Crypto loan shrinks 43% since the top

Last week released Galaxy Digital A Report titled The state of crypt lendingwhich examined both centralized and decentralized lending and loans over the crypto ecosystem.

We don’t hear that much about Decentralized funding (Defi) longer, so let’s quickly go through what it is. Defi refers to blockchain-based alternatives to traditional financial services such as loans, lending and earns returns on deposits. While defi has often been clumped together with Non-fungible tokens (Nft), Initial coin range (Icos) and MemecoinsIt was originally intended to bring conventional financial services to Blockchain.

What stands out most in the Galaxy report is the scale of the collapse of the Crypto Lending Market, which began to be discovered in 2022 and has not recovered since then. A leading factor in space was that many of the largest lenders – including OriginThe Celsius NetworkThe Blockfiand The trip—All submitted for bankruptcy, which wiped out a lot of market value during the process. According to Galaxy, the total size of the Crypto Lending market was $ 36.5 billion from the fourth quarter of 2024, a reduction of 43% from its maximum time of $ 64.4 billion during the fourth quarter of 2021.

Galaxy believes that the market will bounce back, as it is already on an upturn from its lowness, but I am personally not so sure. Many people were burned by these lending products, especially if they had an instrument offered by one of the companies that collapsed. In addition, if you are new to crypto, the mechanics behind these platforms are more confusing than they are attractive.

In addition, the loss of some of the major lenders and the well -known Stories of risk Becoming incorrect handling of them has created a problem of trust in space. When four of the biggest players go bankrupt for two years, it is difficult to convince someone, especially newcomers, that even if you mainly have the same business model, “this time will be different.”

I do not think that lending will disappear, but getting new users on board will be an upward fight unless a real need for these lending services will appear or the return becomes so attractive that users cannot pass their coins to earn interest.

Donald Trump can launch a web3 game

Its Rumored That Donald Trump launches a crypto game. According to reports, the game is said to have a monopoly -like feel and is led by Bill Zanker, the same person who helped to start Trump’s NFT and Memecoin.

Although there is not much information about how the game will work or even how Cryptocurrency will be involved, what is known is that the game is expected to be launched later this month. Unfortunately, Trump and his team could not have chosen a worse time to launch, as Web3 game market Shrinks, does not grow.

According to DappradarInvestments in Web3 games amounted to just $ 91 million in the first quarter of 2025 – a 71% reduction from Q4 2024. Daily unique active Wallets In the space also decreased by 3% during the same period, which suggests that the market is cooling from a user perspective.

Launching a crypto game in this type of climate can be more of a challenge than it is an economic blessing, especially with the memory of Trump’s latest cryptofel fresh in the heads of potential investors and users: launch launching $ Trump Memecoinwhich has decreased more than 85% since the launch date.

Ethereum decreased by 48% over the past year

The last few years have been challenging for almost every cryptocurrency, but most large coins have seen some form of rebound over the past year – except Ethereum. While many of the household nams have posted small profits or losses over the past year, Ethereum is down 48% and shows no signs of recovery.

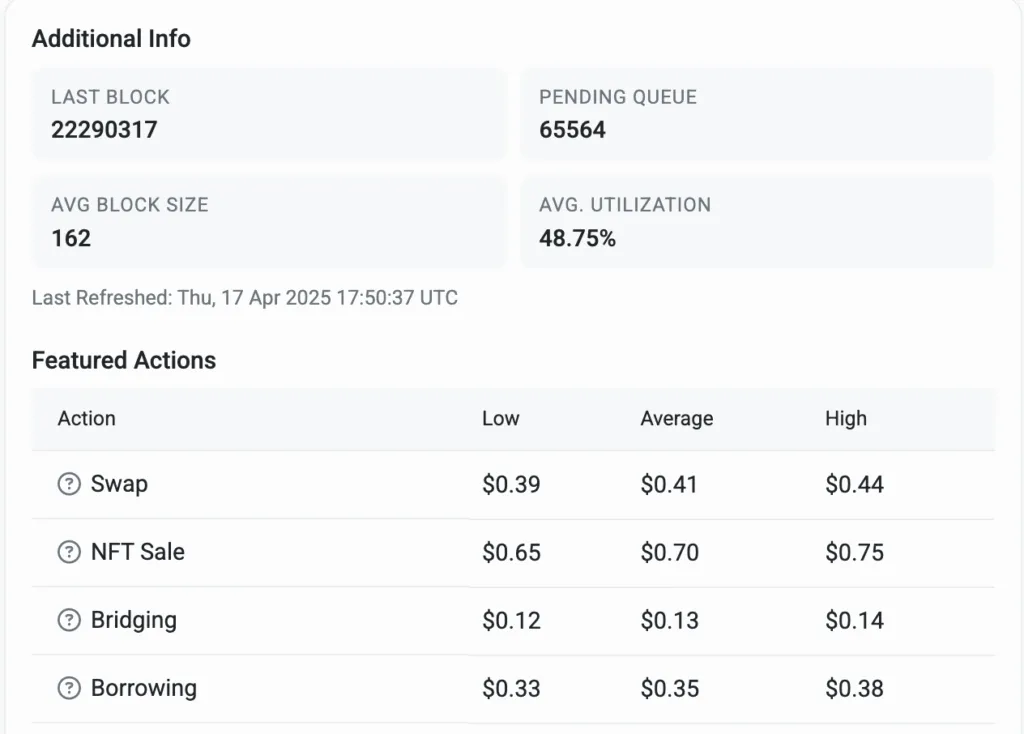

One of the biggest reasons for Ethereum loses ground is simple: cost. Despite network upgrades, the transaction fees at Ethereum remain significantly higher than on competing chains. At the time of writing, joint measures on the chain at Ethereum can cost over ten cents each, while on some of the best competing chains, the same measures usually cost fractions of a penny.

It may not sound like much, but these fees are important on a scale or for users in emerging economies. Whether you are a founder who is trying to launch a defi product or just someone who wants to interact with a decentralized application (DAPP), Ethereum can quickly become cost entrepreneurs. In some cases, users must even “refill” their wallets just to afford the transaction fees, which is not a good user experience.

But the purpose of this segment is not to draw Ethereum, it is to highlight what Ethereum is struggling tells about the broader market.

I think Ethereum’s passing reveals that the market does not care about inheritance status anymore-it used to be enough to be one of the first few names-brand coins or tokens that existed. But now it looks like individuals who actually use blockchains or are interested in using blockchains Care more about affordable prices. To be fair, brand recognition is still important, but just because a blockchain had a brand recognition earlier does not mean that it will retain that status if it falls out of the benefit of blockchain enthusiasts. If a blockchain nails the two criteria it will attract both users and developers.

If it fails in any of these areas – especially while competitors are given land – it risks less relevant. Ethereum still has named recognition, but right now it is seriously missing in terms of affordable prices, which is why creators choose to use other blockchains, which pull users away from Ethereum to these other chains and why the market price reflects their dissatisfaction with Ethereum.

Look at | Mining Disorders 2025 Highlights: Profitable trends that every miner should know

https://www.youtube.com/watch?v=KJ5j8bfxazy Title = “Youtube video player” Ramborder = “0” Allow = “Accelerometer; Autoplay; Clipboard writing; encrypted media; Gyroscopes; Image-in-Image; Web-Share” Reference Policy = “Strict-Origin-When-Cross-Origin” Permitting Lorscreen = “” “” “”