially tested that the BTC was that they were done that they were done that they were done that they were so much tested that they were so much tested that Options to contain cash, substantially tested that BTC was a completely functional asset.

Whatever reason you can imagine that business is Storage scrap To one day sell it, which in itself could unwind the entire financial technical game. If a company sells a large part of its Treasury, it can lead to the price of crypto supply falling, which then reduces the total value of the remaining Treasury. This decline can affect the company’s perceived value and damage the share price and trigger a negative spiral that turns all the profits that made the strategy so attractive in the first place.

There is still not enough data to know how this plays. Only a handful of companies have tried the listed Crypto Treasury model, and even fewer have liquidated their positions, which makes it difficult, and no doubt premature, to call Crypto Treasury a winning strategy. As more time goes by and the price of BTC continues to move, we will find out if this strategy is really an achievement of financial technology or if it is just another financial gimmick.

Watch: Teranode & Web3 world with edge-to-edge electronic value system

https://www.youtube.com/watch?v=vcng542TThe Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard writing; encrypted media; Gyroscopes; Image-in-Image; Web-Share” Reference Policy = “Strict-Origin-When-Cross-Origin” Permitting Lorscreen = “” “” “”