Cashless payments have risen in Kazakhstan In the past year, it accounts for over 80% of all payments In the country, a report from the central bank reveals.

As of March 1, Kazakh had 81 million debit cards, with debit cards that dominate the market. In February, these cards were used to make payments worth 15.4 trillion Tenge ($ 29.7 billion), an increase of 21% from year to year. The number of transactions that have increased 13.7% to one billion, according to Report by the National Bank of the Republic of Kazakhstan (NBRK).

The report reflects previous results from the Central Bank and other experts in the finance industry and points to accelerating growth in cashless payments in the central Asian nation.

In one ReportNBRK revealed that cashless payments increased its share to 85% last year, by over 70% of Kazakhs who now use Online Bank, an increase of 460% over the past five years.

The latest report repeats this growth and reveals that Internet And mobile bank accounts for four of five of all non-contact transactions and almost 90% of the volume. Pos terminals were the second big avenue.

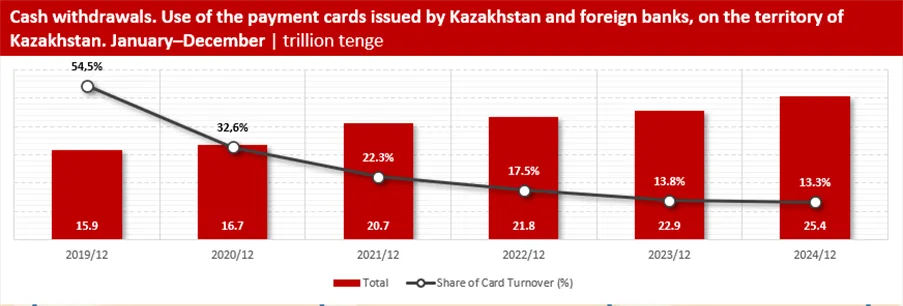

However, while cashless payment methods have grown consistently, Kazakhs pull out more cash than ever from ATMs. In 2024, they retreated $ 25.4 trillion Tenge ($ 50 billion), 11% more than 2023. This was after 5% growth during each of the previous two years. Over the past five years, cash withdrawals have increased 60%.

Local experts say that increasing taxes and a Vaudful economy could hinder the consistent growth of digital payments, with more people turning to cash to avoid higher transaction fees. It can also lead to more small businesses conducting informal operations, which benefits cash over digital payments.

The imminent launch of the country’s Central Bank digital currency (CBDC) can reshape the dynamics of digital payments. NBRK is among the more advanced central banks on the CBDC front and has implemented successful digital Tenge pilots over the past 18 months. Last year, that struck a deal with China to collaborate on CBDC-driven cross-border transfers, and shortly after, used programmable digital Tenge to pay for the construction of a railway to China.

Digital assets have also gained enormous popularity in Kazakhstan, with 8% of the population that owns a symbol at the end of last year, a report revealed. Merchants contributed $ 367,000 in taxes in the first eight months of 2024, with Block reward miners And mining pool operators who refer $ 10.4 million during the same period.

Vietnam Eyes payment tokenization to increase adoption

IN VietnamThe country’s primary payment infrastructure provider plans to integrate payment tokenization to protect consumers and increase uptake.

National Payment Corporation in Vietnam (Napas) has announced a new partnership with Idemia Secure Transaction (IST) to grow digital payments in the country. Napas is the country’s provider of electronic clearing services, the majority owned by the central bank together with the country’s commercial lenders.

Under the new PartnershipNAPAS will integrate IST’s digital card solutions, including payment card tokenization, to increase Vietnam’s contactless payments.

The IST’s token platform enables card issuers to replace sensitive card information with a token, which consumers can then use to make payments safe.

Short tokenization becomes critical in the payment space, with card fraud projected to hit $ 43 billion in 2026. Large card issuers tokenize their cards to protect consumers, with Mastercard (Nasdaq: MA) Reporting That 30% of its global transactions last year were tokenized. Visa says it has issued over 10 billion tokens over the past decade.

In Vietnam, the new partnership will promote wider adoption of digital payments And protect consumers, commented Isaac Lee, the regional VP for Asia and the Pacific on Ist.

“With QR code payments that are common in Vietnam for several years now, the community sees mobile contactless payments as an innovative evolution that paves the way for a more cashless economy,” he said.

Vietnam’s revolution for digital payments received another boost over the past week with signing of a consensus agreement (MOU) between the government and China’s largest bank, ICBC. The partnership, which also includes Chinese card issuers Unionpay, enables cross-border QR code payment operations. It strives to give consumers in both countries easier and more comfortable cross -border payment option.

See: Universal blockchain asset unlocks the future for payments

https://www.youtube.com/watch?v=cen6ybzqedc Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard Writing; Encrypted Media; Gyroscope; Image-in-Bild; Web Dividend” Reference Policy = “Strict-Origin-When-Cross-Origin” Allowing Lorscreen = “>”